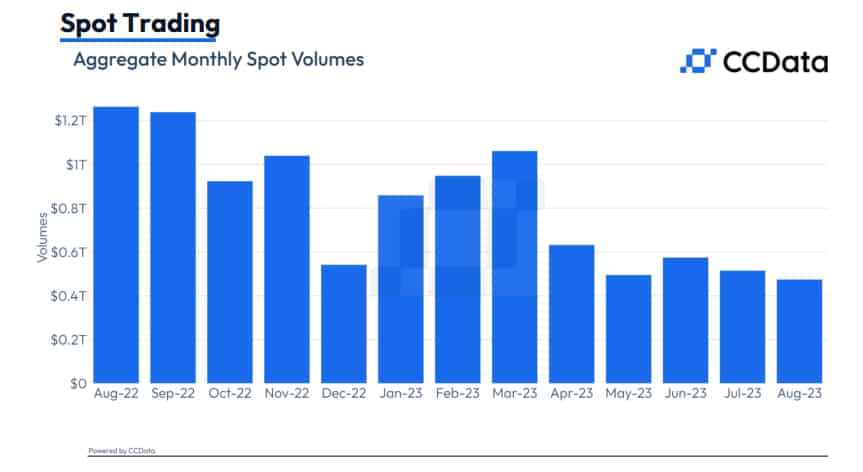

August witnessed a remarkable slump in activity within the crypto spot market, as reported by CCData, a leading digital asset data provider. Trading volume on centralized exchanges plunged by 7.78%, reaching $475 billion, marking its lowest point since March 2019.

