As well as predicting the markets, one of the hardest things about stock trading can be keeping track of your investments. This is especially the case for short-term traders – who only hold positions open for minutes or several days at most.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

With this in mind, today we unveil the very best stock tracking apps of 2023.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

We also talk about what factors to look out for when searching for the stock tracking app for your financial goals and some key features you may want to ensure you have access to.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

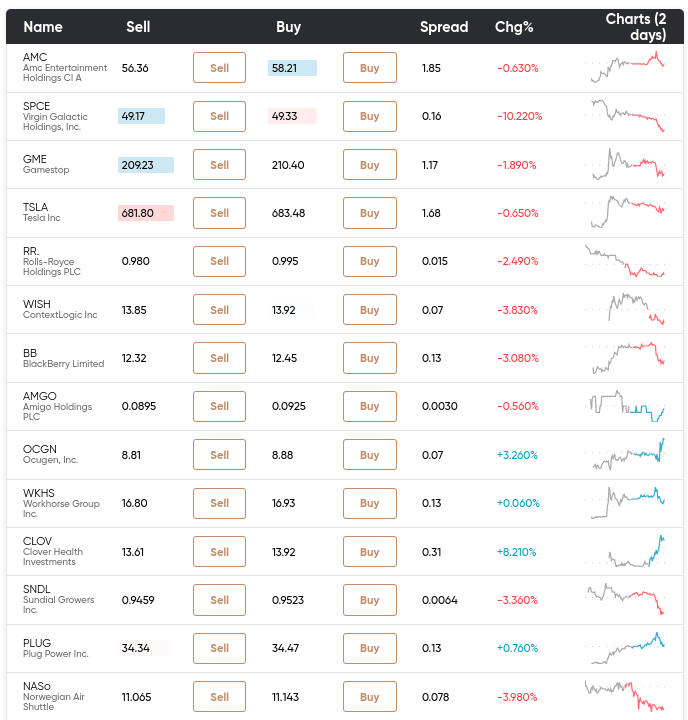

Best Stock Tracking Apps 2023: Sneak Peek

For those who would rather cut to the chase and read the entirety of this page later – see the best stock tracking apps of 2023 listed below:

- No 1: AvaTrade – Overall Best Stock Tracking App 2023

- No 2: EightCap – Best Stock Tracking App for MT4/5.

- No 3: Capital.com –Best Stock Tracking App With Beginner-Friendly Interface.

- No 4: LonghornFX – Best Stock Tracking App for High Leverage.

- No 5: Currency.com – Best Stock Tracking App for Tokenized Shares.

We review all of the above stock tracking apps in full further down in this guide.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is a Stock Tracking App?

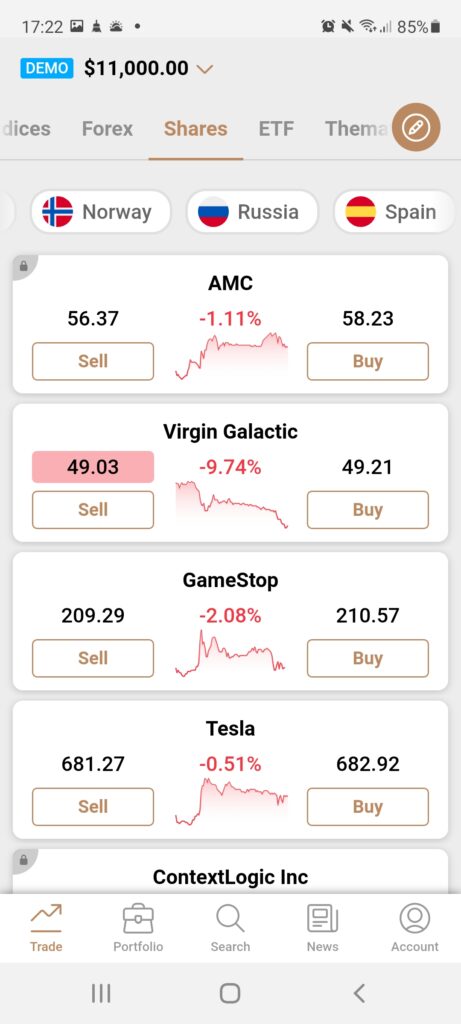

For anyone wondering what a stock tracking app is – it’s an application that you can download on your mobile phone. Put simply, you will join a trusted provider, download and install the app, and sign in to your newly created account.

