The U.S. dollar is on a winning streak, hitting a six-month high against a basket of currencies and reaching a 16-year peak against the Chinese yuan. This surge is propelled by robust indicators from the U.S. services sector and labor market, showcasing the resilience of the American economy amid global turbulence.

The Dollar Index, gauging the greenback’s strength against six major currencies, surged 0.28%, reaching 105.15, its loftiest level since March. The dollar didn’t stop there, climbing 0.33% to 147.87 yen, a level unseen since November 2022.

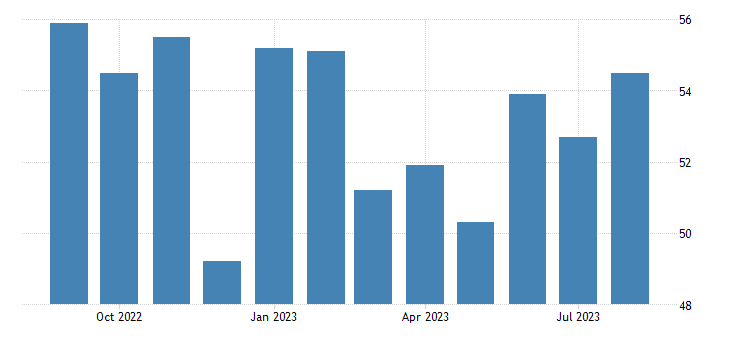

The rally began with the U.S. services sector, which outpaced expectations in August, according to the Institute for Supply Management (ISM). Their non-manufacturing index surged to 54.5 from July’s 52.7, comfortably beating the anticipated 52.5. This signifies sectoral growth, a significant contributor to over two-thirds of the U.S. economy.

Further fueling the dollar’s ascent, the labor market demonstrated resilience. Initial claims for state unemployment benefits plummeted to 216,000, a level unseen since February, surprising economists who had predicted an increase to 234,000 claims.

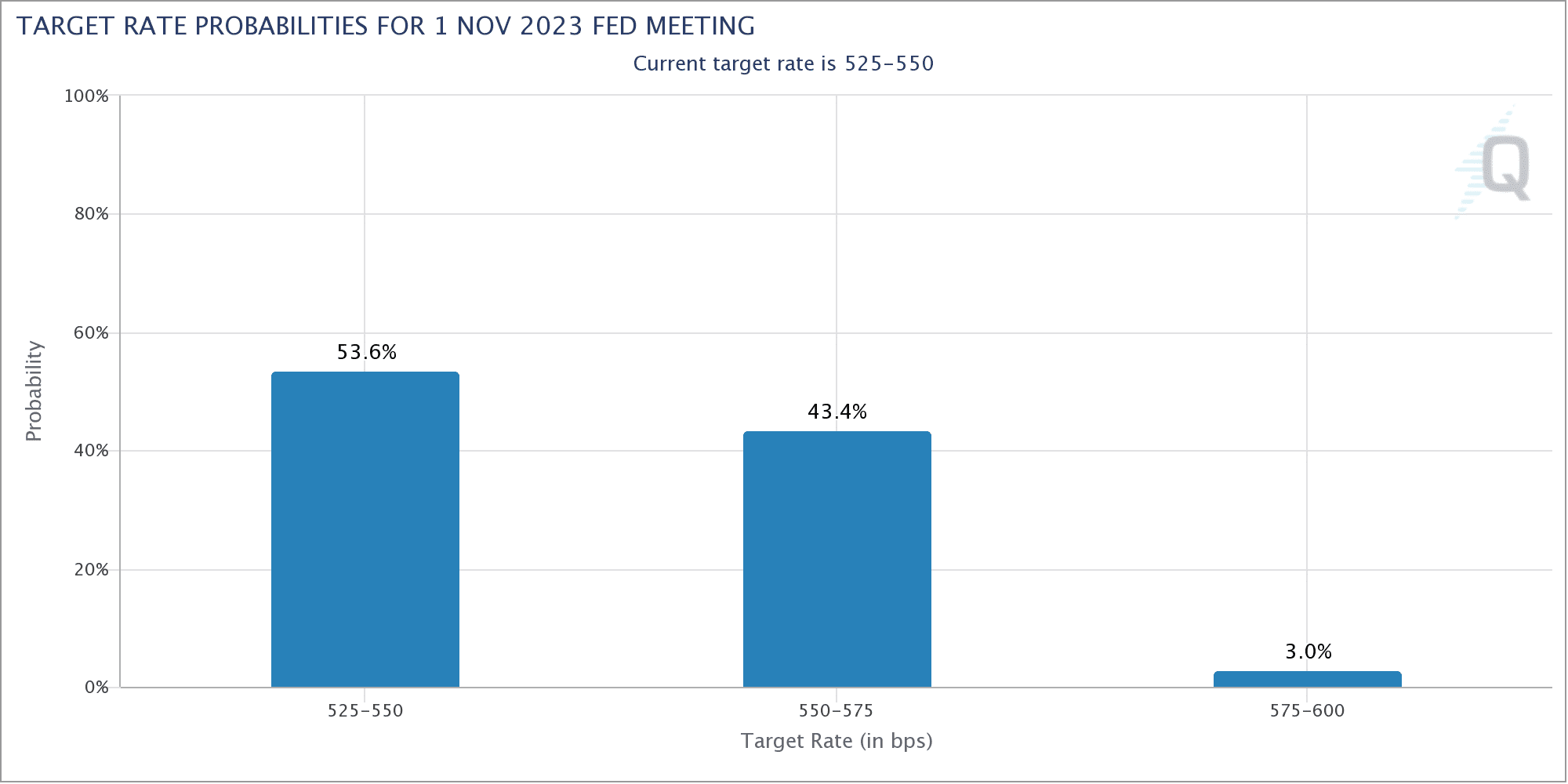

These encouraging developments have heightened expectations of another Federal Reserve interest rate hike this year, despite the prevailing sentiment that rates will remain steady at the upcoming meeting later this month. The CME FedWatch tool indicates a greater than 40% chance of a rate increase in November, underscoring the dollar’s attractiveness for investors.

Yuan, Euro, and Pound Struggle Against the Dollar

On the flip side, the Chinese yuan has faced headwinds, plummeting to a 16-year low against the dollar. China grapples with challenges stemming from a property market downturn, sluggish consumer spending, and dwindling credit growth, pushing the yuan to 7.3282 per dollar, its weakest since December 2006.

Meanwhile, the euro and British pound are feeling the heat from the dollar’s vigor and their own domestic concerns. The euro slipped to $1.0706, nearing its lowest point since June, while the pound edged down to $1.2478, approaching its weakest level since early June.

Interested in becoming a Learn2Trade Affiliate? Join us here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.