The Japanese yen experienced a rollercoaster ride in the currency markets following remarks by Bank of Japan (BOJ) Governor Kazuo Ueda. On Monday, the yen surged to a one-week high of 145.89 against the U.S. dollar, but its strength was short-lived, falling to 147.12 per dollar on Tuesday, down 0.38% from the previous close.

Ueda’s comments, made during an interview with a newspaper, suggested the possibility of exiting the long-standing negative interest rate policy by the end of the year. The yen initially rallied as investors interpreted this as a shift in the BOJ’s ultra-loose monetary stance.

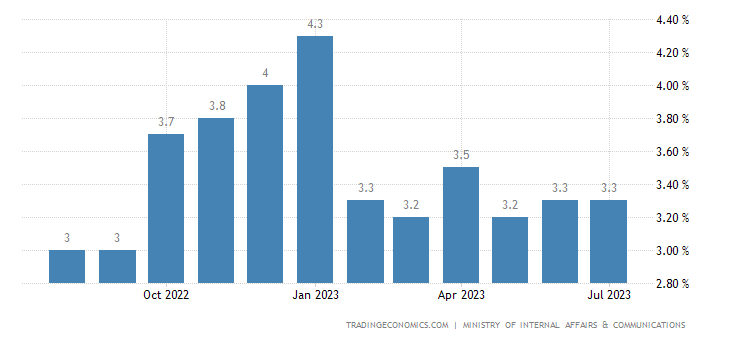

However, some analysts cautioned against reading too much into Ueda’s statements, pointing out that Japan remains far from its 2% inflation target. According to Reuters, Adam Cole, Chief Currency Strategist at RBC Capital Markets, remarked, “Japan is still a long way from meeting the criterion of sustainable 2% inflation, and the comments don’t really change much for me.”

In contrast, Hiroshige Seko, a senior ruling party official, interpreted Ueda’s remarks as indicating the central bank’s intent to continue monetary easing.

Yen Remains Weak Against the Dollar Due to Central Bank Policy Divergence

The yen has faced sustained pressure against the U.S. dollar as the U.S. Federal Reserve has been steadily raising interest rates since the previous year, while the BOJ continues to maintain one of the most dovish stances among central banks worldwide.

Despite the market’s initial excitement, uncertainty prevails as to whether Japan can truly exit its negative rate policy by year’s end. Investors will closely monitor economic data leading up to December to gauge the BOJ’s next move.

The currency markets remain on alert, with a watchful eye on future BOJ announcements, as the yen’s value hinges on Japan’s ability to combat deflation and reach its inflation goals.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.