This allows you to analyze and track all of your stock investments from the palm of your hand. If that isn’t convenient enough – the providers we review today also enable you to place orders and keep fees to an absolute minimum.

Best Stock Tracking Apps 2023: Full Disclosure

Without further ado – below you will find reviews of the best stock tracking apps of 2023. After our reviews, we explain what makes the best – so you know what to look for yourself.

1. AvaTrade – Overall Best Stock Tracking App 2023

AvaTrade offers a stock tracking app called AvaTradeGO, which is free to download for Android and iPhone users. This end-to-end trading solution allows you to manage your portfolio - keep a close eye on price updates, and place orders. You will not pay any commission fees to trade here.

This top-rated stock tracking app provides access to the biggest companies in the world - via CFD instrument. This means you have the added benefit of speculating on the future price of the underlying asset - in either direction. Not to mention the option of leverage, which is available up to 1:5 - meaning you can take a position five times that of your account balance.

So, what's available to trade here? You can buy and sell shares in companies listed on some of the world's largest stock marketplaces. This includes popular exchanges in places like the US, the UK, Europe, and others. There are more than 1,000 stocks to trade - and found this to include the likes of Apple and Microsoft. The long list also includes Netflix, Groupon, Tesla, HSBC, Facebook, Google, Berkshire Hathaway, Intel, and tons of other well and lesser-known companies.

As this is a commission-free stock tracking app provider, we had a look at the spread and found this to be very tight on most markets. For instance, the spread on Apple averages 0.1%. AvatradeGO makes it easier to track the global markets, thanks to its partnership with multiple platforms. This includes the well-known trading software MT4 - with a wide variety of charts, indicators, and customizable drawing tools. You can also adapt your own stocks watchlist, to monitor assets you are interested in.

This stock tracking app offers live multilingual support and you can also access your account via the desktop version. Other compatible platforms include DupliTrade, AvaSocial, and ZuluTrade. These three third-party platforms allow for copy trading. Furthermore, you can deposit a minimum of $100 to trade stocks on the go and there are plenty of payment options. This includes Skrill, WebMoney, Neteller, Visa, Mastercard, and bank transfer. You can trade lots as small as 0.01 units on this app. In terms of how safe the application is - ASIC and five other bodies regulate this stock CFD provider.

- Stock tracking app with over 1,000 markets and $100 deposit minimum

- Regulated in 6 jurisdictions, inclusive of Australia and the EU

- Trade stock CFDs with 0% commission and tight spreads

- Admin and inactivity fee after 12 months

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

3. LonghornFX – Best Stock Tracking App for High Leverage

Looking to access stocks listed on global exchanges in the UK, the US, or Europe with high leverage? If so, LonghornFX might be the stock tracking app for you. In fact, you may be offered up to 1:500. The minimum lot size here is 0.01 units - which is ideal for entry-level traders. This application is free for traders using iPhone or Android phones and specializes in CFDs. LonghornFX is the online broker behind the stock tracking app. This top-rated application lists heaps of stock CFDs from some of the most traded marketplaces in the world.

Recognizable stocks include eBay, Mastercard, Microsoft, Air France, Hilton, Apple, Netflix, Siemens, Volkswagen, Procter & Gamble, Tesla, and more. There are over 40 stocks CFDs to buy and sell here and you will be required to create an account at LonghornFX, download the stock tracking app, and then link your account to the aforementioned MT4. This can either be done via the application or on desktop/Windows. Both newbies and seasoned traders will find this a simple process.

