In a display of resilience, the British pound continued to exhibit robust performance against the euro on Thursday. This ongoing trend can be attributed to the latest revelations in inflation and growth data, which underscore the growing disparity between the economic situations of the UK and the eurozone.

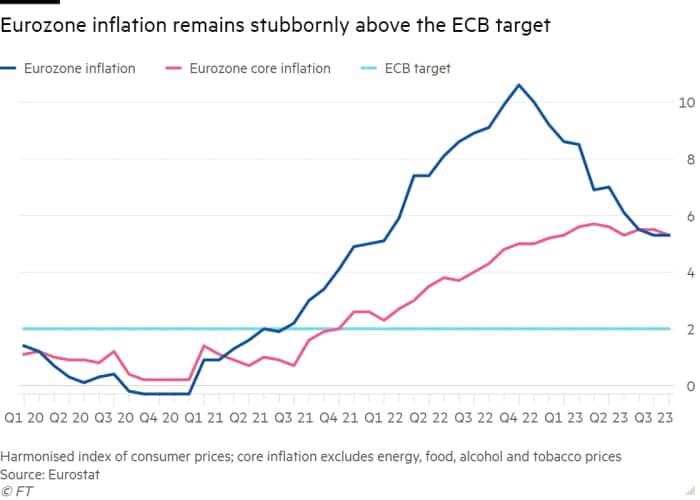

The Eurozone’s inflation remained stagnant at 5.3% in August. However, a notable shift was observed in the core inflation rate, excluding volatile elements like food and energy, as per official data. This shift prompted a downward adjustment in expectations for an impending interest rate hike by the European Central Bank (ECB) in September.

Market sentiment has now shifted, with a mere 30% probability assigned to a 25 basis point hike in September. This figure represents a significant drop from the 60% probability reported a day prior, according to Reuters.

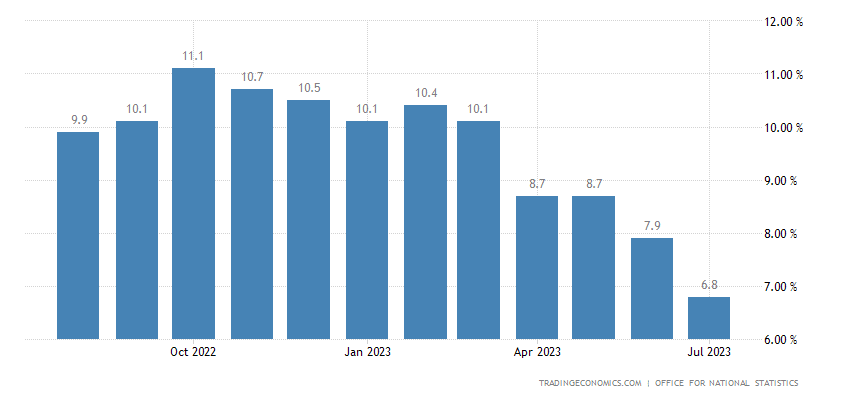

Conversely, Huw Pill, Chief Economist of the Bank of England (BoE), expressed resolute determination to tackle the elevated inflation rate in the UK, currently pegged at 6.8%—far above the targeted 2%. Pill emphasized the necessity of elevated interest rates to rein in persistently high core inflation. He acknowledged the associated risk of potential repercussions for the UK economy but affirmed the BoE’s commitment.

Forecasts suggest a substantial 80% likelihood of the BoE implementing an interest rate increase to 5.5% next month, with expectations of rates peaking at 5.75% before the year’s end.

