In a pivotal move, the U.S. House of Representatives has taken a step closer to potentially prohibiting the development of a digital dollar, a decision that could impact the nation’s competitiveness in the global race for Central Bank Digital Currencies (CBDCs).

#NEW: The House Financial Services Committee advances national security, financial privacy, anti-CBDC legislation to the full House for consideration.

📖 Read more 🔗https://t.co/NdYnxygUwq

— Financial Services GOP (@FinancialCmte) September 20, 2023

A bill, spearheaded by Rep. Patrick McHenry (R-N.C.), gained traction as it was approved by the House Financial Services Committee. The legislation not only mandates congressional approval for CBDC pilot programs but also seeks to bar the Federal Reserve from issuing a retail digital currency. The primary motivation behind this move is to safeguard both American citizens’ privacy and the stability of the financial system from potential CBDC-related risks.

However, this contentious bill has sparked fierce opposition from Democratic lawmakers. They contend that it may stifle innovation and hinder research into CBDCs, which hold the promise of delivering faster, cheaper, and more straightforward payment solutions for American citizens. Rep. Maxine Waters (D-Calif.), the committee’s ranking member, cautioned that such legislation could keep the U.S. trailing behind nations like China, which are aggressively pursuing their own CBDC initiatives.

Digital Dollar Fate Unlikely in the Senate

The bill’s fate in the Senate remains uncertain, given that the Senate Banking Committee is led by Sen. Sherrod Brown (D-Ohio), a known skeptic of the digital asset industry.

In contrast, the Federal Reserve is taking a cautious approach. It has not yet formally proposed the creation of a digital dollar and is currently in the early stages of conducting “basic research” on the potential implications of such a move. Michael Barr, Vice Chairman for Supervision at the Fed, emphasized that they would only proceed with a digital dollar if guided by the White House and with the backing of congressional legislation.

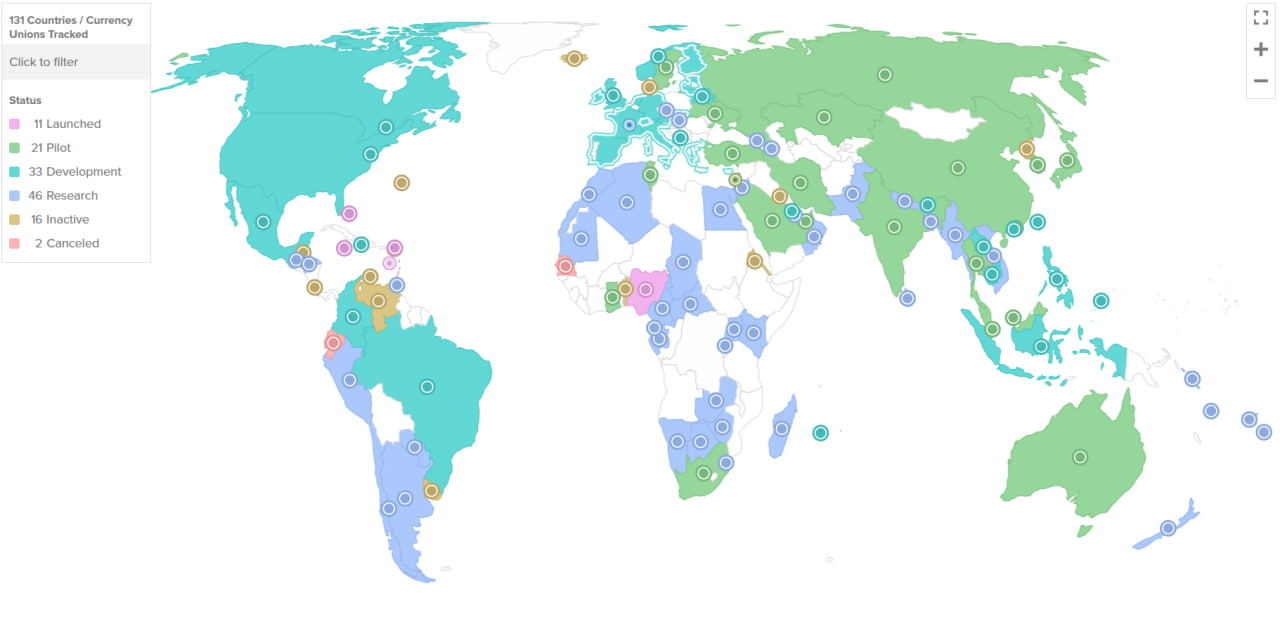

The United States is not alone in its exploration of CBDCs. According to data from the Atlantic Council, over 66% of central banks worldwide are actively exploring or considering the adoption of CBDCs. These digital tokens, unlike decentralized cryptocurrencies, represent a nation’s fiat currency and are underpinned by the authority of its central bank.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.