In an exciting turn of events, the British pound staged a remarkable recovery on Friday, putting an end to its recent three-day slide. The catalyst behind this resurgence was the strikingly robust performance of the UK economy in June. Sterling not only managed to edge up against both the dollar and the euro but also injected a renewed sense of optimism into the market.

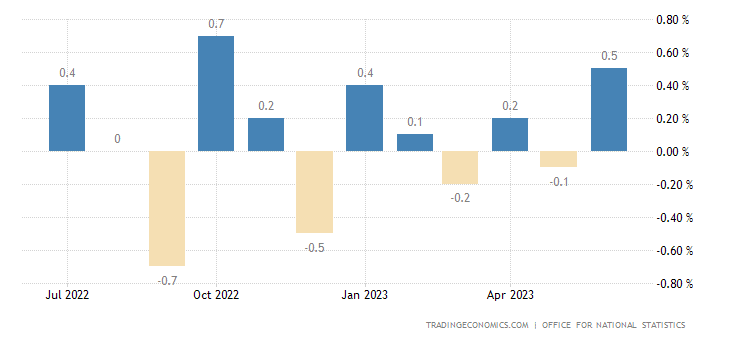

The latest data, unveiled by the Office for National Statistics, revealed a surprising 0.5% growth in British economic output for June. This achievement considerably surpassed the forecasts of economists who had participated in a Reuters poll, where a more conservative growth estimate of 0.2% had been anticipated.

However, while the UK continues to stand as the sole major advanced economy that has yet to fully reclaim its pre-pandemic standing from late 2019, June’s unexpected economic vigor has cast a hopeful glow over the economic landscape.

This unforeseen momentum has breathed life into the prevailing sentiment that the Bank of England is poised to pursue further interest rate hikes. The central bank’s recent emphasis on the vital role of economic resilience in its decision-making process has lent further weight to this narrative.

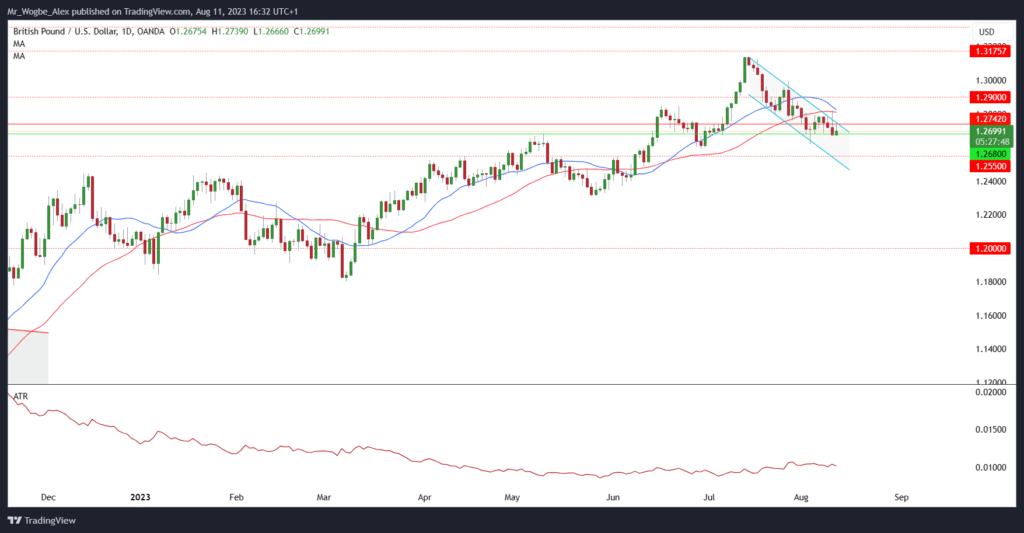

Pound Retests 1.2742 Resistance

On the currency front, the pound exhibited a commendable show of strength, advancing by a respectable 0.5% against the dollar to reach a value of $1.2739 earlier today. However, the single currency has retraced slightly to the 1.2700 mark, where it currently sits as of press time.

While this increase may appear moderate at first glance, it’s worth noting that the pound managed to outperform its peers within the G10 category even as it retained a trajectory toward its fourth consecutive weekly loss.

Delving into the specifics, the manufacturing sector showcased a resounding comeback in the second quarter, marking its most prosperous showing since the early months of 2019. According to Reuters, this achievement, particularly when excluding the initial rebound that followed the initial COVID-19 lockdown in 2020, underscores the resilience and adaptability of the UK economy.

Investor attention now pivots to the imminent release of the next wave of UK economic indicators scheduled for the upcoming week. This dataset promises a comprehensive insight into inflation statistics, wages, and employment figures.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.