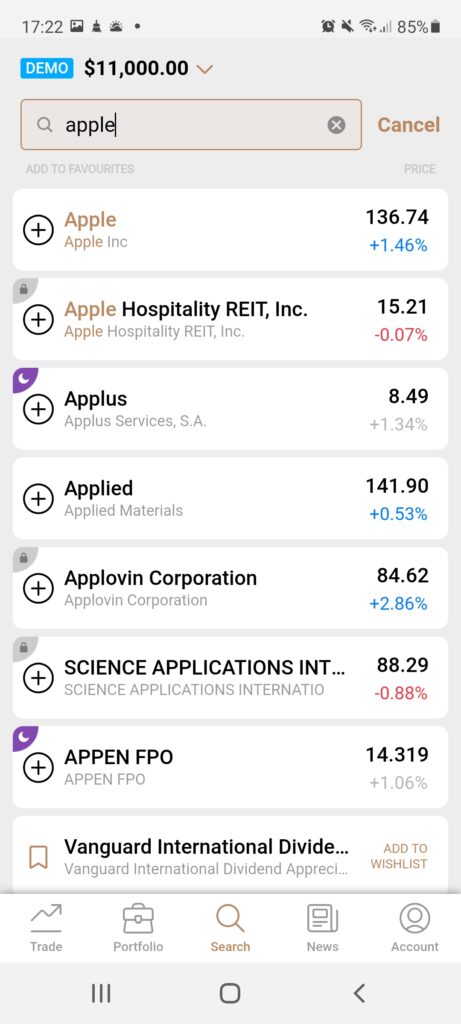

For anyone unsure of how to get started on a stock tracking app, there will be step-by-step instructions available at the end of this guide. Once you have completed this step, you will be better prepared to monitor your chosen stocks via the many features and tools on offer. You can also incorporate stop-loss and take-profit orders with ease. If you have yet to learn the complexities of technical analysis, you can take advantage of the plethora of trading tools via a risk-free demo account. This will come with paper funds.

Don't forget, in contrast to traditional stock trading - this is a CFD app so you can also short sell if you feel like the value of the asset will fall. Unlike many stock tracking apps, this one welcomes Bitcoin deposits (minimum $10 equivalent). Those of you without crypto can still fund your account using a credit or debit card. Please note that LonghornFX will exchange your fiat into BTC coins, although your account will be denominated in US dollars. This platform follows AML and charges 0.0005 BTC per transaction.

- CFD stock tracking app with high leverage up to 1:500

- Low commission and competitive spreads

- Same-day withdrawals and wide range of CFD assets

- Platform prefers Bitcoin deposits

4. Currency.com – Best Stock Tracking App for Tokenized Shares

Currency.com offers a different type of stock tracking app. Whilst you can still do the same kind of thing - you won't be trading CFDs. Instead, you will be buying and selling tokenized shares. The token - created using Blockchain technology - will track the real-world price of the underlying stocks and shares and fluctuate along with the asset. Again, this cuts out the need to take ownership of the asset, and also means you are able to short sell and leverage your positions.

This stock tracking app enables you to trade full or fractional share tokens that represent stocks from exchanges from multiple European markets, the UK, the US, and Asia. You can buy and sell a wide range of tokenized shares via this stock tracker app. This includes Tesla, Facebook, Alibaba, Nikola, Blackberry, Nike, Apple, Virgin, Abercrombie and Fitch, Nintendo, Estee Lauder, Royal Mail, Samsung, Royal Dutch Shell, and many others. This guide found that the Currency.com app is uncomplicated to use - which is perfect for newbies.

Currency.com - the brokerage behind the stock tracking app - also charges a low commission - which is the equivalent of $6 for each BTC that is traded. This provider also offers super-low fees, with the spread on Apple averaging 0.09%. This platform also offers up to 1:500 leverage to boost your trading power. The best portfolio management apps provide access to tools needed to perform technical analysis. In the case of Currency.com, the provider offers 75 high-quality indicators to monitor your stock interests.

You can also create tailor-made charts with multiple layouts and a wide variety of drawing tools. This allows you to choose your own chart patterns, draw trend lines, and view Fibonacci values. To fund your account, you will have the choice of a variety of methods including Bitcoin, Ethereum, Visa, Mastercard, Yandex Money, and bank transfers. The minimum deposit on the stock tracking app is $10, or $50, via bank transfer. Furthermore, this provider is regulated and follows AML rules.

- Stock tracking app with tight spreads

- Low commission fees and high leverage up to1:500

- Same-day withdrawals and tons of tokenized stock

- You can not buy any traditional stocks via this app

5. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

What Makes the Best Stock Tracking Apps in 2023?

We have reviewed the five best stock tracking apps for 2023 – and each of them has heaps to offer and is backed by a regulated and reputable provider. Notably, some stock tracking apps will require you to open two separate accounts to monitor your stock investments – one with them, and one with a broker.

In contrast, all the platforms we talked about today only require one sign-up, and make keeping an eye on the markets easy. Although we have done the legwork for you, you may still want to shop around and see what else is out there. With this in mind, you will see some key considerations below.

