Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

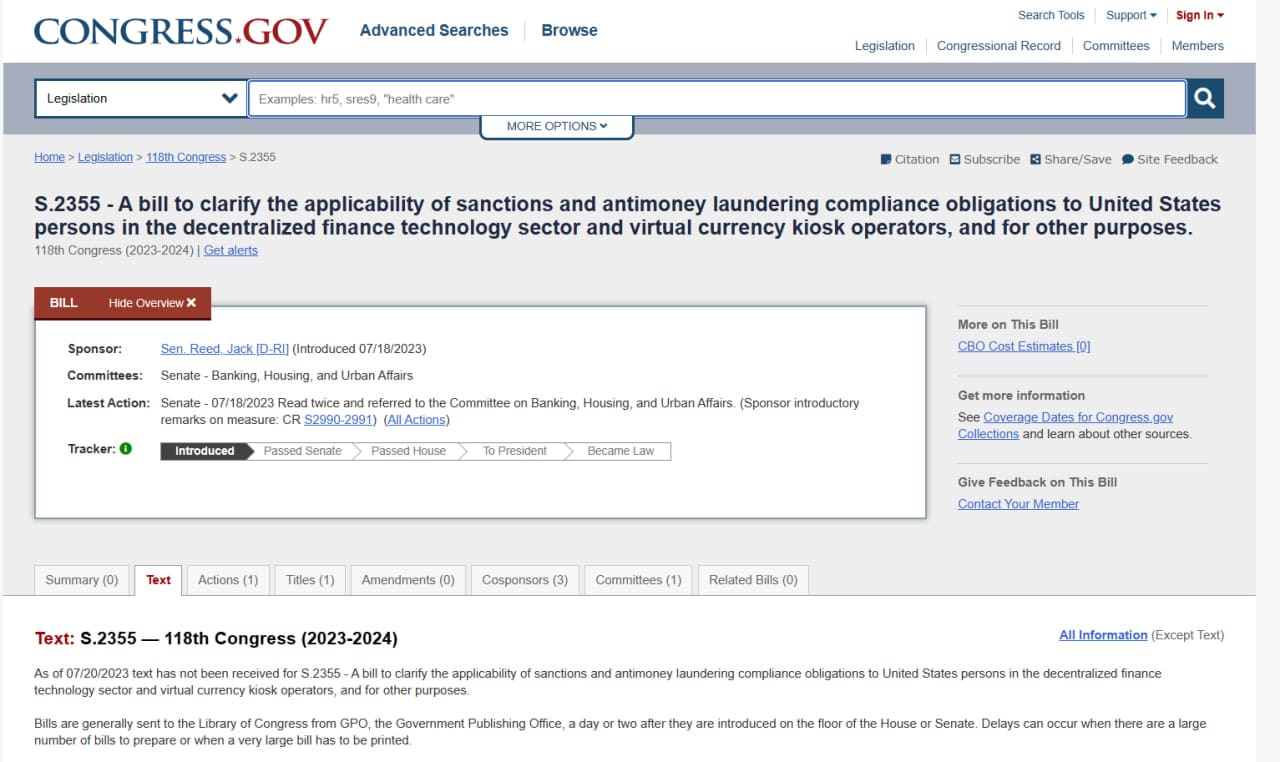

In a bid to tackle the evolving challenges posed by the crypto industry, the U.S. Senate is gearing up to take another swing at regulating decentralized finance (DeFi) protocols. The proposed bill, known as the Crypto-Asset National Security Enhancement Act of 2023, is set to introduce stringent anti-money laundering (AML) requirements to enhance security measures for DeFi platforms.

Decentralized Finance (DeFi) on the Radar

With the growing popularity of DeFi protocols, the need for effective regulation has become increasingly apparent. These financial applications enable users with a crypto wallet to access borrowing, lending, and trading services using smart contracts, all directly on permissionless blockchains. While DeFi offers unprecedented financial opportunities, it also presents challenges in terms of monitoring and ensuring compliance.

🚨US SENATE INTRODUCES BILL TO REGULATE DEFI LIKE TRADITIONAL BANKING INSTITUTIONS pic.twitter.com/fS3urVKGT1

— Blockchain Daily (@blckchaindaily) July 19, 2023

CoinDesk reports that the primary aim of the bill is to combat the rise in crypto-related crimes and secure the nation’s financial landscape. By imposing bank-like controls on DeFi user bases, the government intends to restrict avenues for money laundering and the evasion of sanctions, which can pose significant risks to national security.

Navigating the Challenge of Controller-less Protocols

One of the major challenges in regulating DeFi lies in the absence of a central controlling authority. To address this, the proposed bill places responsibilities on entities that develop user-friendly interfaces for DeFi protocols’ intricate smart contracts.

For instance, Uniswap Labs serves as a controller for Ethereum’s leading decentralized exchange, simplifying user interactions.

In cases where no clear controller is identifiable, entities investing substantial amounts, exceeding $25 million, in the development of the DeFi protocol will be entrusted with fulfilling the outlined obligations. These obligations include stringent customer vetting, robust anti-money laundering programs, prompt reporting of suspicious activities, and blocking the access of sanctioned individuals to the protocol.

Empowering the Treasury Department

To effectively combat money laundering in the crypto space, the bill extends the authority of the Treasury Department to non-traditional financial settings, including cryptocurrencies. This move is aimed at ensuring that criminals cannot exploit gaps in the financial system to facilitate illicit activities.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.