In an unexpected twist of events, the British pound encountered a minor stumble on Tuesday, holding its ground above recent one-month lows. This follows the release of a thought-provoking survey shedding light on subdued sales growth for British retailers over the past 11 months. This downturn in fortunes has been attributed to a combination of persistently inclement weather and the lingering specter of high inflation.

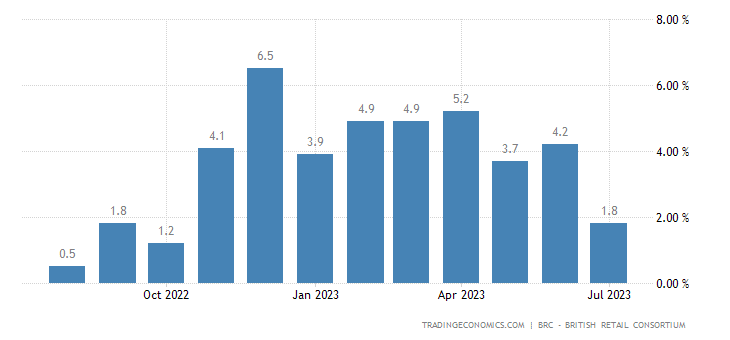

Delving into the specifics, the British Retail Consortium (BRC) revealed that the uptick in retail sales values managed a modest 1.5% rise when juxtaposed with the corresponding period last year. This figure, notably falling short of the 12-month average growth rate of 3.9%, paints a stark contrast to the glistening peak of 5.2% attained back in April.

Interestingly, the reported figures remain devoid of any adjustment for inflation. Thus, July’s seemingly modest surge in spending paradoxically signifies a decline when viewed through the lens of actual sales volumes.

British Pound Remains Strong on the Larger Front

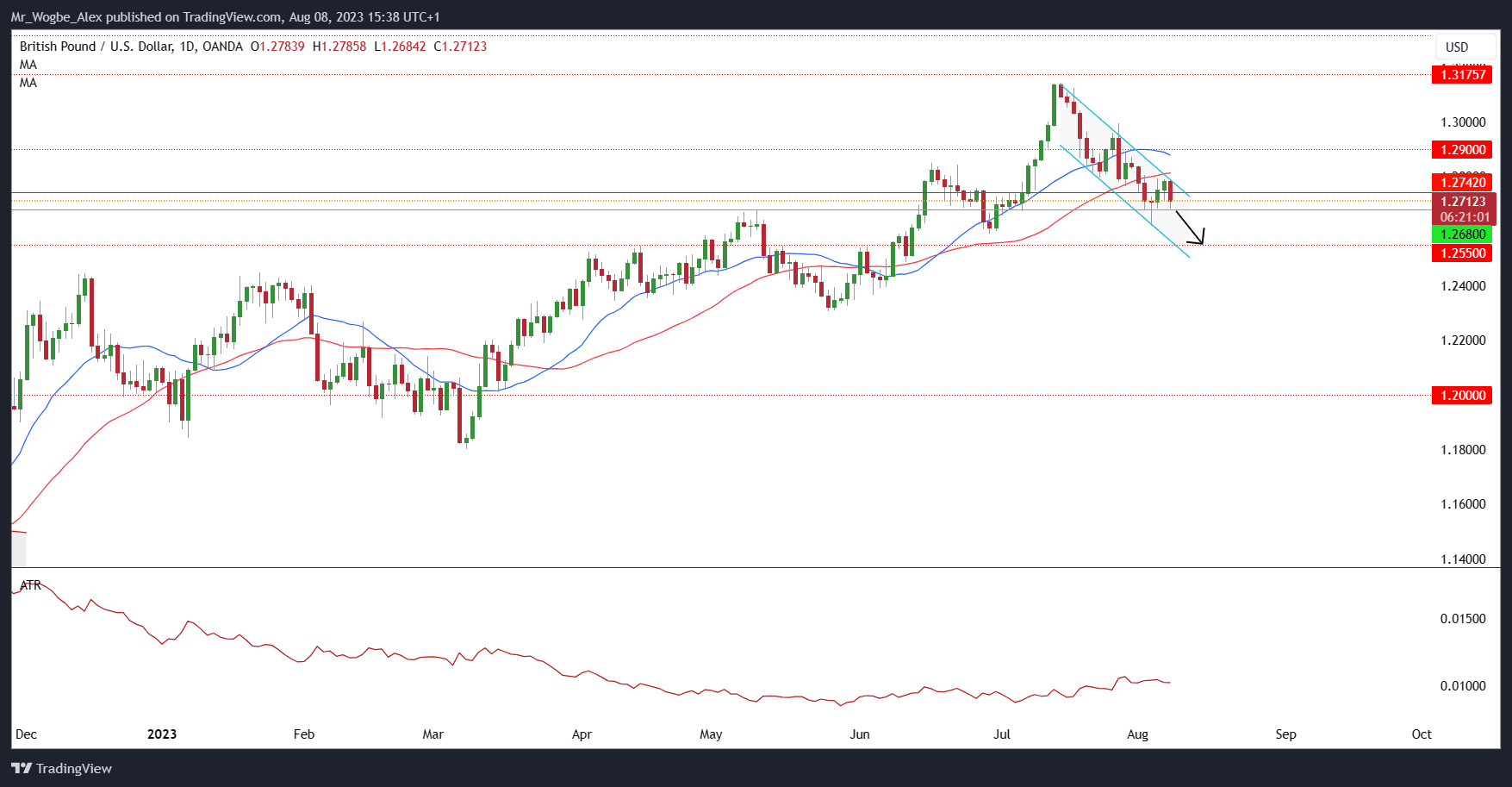

Steering our attention to the currency front, the pound, ever the picture of resilience, was observed to have retreated 0.6% against the dollar, ultimately settling near $1.2700 as of the time of this report. A similar narrative unfolded in its exchange with the euro, with the pound conceding a slight 0.02% and ultimately finding its footing at 86.07 pence.

Against this backdrop rife with nuance, sterling has commendably charted a 5.13% ascent against the US dollar year-to-date. While the fervor might have ebbed from the 8.6% year-to-date standing witnessed in July, sterling maintains its stance, a testament to its inherent mettle. A noteworthy contender in this year’s performance derby, the Swiss franc, ekes out a slender lead with a 5.41% gain against the dollar.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.