Regulation and Compliance

If the provider of the stock tracking app is regulated, you know you are adding funds to your account in a safe space. After all, platforms holding a license have lots of regulatory hoops to jump through.

- Depending on the jurisdiction it falls under, the app will have to follow a very long list of rules to ensure a safe and fair trading environment.

- Some of the most commonly seen bodies keeping the space free from crime are ASIC, the FCA, and CySEC.

You will often find that regulated stock tracking app providers keep your capital in a separate account to its own, and you will also have to upload proof of identity when signing up.

Tight Spreads and Low Fees

How much disparity there is between stock tracking apps might surprise you. One of the most obvious things to consider when looking to sign up with a new provider is fees.

You will see below a quick explanation of the different fees you will need to be aware of when searching for the best stock tracking app for you.

Commission fees

This fee definitely comes in all shapes and sizes. Some stock tracking apps might stipulate a fixed fee, such as $8 for a specific amount of units traded.

Another may require a percentage of your order value such as 2%. The best stock tracking apps either charge no commission or at least a competitive variable rate.

Spreads

Low spread brokers are your best bet when looking for a stock tracking app. The tighter this indirect fee is, the easier you can allow your gains to grow. As you probably already know, the spread is the difference between the bid and ask price of the stock you are trading.

Inactivity Fees

Not all stock tracking apps charge inactivity fees, but it is something to be mindful of.

- As you can probably guess, this is charged by some stock tracking apps for not actively trading or making a deposit for a certain length of time.

- This will always be mentioned on the platform somewhere, so do make sure you check the fee table.

- If you plan on using the stock tracking app to monitor, buy and sell regularly then this charge probably won’t be a concern to you.

This is because in most cases the provider won’t charge this fee until several months of dormancy, or even a whole year of inactivity has passed.

Rollover Fees

This is an important fee to be aware of, particularly if you see yourself embracing the flexibility of share CFDs via your chosen stock tracking app. Notably, you might also see this referred to as an overnight financing or swap fee.

In a nutshell, this is a bit like an interest rate. All CFD stock tracking apps will charge it for holding your leveraged position open for you – after the relevant markets have officially closed.

This guide found that the best stock tracking apps will make you aware of the cost of keeping your CFD positions open overnight, and will also tell you what time this charge kicks in.

Variety of Global Marketplaces

When you are looking to sign up with the best portfolio management apps – it’s important to have a look around and see what is listed and available to trade. You will probably track existing stock positions, but also ones you are interested in.

Whilst one provider might only offer access to say the London Stock Exchange – another will list stocks listed on exchanges located everywhere from the US to Europe and Asia.

- Australian Securities Exchange – Australia

- Bombay Stock Exchange – India

- Deutsche Börse – Germany

- Euronext – Amsterdam, Belgium, Brussels, Dublin, Lisbon, Milan, Oslo, Paris, and Portugal

- Hong Kong Stock Exchange – Hong Kong

- London Stock Exchange – The UK

- Madrid Stock Exchange – Spain

- Moscow Stock Exchange – Russia

- Nasdaq – The US

- National Stock Exchange – India

- New York Stock Exchange – The US

- Oslo Stock Exchange – Norway

- Japan Exchange Group – Japan and Osaka

- Shanghai Stock Exchange – China

- Shenzhen Stock Exchange – China

- Swiss Exchange – Switzerland

- Toronto Stock Exchange – Canada

The Currency.com stock tracking app offers access to marketplaces in 11 different regions, and sectors cover everything from utilities to technology. As you can see, it’s never been easier to buy and sell stocks from countries all over the world – meaning the best stock brokers will list a wide variety.

Best Stock Tracking Apps: Platform Features

We have listed below some of the most popular features offered by the best stock tracking apps for 2023. Whilst not all of them will be to your taste, it’s good to know what’s available.

Profit From Rising and Falling Stocks

High leverage brokers often go hand in hand with CFD stock tracking apps. Some of the providers we reviewed today will offer leverage of up to 1:500, although if you have no experience of using it you should proceed with caution.

Some new and seasoned stock traders prefer to cap themselves at say 1:2 or 1:5 leverage. The latter means you are still able to increase your position five-fold!

