The U.S. dollar maintained its position near an 11-month high on Wednesday, despite facing some pressure. China’s resurging economy triggered optimism, propelling Asian currencies and commodities upward. Yet, the greenback stood its ground, bolstered by rising U.S. yields driven by robust retail sales data.

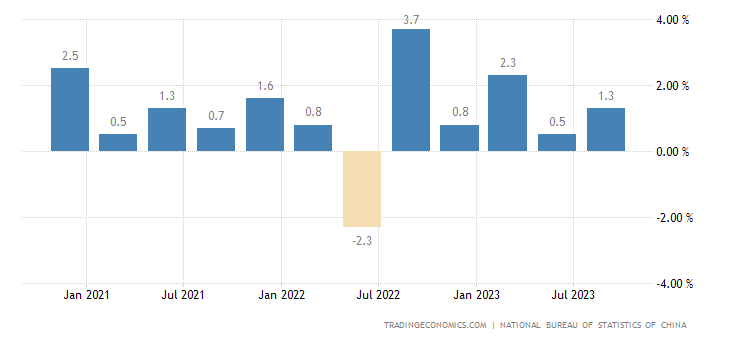

This comes as China’s GDP surpassed expectations, surging by 1.3% in the third quarter, outperforming the projected 1%. This acceleration from the previous quarter’s 0.5% growth signaled a strong rebound for the world’s second-largest economy. Simultaneously, industrial output increased and unemployment rates fell.

China’s positive economic news immediately impacted Asian currencies. The yuan soared to a one-week high of 7.2988 against the dollar before settling at 7.3140. The Australian dollar, sensitive to China’s performance, gained 0.44% to reach $0.6393, while the New Zealand dollar rose 0.39% to $0.5918.

Dollar Index on a Slight Descent

The dollar index, measuring the greenback against six major peers, witnessed a slight descent, reaching 106.01 over three days. Despite this dip, it still remains below its peak of 107.348 achieved last week, the highest level since November 2022.

The U.S. dollar’s resilience is rooted in the strong U.S. economy, which shows no signs of slowing down in the face of the pandemic. Recent data revealed a significant 1.6% increase in U.S. retail sales for September, surpassing expectations and driving U.S. Treasury yields higher.

The Japanese yen, influenced by U.S. Treasury yields, experienced fluctuations. Despite gaining against the dollar initially, reaching 148.73, it has since edged closer to the critical 150 mark, currently at 149.82. Japan’s central bank’s ultra-loose monetary policy, maintaining bond yields near zero, continues to weigh on the yen.

Future Prospects Hinge on Trade Talks and Geopolitical Tensions

The future outlook of the dollar rests on factors like the resumption of U.S.-China trade talks and geopolitical tensions in the Middle East. Recent events, such as the Gaza hospital explosion, have heightened concerns about the potential for a broader conflict.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.