The British pound has embarked on a positive trajectory and is poised to achieve its most substantial one-day gain in almost two weeks. This surge comes on the back of impressive core inflation data for July.

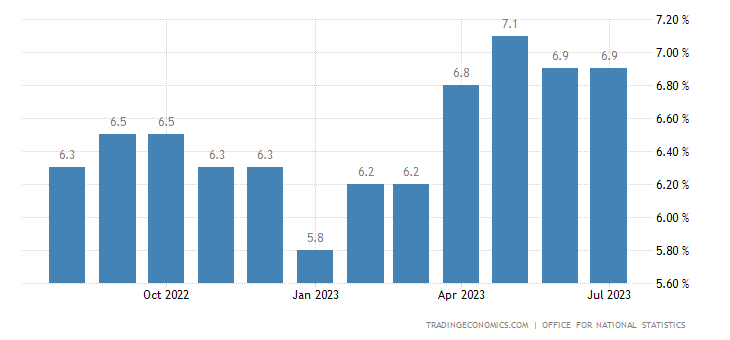

Core inflation in the UK, excluding the volatile elements of energy and food prices, has remained impressively steady, maintaining its level at 6.9%. This figure has defied expectations, surpassing the 6.8% projection derived from a recent Reuters poll.

This commendable inflation performance poses an intriguing challenge for the Bank of England. The institution, tasked with steering the economy towards a 2% inflation target, now faces the conundrum of how to address inflation rates that continue to outpace expectations.

With the current level far exceeding the targeted threshold, the central bank is potentially pushed to explore further rate hikes. However, this strategy carries its own share of risks, potentially impacting the delicate equilibrium between economic growth and price stability.

Global Market Dynamics Amid Growth Concerns

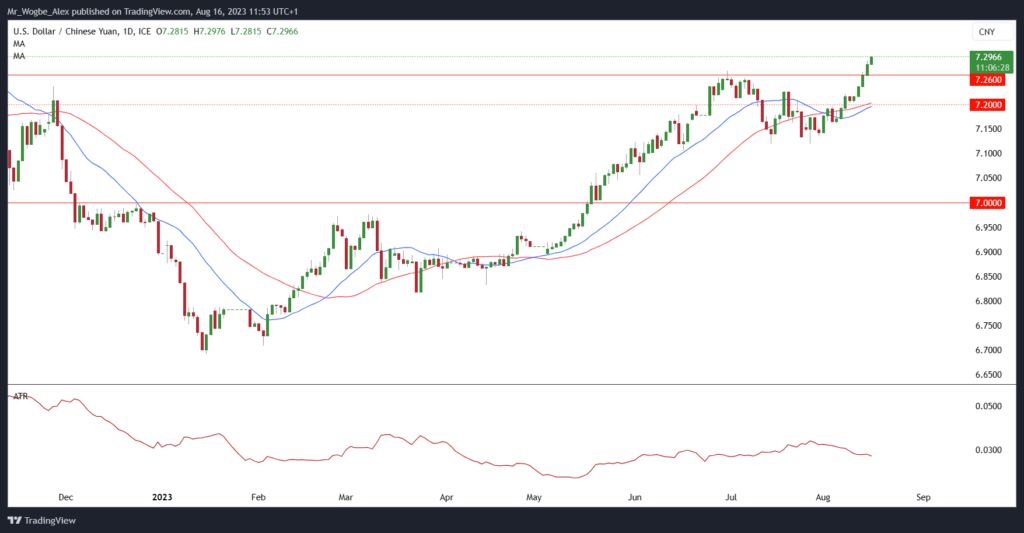

Beyond the United Kingdom, global markets are experiencing a diverse mix of sentiments, largely driven by growing concerns about a deepening global growth slowdown. This unease is particularly evident in the weakening trajectory of the yuan.

Both onshore and offshore markets have witnessed a marked decline, with the yuan sliding to its lowest level in several months. The currency reached as low as 7.2976 per dollar, breaching the critical 7.2600 resistance for the first time since October 2022.

Amidst this backdrop of global economic uncertainties, the New Zealand dollar remains resilient. This stability can be attributed to the recent decision by the country’s central bank. The bank has slightly adjusted its timeline for initiating borrowing cost reductions. This strategic move has added a layer of support to the New Zealand dollar, offering stability in the face of the prevailing economic fluctuations.

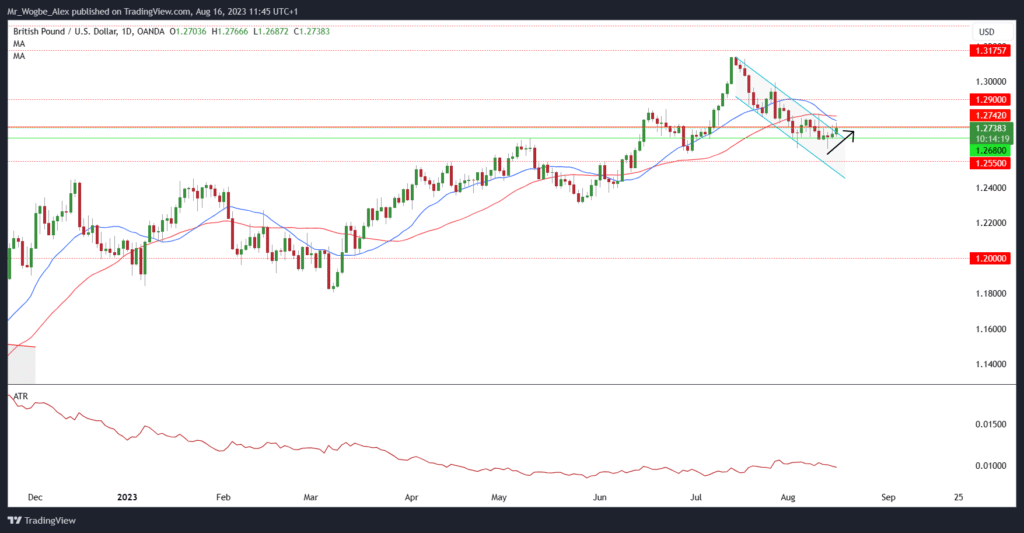

Will the Pound Sustain Its Gains Against the Dollar?

As the global economic landscape continues to evolve, these currency dynamics carry significant implications for various economies. The British pound’s resilience amidst core inflation strength showcases the delicate balance central banks must strike.

Later this week, traders will look at the upcoming FOMC Meeting Minutes and Initial Jobless Claims from the US for clues on if the pound can sustain its rally against the dollar.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.