The U.S. dollar has soared to its loftiest position in six months, riding on the coattails of robust economic indicators and growing expectations of imminent interest rate hikes.

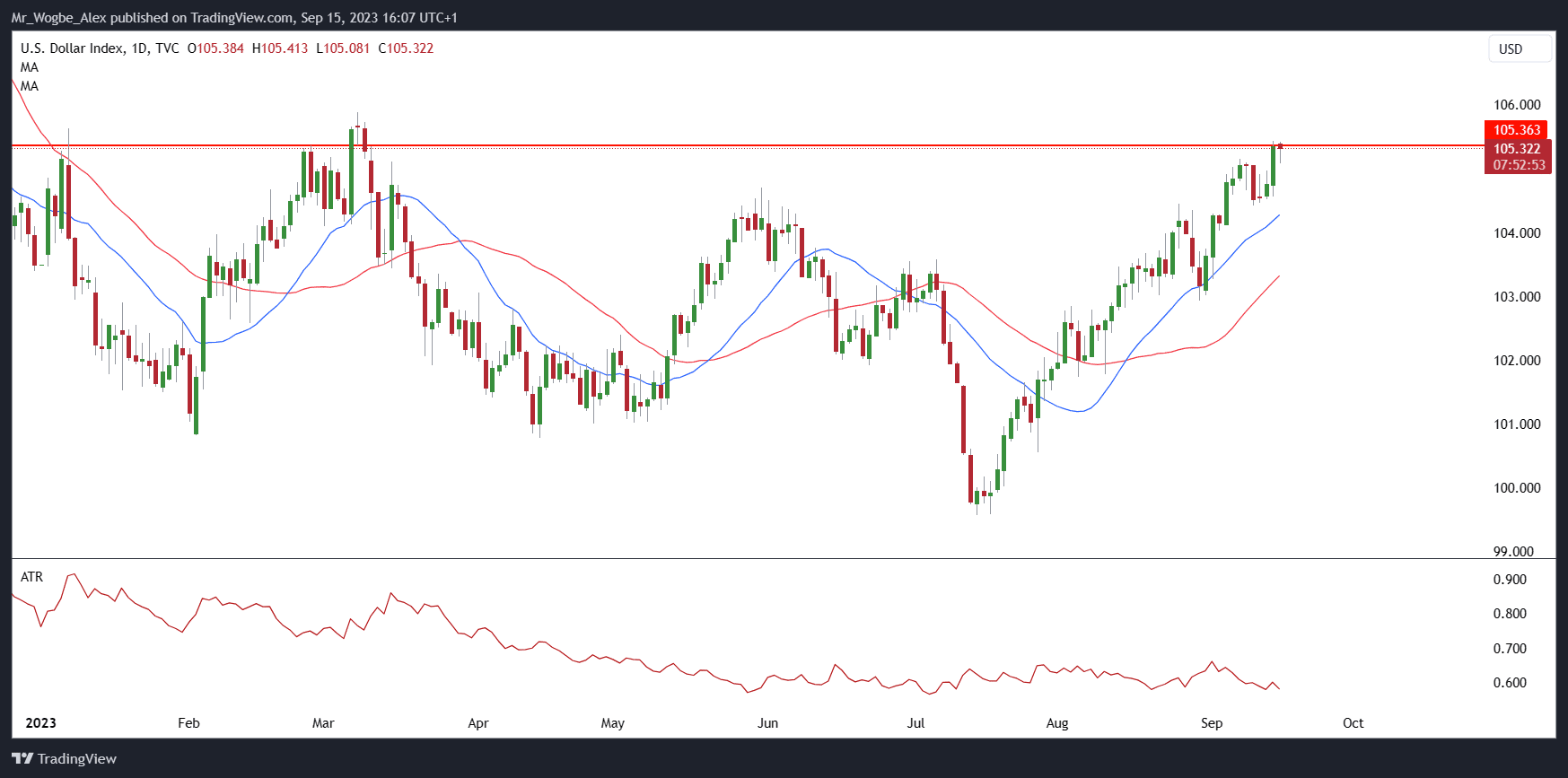

The dollar index, which gauges the greenback’s strength against a basket of major currencies, climbed to an impressive 105.435 on Thursday, marking its highest point since March 7. While it dipped slightly to 105.322 on Friday, it remains steadfastly on course for its ninth successive weekly ascent.

This formidable dollar rally was fueled by resounding statistics in August, showcasing that U.S. retail sales exceeded expectations. Driven by surging gasoline prices and robust consumer spending, these figures buttress the conviction that the American economy is sprinting ahead of its global peers. Consequently, speculation is rife that the Federal Reserve might have to expedite interest rate hikes.

Euro and Yen Fall Against the U.S. Dollar; Yuan Recovers

Across the Atlantic, the euro found itself under duress, plummeting to $1.0631 on Thursday, its lowest point since March 20. The European Central Bank (ECB) may have ratcheted up its benchmark rate to an unprecedented 4%, but it cautioned that this could potentially be the finale of its current rate hike cycle. To exacerbate matters, the ECB scaled back its growth and inflation forecasts for the coming year, hinting at a probable rate cut in 2024.

Meanwhile, the Japanese yen languished at a ten-month nadir of 147.95 per dollar as the Bank of Japan (BOJ) maintained its accommodative stance, distinctive among global central banks. The BOJ clung to its policy rate of -0.1% and its 10-year government bond yield target of approximately zero. To bolster economic prospects, it expanded its asset acquisitions.

Remarkably, the Chinese yuan countered the trend, clawing back some territory against the dollar following a report revealing robust growth in China’s industrial output and retail sales for August. Nevertheless, its ascent was tempered by the People’s Bank of China’s decision to slash banks’ reserve requirement ratios by 25 basis points in an attempt to infuse liquidity and stimulate growth.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.