British Pound enthusiasts had a thrilling ride on Wednesday as market data revealed a pleasant surprise: UK inflation slowing down more than expected in June. This sudden turn of events brought a glimmer of hope for cash-strapped consumers and businesses, offering them respite from the fear of relentless rate rises.

According to a Reuters report, investors celebrated this positive development with gusto, as both British property stocks and government bond prices soared on the news. The unexpected decline in inflation breathed new life into the market, inspiring confidence in the UK’s economic prospects.

In June, the annual consumer price inflation dipped to 7.9%, surprising analysts who had anticipated a decline of 8.2%. While this rate remains significantly above the Bank of England’s desired target of 2%, it is a reassuring drop from the alarming 41-year high of 11.1% witnessed last October.

source: tradingeconomics.com

Investors Turn to Government Bonds

The bond market witnessed a frenzy as investors rushed to seize the opportunity. British government bonds, known as gilts, experienced their most substantial yield drop since March as eager buyers flooded in. The inverse relationship between prices and yields worked in favor of bondholders, adding to the jubilant atmosphere in the financial markets.

Meanwhile, core inflation, excluding the volatile components of food, energy, alcohol, and tobacco prices, also demonstrated a downward trend, dropping to 6.9% from the previous month’s 7.1%. Though slightly below forecasts, this figure still hovers close to the 31-year high recorded just a month prior.

source: tradingeconomics.com

British Pound Traders Watching with Keen Eyes

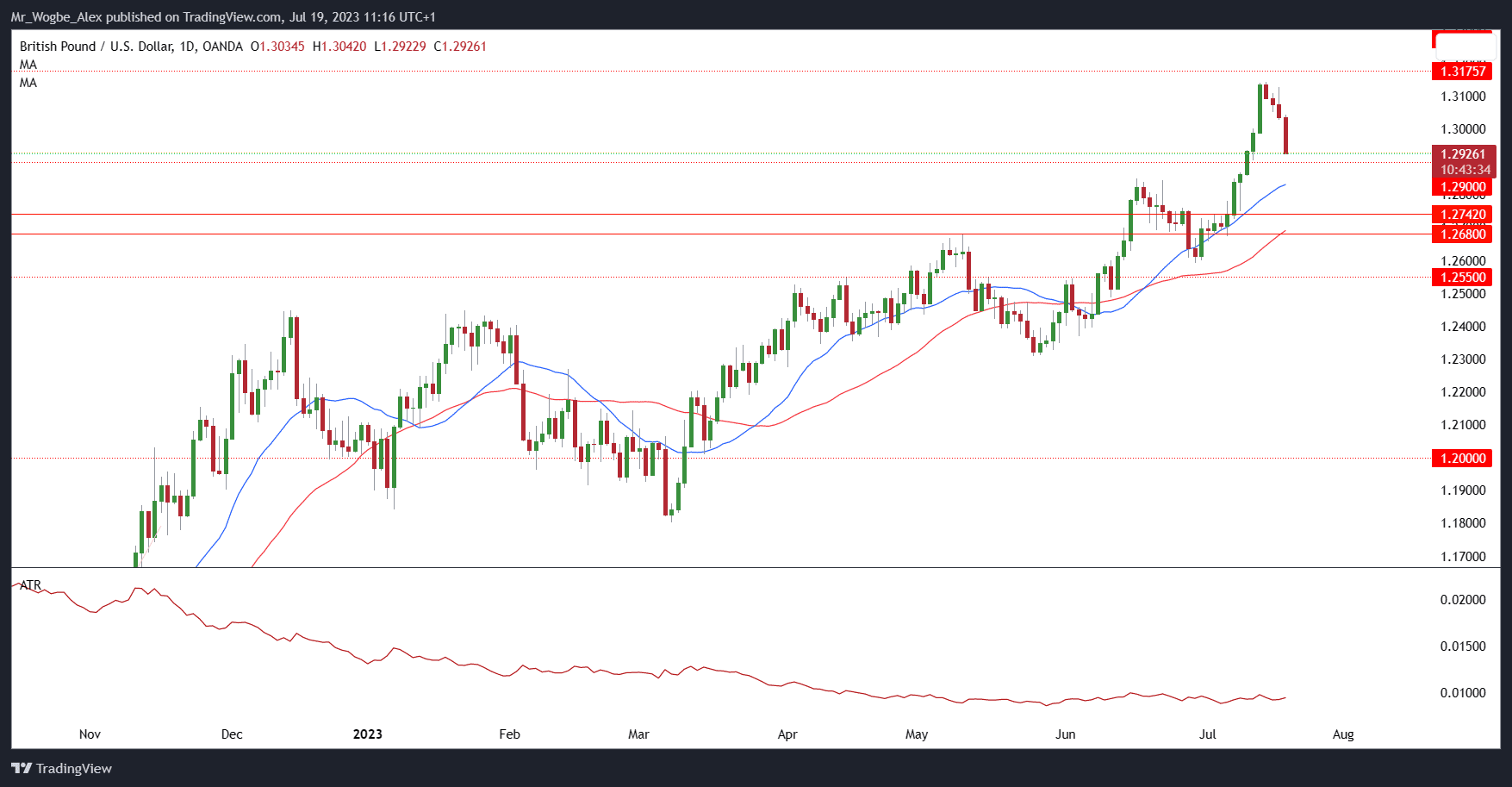

The British Pound experienced some turbulence, falling the most against the dollar so far this month. As of the time of this report, the GBP/USD pair trades down by 0.83% as the pound fell to the 1.2925 level, its lowest point in five days, against the dollar.