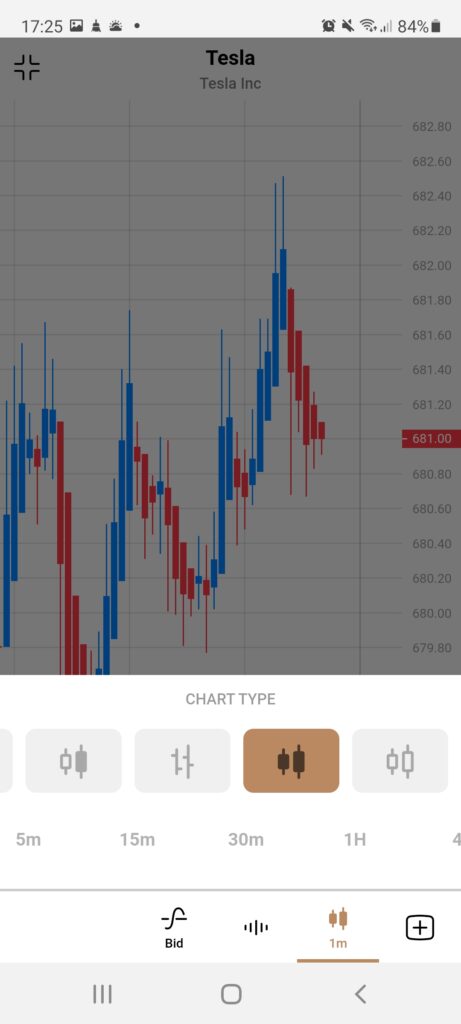

Accessible Charting Tools and Indicators

Charting tools and indicators are a vital part of technical analysis. If it wasn’t for historic price charts and the plethora of timeframes and drawing tools available, it is doubtful we would have a chance at predicting the rise or fall of the stock markets.

As such, this is definitely something to look out for. To give you an idea of what might be available – you will see some of the most popular indicators offered by the best stock tracking apps in the market:

- Standard Deviation

- Moving Average Convergence Divergence (MACD)

- Stochastic Oscillator

- Relative strength index (RSI)

- Bollinger bands

- Fibonacci Retracement

- Average directional index

- Ichimoku cloud

Please remember that if the stock tracking app itself isn’t capable of offering the technical indicators mentioned above – you can access this via the MT4 platform.

The providers we have talked about today either offer direct access to these analytical tools within the app – or are partnered with MT4/5 so you can connect your accounts for the best of both worlds

Demo Accounts Shorten the Learning Curve

If you haven’t got to grips with the aforementioned technical analysis tools needed to track your stock positions – try a demo trading platform for size.

If you are alerted to a potentially profitable opportunity, you need to be able to place an order quickly. You should also be able to flip between a real and paper account – to try stock strategies at your leisure.

Copy Stock Trading Activities

We touched on copy trading in our overall best stock tracking app reviews. For those unaware, as well as monitoring your own trades – you can also grow your portfolio by copying other people.

- If the person you invest in allocates 3% of their trading equity to a sell order on a Twitter position – you will also see 3% of your investment is on a short order on the same asset.

- If this sounds like something you might like to try, stock tracking app provider AvaTrade is compatible with no less than three options to copy a stock trader – like-for-like.

This includes AvaSocial, DupliTrade, ZuluTrade, and Mirror Trader. Some are passive, some are only semi-hands-off, and others require manual attention.

The Best Stock Tracking Apps 2023: Sign up and Download Today!

By this point, you hopefully feel prepared to monitor your stock investment via a stock tracking app. Before you can get started, you will need to sign up with a suitable provider.

By joining an already established platform that is regulated and able to offer you heaps of markets – you will have everything under one roof for easy access.

