The British pound has faced a challenging week, continuing its downward slide against major currencies like the euro and the dollar. The primary cause of this decline is the UK’s cooling inflation, which has caused market participants to temper their expectations of further aggressive rate hikes from the Bank of England (BoE).

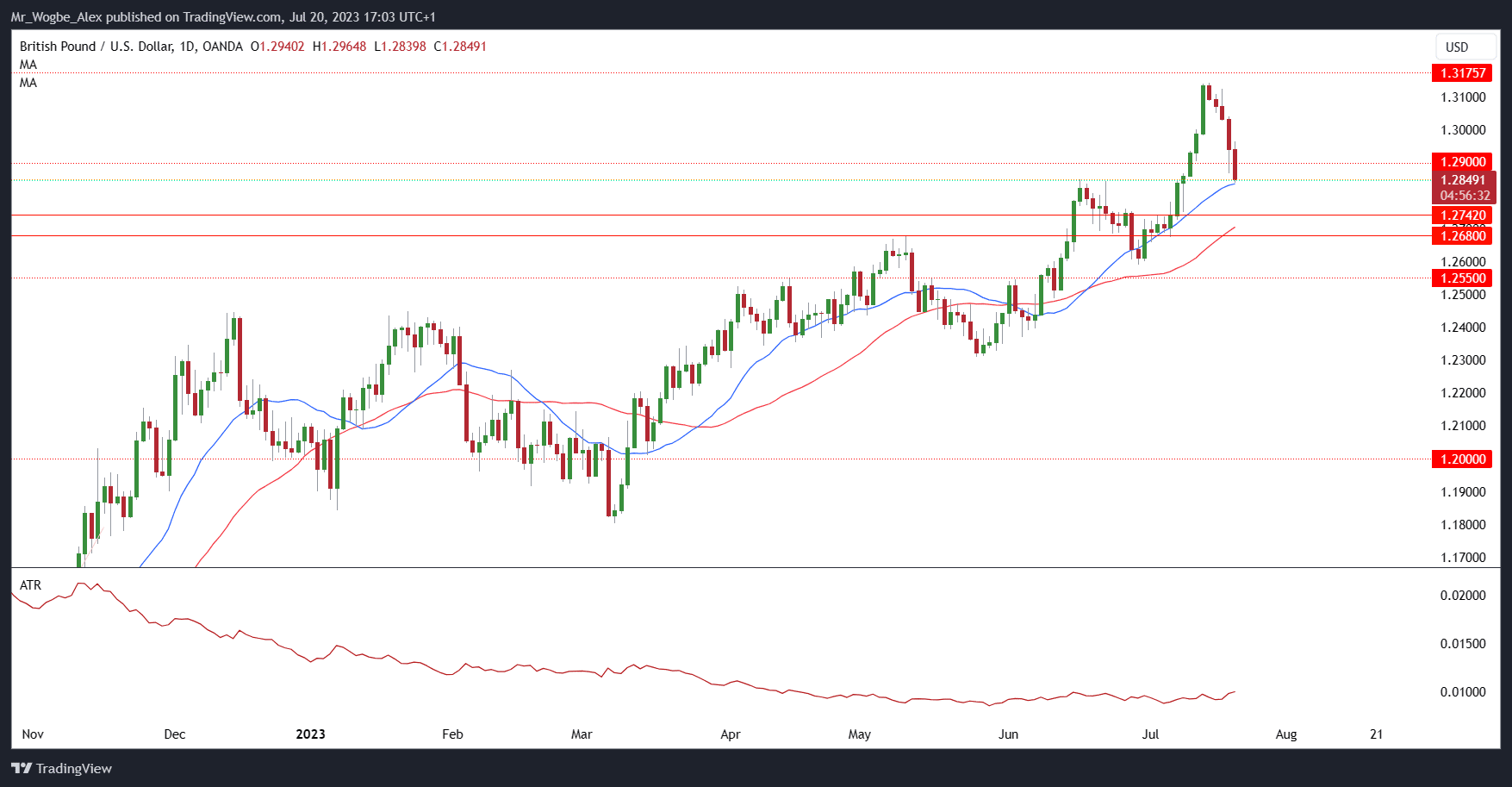

Against the euro, sterling saw a dip of 0.48%, falling to 86.98 pence, edging closer to the two-month low it reached just the day before. Simultaneously, the pound experienced a 0.72% drop against the dollar, with the exchange rate standing at 1.2848. This marks the fifth consecutive day of decline against the greenback, following a 0.74% drop on the previous day.

Meanwhile, data released on Wednesday revealed that the UK’s annual consumer price inflation fell to a much lower-than-expected 7.9% in June, a notable drop from May’s 8.7%. Economists surveyed by Reuters had anticipated a CPI rate of 8.2% for the same period.

source: tradingeconomics.com

The unexpected cooling in inflation has prompted the money markets to recalibrate their expectations for future BoE rate hikes. As a result, the likelihood of UK rates surpassing the 6% threshold now appears to be off the table.

Expert’s Opinion on the Fate of the Pound

Jeremy Stretch, the head of G10 FX strategy at CIBC Capital Markets, offers his insights on the situation, as reported by Reuters. He predicts that rates are now expected to remain below 5.75%, a considerable shift from the assumptions made just two weeks ago, when rates were expected to exceed 6.50%. Despite this change, Stretch believes that ongoing rate support will provide some stability for the British pound.

Even with the recent cooling, the UK retains the unfortunate distinction of having the highest inflation rate among the G7 nations. Comparatively, the United States is experiencing headline consumer price pressures at a rate of just 3%, and the euro zone’s inflation hovers at 5%.

Future Outlook for Sterling

Despite the recent drop, experts remain cautiously optimistic about the future outlook for the pound. While it has experienced a challenging week, many anticipate that sterling will likely stabilize above the lows witnessed earlier.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.