The British pound found itself at a critical juncture, with its recent movements reflecting a delicate balance between economic expectations and central bank decisions. Despite a slight uptick on Friday, the currency remained close to a two-week low, sparking interest and concern among traders and investors alike.

At present, the pound was up 0.63% against the US dollar, settling at 1.2888, and exhibited a 0.11% increase against the euro, reaching 85.68 pence. However, against the yen, the sterling faced temporary pressure earlier today, slipping as much as 1.1% to a six-week low.

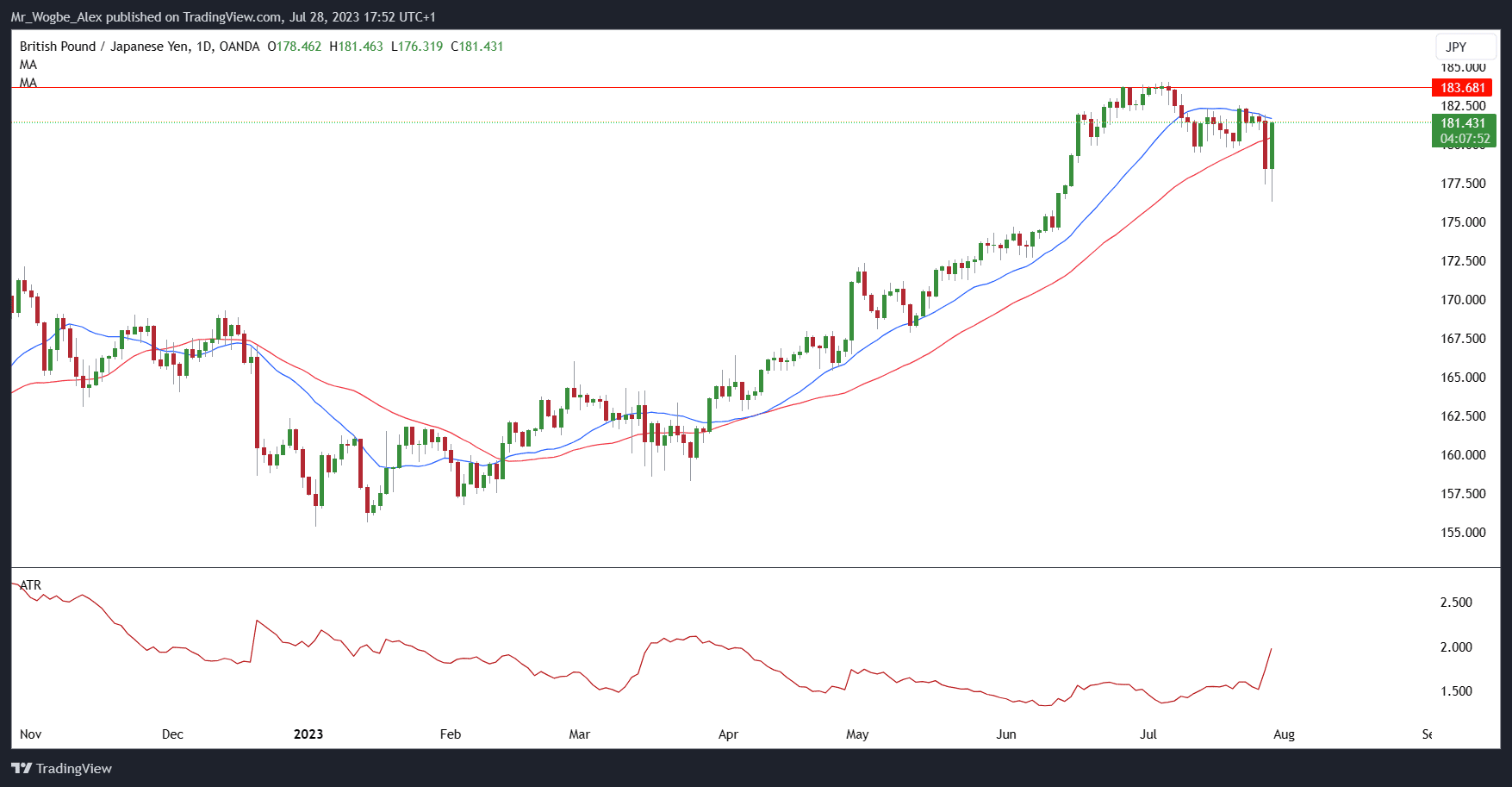

The Bank of Japan’s announcement to make its yield curve control (YCC) policy more flexible initially fueled speculations of a shift away from ultra-loose monetary policy, causing a rally in the yen. Nonetheless, this rebound was short-lived, and sterling recovered, rebounding 1.67% higher at 181.43 yen as of the time of this report.

Upcoming BoE Meeting Keeps Pound Traders on Edge

The upcoming Bank of England (BoE) meeting, scheduled for August 3, has kept market participants on edge. The prevailing sentiment leans towards a 25 basis point rate increase, although there remains a cautious 25% chance of a more substantial half-point rise.

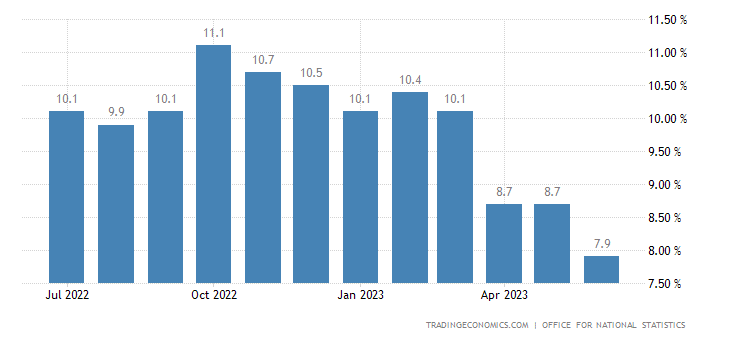

Despite the optimistic outlook on the pound’s strength, interest-rate differentials, a significant driver of sterling’s performance this year, have experienced a decline. With inflation showing signs of cooling down and certain sectors of the economy slowing, the likelihood of UK rates surpassing the current 5% to 6% has diminished.

Traders and investors continue to closely monitor central bank decisions and economic indicators, seeking insights to navigate the currency’s uncertain terrain. The upcoming BoE policy meeting holds particular significance, as it is poised to shape market sentiment and influence the pound’s future trajectory.

With interest rates and inflation dynamics as key factors, market participants are exercising caution while maintaining their optimistic stance on the British pound’s potential for growth. As the economic landscape evolves, it remains to be seen how the pound will respond to both local and global forces in the weeks to come.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.