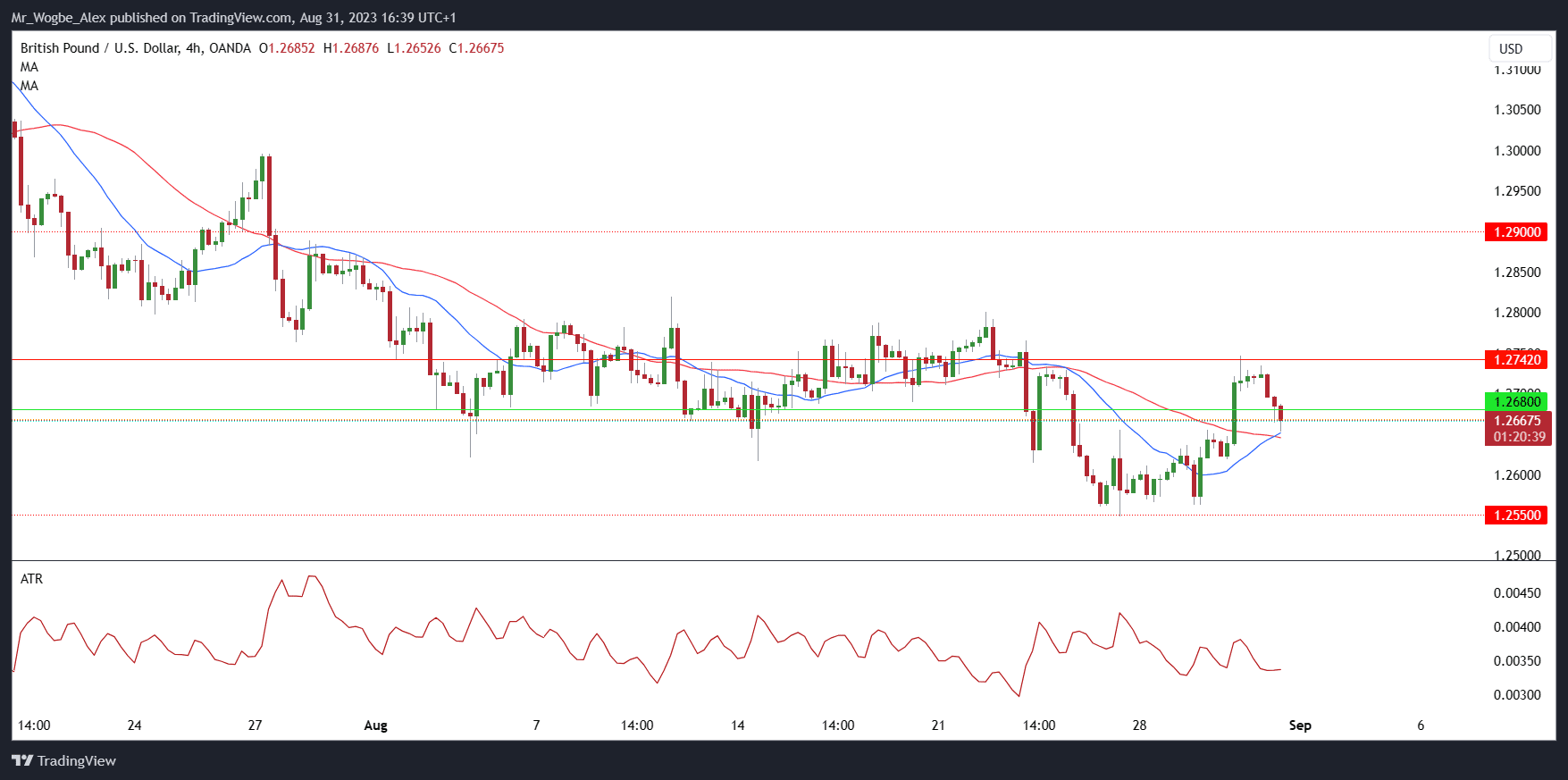

Pound Dips Against the Dollar, Stays Strong Against Others

The pound did experience a marginal dip against the dollar, down by 0.41% at $1.2668. Nonetheless, it managed to outshine many other major currencies as the dollar staged a recovery following a recent three-day slump.

Throughout the year, sterling has emerged as a standout performer against the dollar, driven by promising prospects of prolonged rate hikes by the BoE and remarkably positive economic indicators from the UK.

However, a section of analysts anticipates a gradual slowdown in the pound’s upward momentum, predicting impending challenges in the coming months.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.