In a promising development, the euro made gains against the dollar on Wednesday as new inflation data from Germany and Spain heightened the likelihood of an impending rate hike by the European Central Bank (ECB).

Fresh statistics reveal that consumer prices in both of these nations surged beyond projections in August, signaling a growing buildup of inflationary pressures within the eurozone.

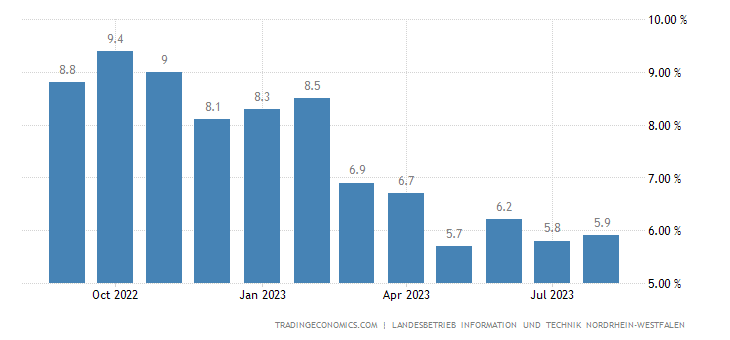

Germany, the economic powerhouse of the bloc, witnessed a notable inflation uptick in North Rhine-Westphalia, its most populous state, with a year-on-year jump from 5.8% in July to 5.9% in August. Impressively, this rate is the highest since 1993, markedly overshooting the ECB’s target of maintaining inflation just below 2%.

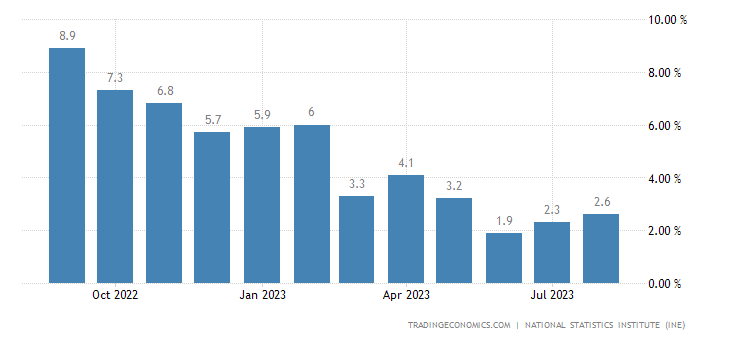

Similarly, Spain, the eurozone’s fourth-largest economy, observed a rise in inflation to 2.6% year-on-year from 2.3% in July, aligning with the forecast laid out by Reuters-analyzed analysts.

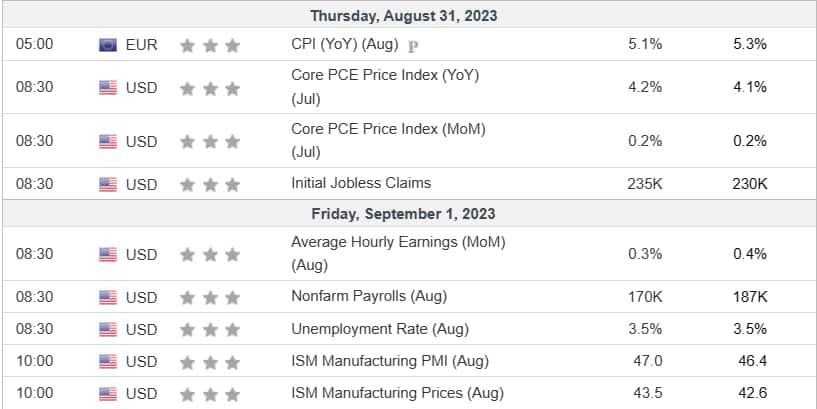

These figures could potentially herald an era of heightened inflation for the entire eurozone, with a comprehensive report set for release on Thursday.

The financial arena responded promptly, adjusting expectations for a forthcoming ECB rate hike. The anticipation of a 25 basis-point adjustment in September escalated to a 60% probability, according to Reuters. Worth noting is that the ECB has held its key interest rate at zero since March 2016, simultaneously conducting bond purchases to invigorate economic activity.