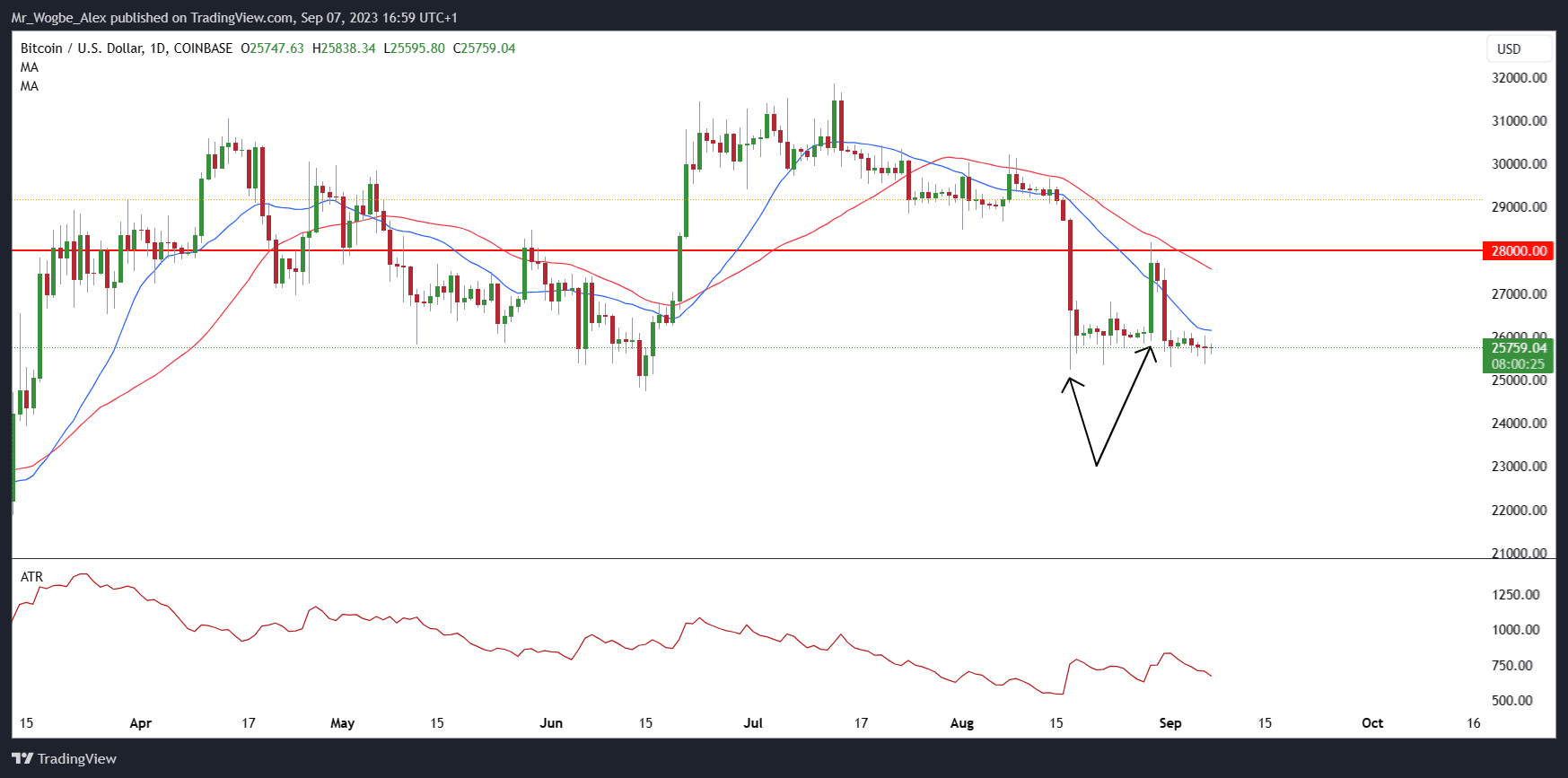

This drop in spot trading activity is indicative of disinterest among traders despite sporadic bursts of volatility in August, primarily driven by external factors. Grayscale Investments secured a legal victory against the U.S. Securities and Exchange Commission (SEC) on August 29th, allowing it to convert its Bitcoin Trust (GBTC) into an exchange-traded fund (ETF). This development briefly boosted Bitcoin’s price to $28,000; however, the rally proved short-lived and failed to ignite significant trading interest.

Even an over 10% drop in Bitcoin’s value to $25,000 on August 17th, mirroring a broader sell-off in traditional markets, did not translate into increased trading volumes on centralized exchanges.

Crypto Derivatives Market Volume Plummets to 2021 Low

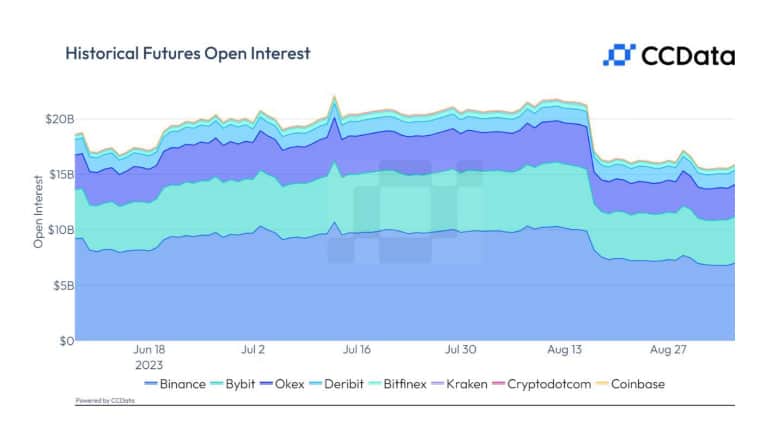

The crypto derivatives market, encompassing futures and options, also experienced a contraction in August. Derivatives trading volume plummeted by over 12%, landing at $1.62 trillion, its second-lowest point since 2021.

The open interest, representing the total value of outstanding contracts, took a substantial hit, plummeting by 19.5% to $17.1 billion, erasing $4.13 billion worth of open positions. This implies that the market’s current dynamics are driven more by speculative trading than long-term conviction.

Despite these fluctuations, Binance continues to maintain its top position in both the spot and derivatives segments. However, it has faced regulatory scrutiny and global pressure concerning compliance and security issues, with its spot market share falling to 38.5%, its lowest since August 2022.

In conclusion, August’s crypto market exhibited notable declines in spot trading and derivatives activity, seemingly unresponsive to external catalysts. These shifts suggest a crypto market that is presently influenced more by speculation than steadfast conviction.

Interested in becoming a Learn2Trade Affiliate? Join us here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.