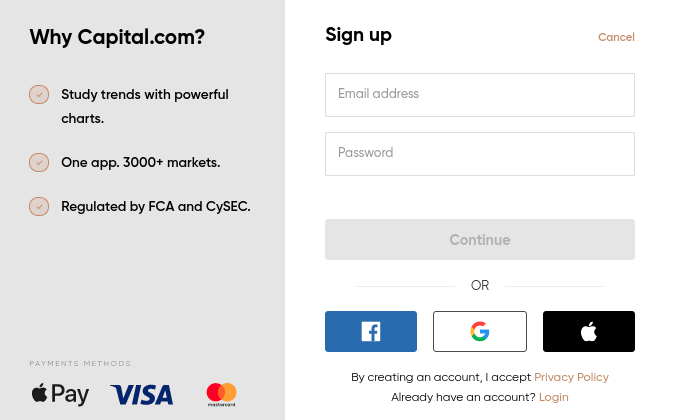

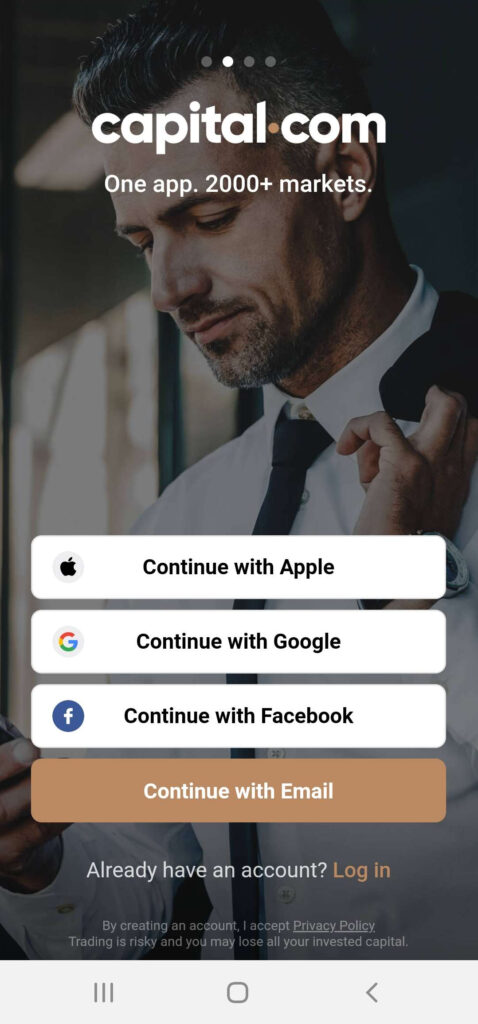

Step 1: Sign-up With a Stock Tracking App Provider

Sign up with whichever stock tracking app is most suitable for your needs. You might base this choice on low fees, features available, or listed markets.

To fully complete your account registration you will also need to enter a few details about your trading experience and financial situation.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Step 2: Send Clear Copy of ID Documents

To proceed with your registration with your chosen stock tracking app, you will need to upload some documentation.

You will be asked to upload a clear copy of your passport or driving license, followed by a bank statement or utility bill. This must state your full name, address, and be dated within the last 6 months.

Step 3: Download and Install Stock Tracking App

When you receive an email confirming your new account, you can head over to the relevant app store to download the mobile application.

Step 4: Add Money to Your Account

Once you are logged into the stock tracking app, you can select a payment method from what’s available and choose an amount to deposit. This will allow you to buy and sell stocks from the palm of your hand and hopefully – make some gains along the way.