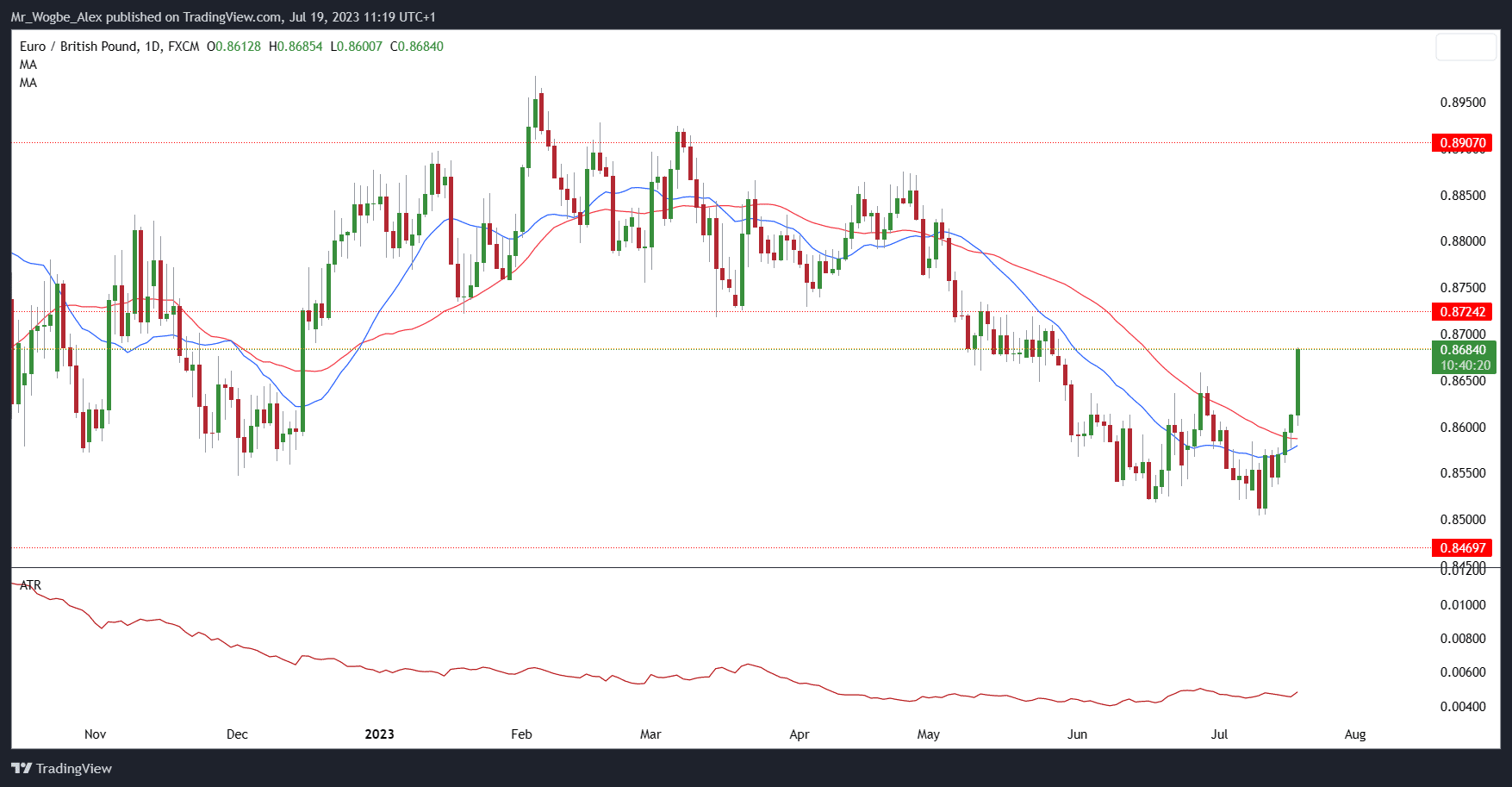

Traders watched closely as it traded near the impressive 15-month highs observed the previous week. Similarly, against the euro, the Pound weakened to its lowest level in nearly two months.

Despite the positive shift, the UK still holds the unenviable position of having the highest inflation rate among the G7 nations. In stark contrast, the United States enjoys a relatively modest headline consumer price pressure of just 3%, while the euro zone inflation rate stands at 5%.

The latest developments have left investors cautiously optimistic about the Pound’s future trajectory. The bond market’s response further strengthens confidence in the UK economy’s resilience amidst challenging economic conditions.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.