Euro Maintains Bullish Streak Against the Dollar

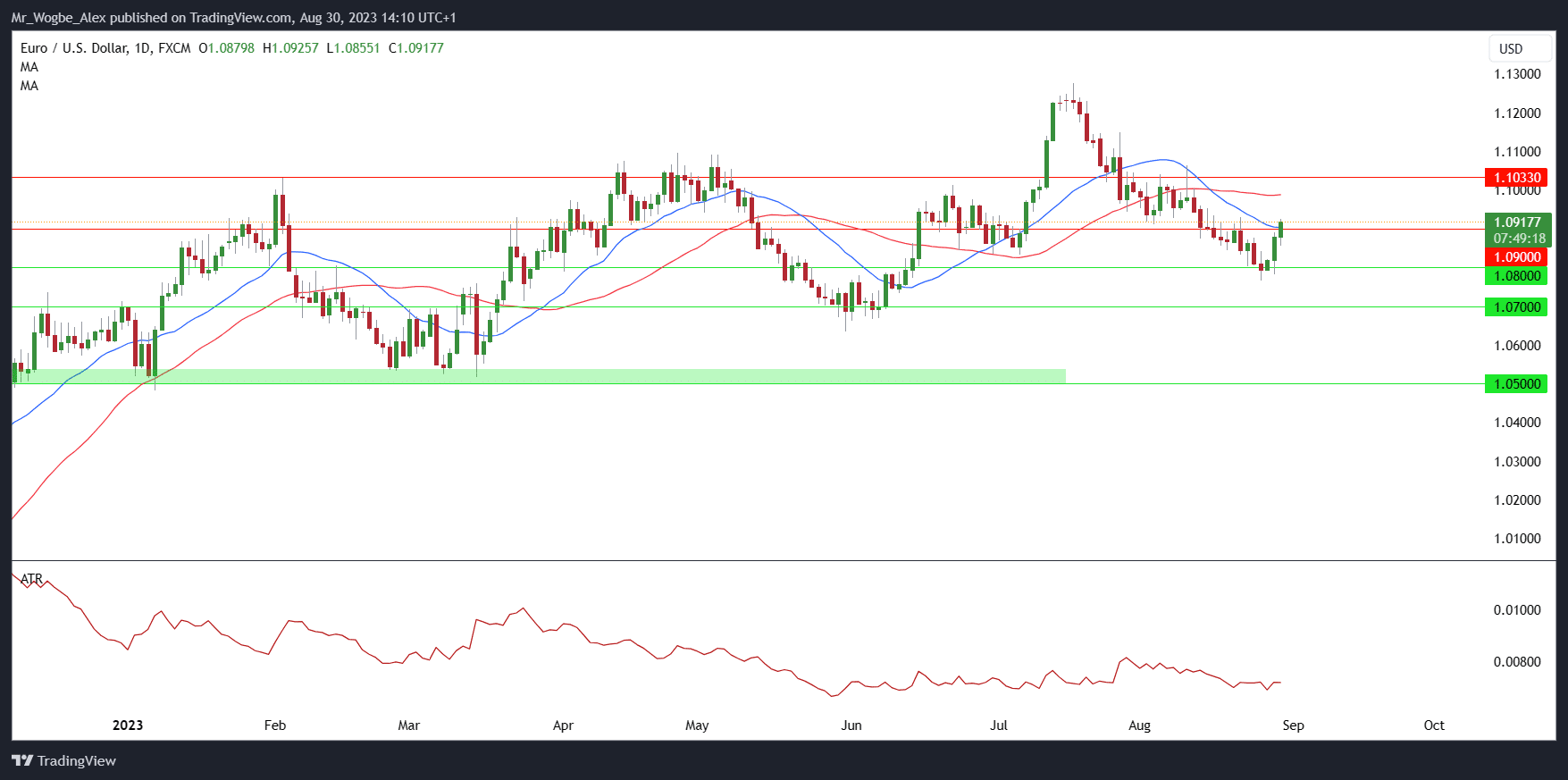

As of the time of writing, the euro has registered a decent 0.39% upswing, reaching a one-week high of $1.0925 on Wednesday. This marked a bullish continuation and a third-day streak of a rebound from the $1.0765 low recorded on August 25.

At the same time, the dollar index, a gauge measuring the greenback against six major currencies, slipped by 0.32% to 103.15.

The dollar’s retreat was further fueled by disappointing U.S. job openings data disclosed on Tuesday, which eroded the probability of imminent rate hikes from the Federal Reserve.

Investor attention is now poised for the U.S. non-farm payrolls report, scheduled for release on Friday, which is expected to shed light on the Federal Reserve’s policy trajectory.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.