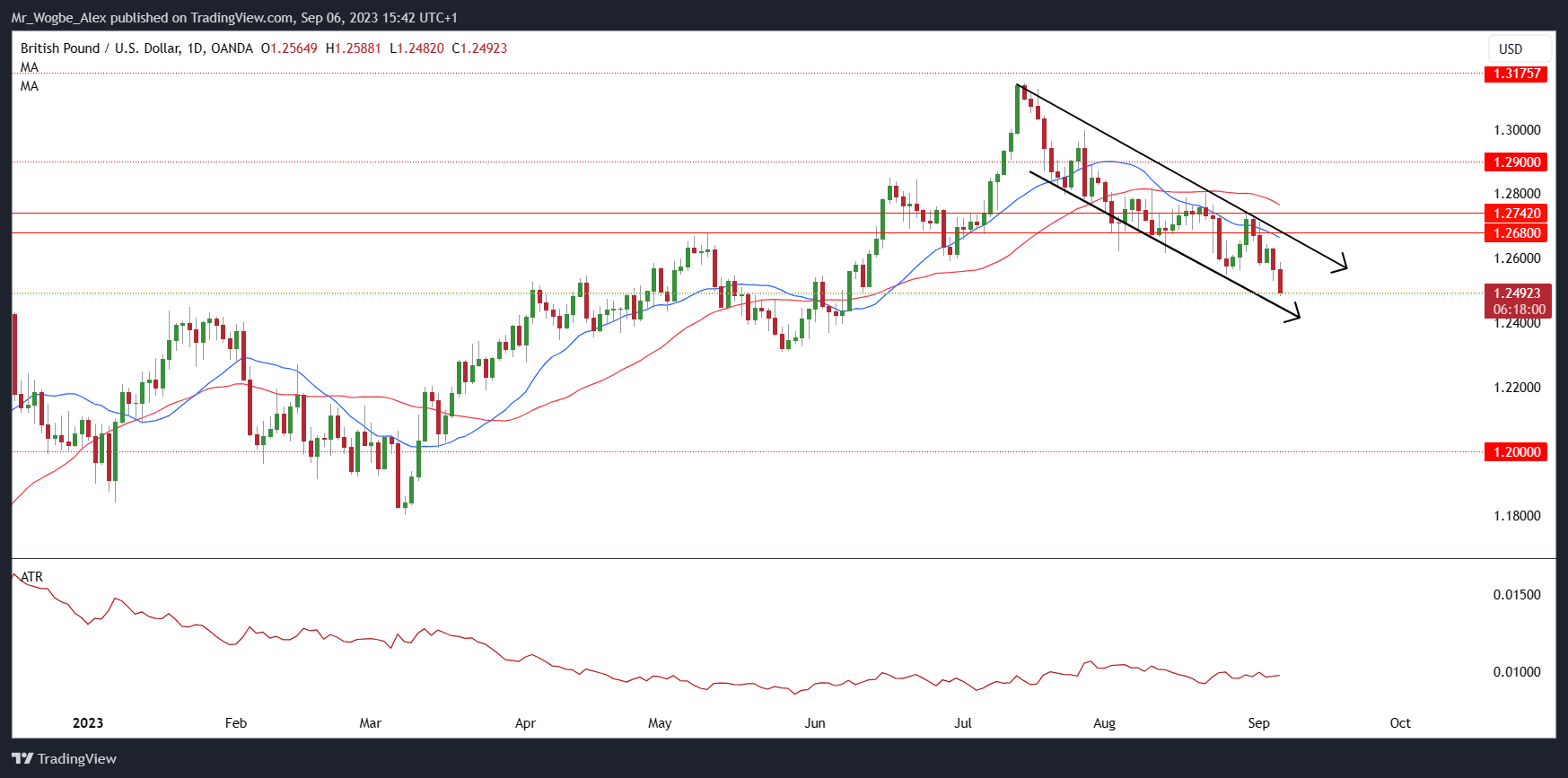

The British pound is feeling the heat as the US dollar surges in the wake of mounting global economic uncertainties and rising oil prices. On Wednesday, the pound slumped to its lowest point in three months, hitting $1.2482 and losing 0.58% against the resurgent greenback, marking a nearly 1.43% decline for September.

The dollar’s resurgence is evidenced by the Dollar Index, which soared by 0.66% on Tuesday, marking its most substantial daily gain since March. This remarkable recovery was propelled by data revealing economic struggles in both China and Europe, in stark contrast to the relatively robust US economy.

The pound, which had previously outperformed its peers against the dollar in the first half of the year, enjoyed a boost from positive British economic data and elevated inflation. This fueled expectations that the Bank of England (BoE) would opt for a longer-term rate hike strategy compared to other central banks.

However, recent remarks by BoE Chief Economist Huw Pill have cast a shadow on these expectations. Pill suggested the BoE’s preference for a cautious, longer-term rate approach rather than aggressive hikes. Currently, the markets have already factored in a 25 basis point rate increase to 5.5% at the BoE’s next meeting later this month. Yet, the timing of subsequent 25 basis point increments remains uncertain.

British Pound Weakens Across Board

The pound’s struggles were not limited to the dollar; it also weakened against the euro and the yen. The euro gained 0.44% to 85.6 pence, while the yen strengthened by 0.67% to 184.38 yen. Japan’s top currency official added to the yen’s strength by hinting at the potential for intervention to counter its depreciation.

Despite these recent challenges, it’s worth noting that just last week, the pound reached its highest value against the yen since 2015. The currency markets continue to be a dynamic arena, with multiple factors at play influencing the pound’s performance. Investors and analysts will be watching closely for developments in the coming weeks to determine the pound’s trajectory amidst these global economic uncertainties.

Interested in becoming a Learn2Trade Affiliate? Join us here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.