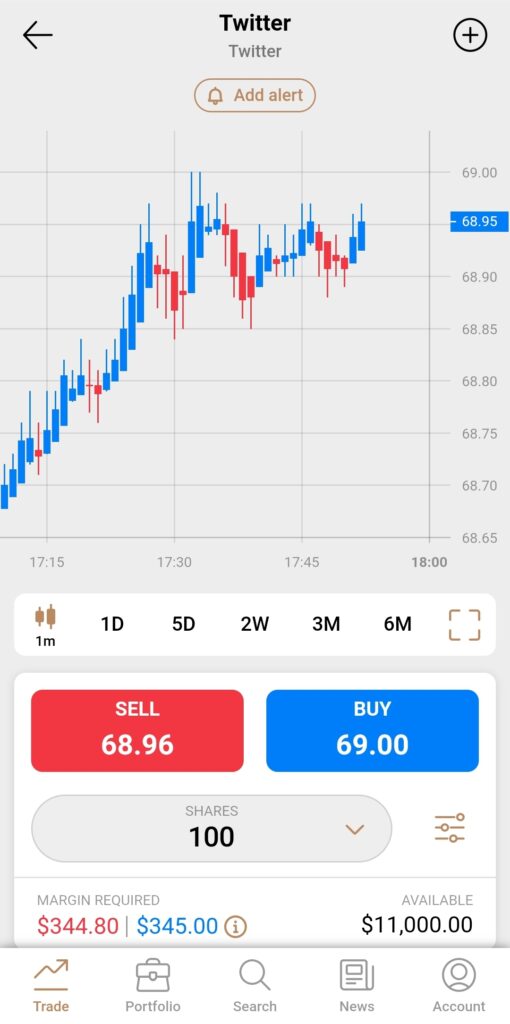

Step 5: Find Your Chosen Stocks

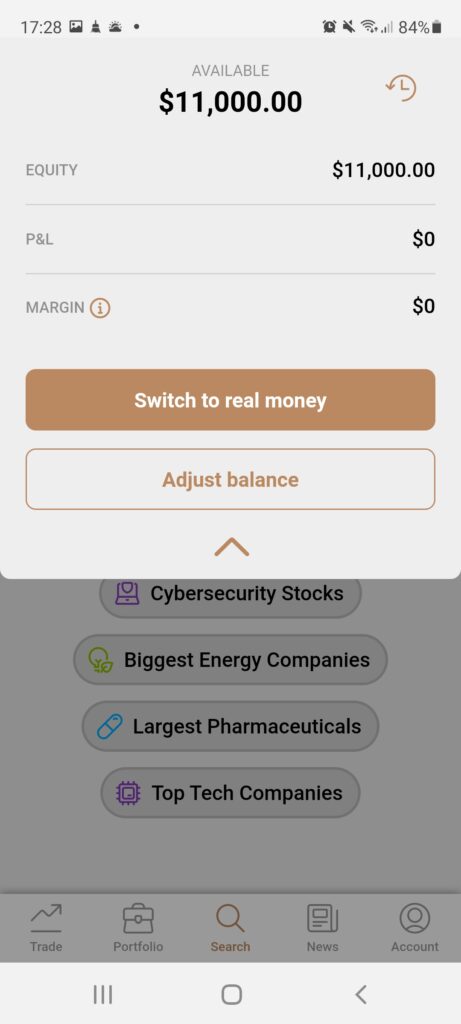

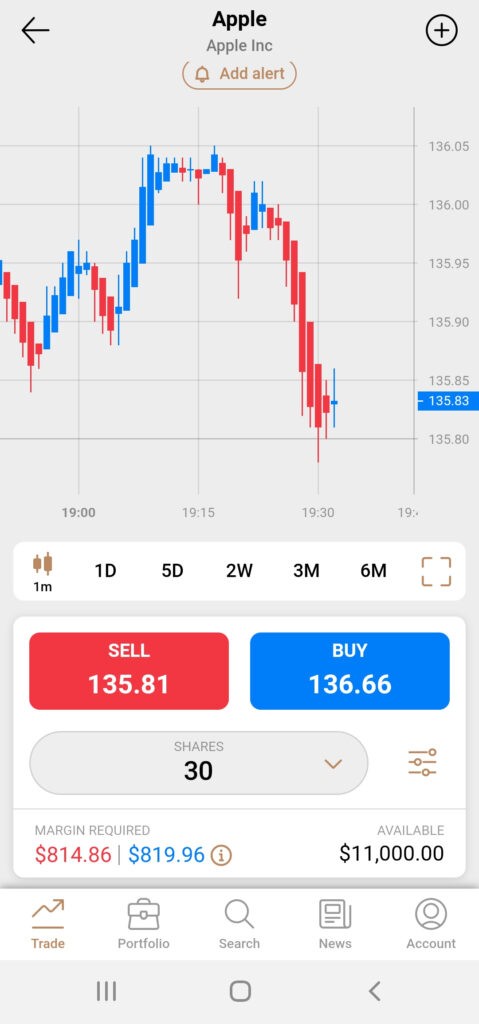

Now you can use the search facility at your chosen stock tracking app to find your desired market. Here we are searching for Apple.

Step 4: Place an Order

Now you can place an order on your chosen stock market. Here we are trading Apple. If you think the price of your chosen asset will increase, place a buy order. Alternatively, you can short sell if you believe the stock price will fall.

And that’s it – the broker behind the application will now execute your order. Finally, you can use your stock tracking app to monitor the value of your share investment 24/7!

The Best Stock Tracking Apps 2023: To Summarize

The best stock tracking apps will provide you with access to investment tools, features, competitive spreads, low trading fees, and portfolio management services. Remember that regulated app providers are held accountable for their actions so are the safest option.

By opting for an existing platform, instead of an independent app – your portfolio is looked after in a secure environment. This also means you can do all of the above on the go, but will also have the option of a desktop platform if you need a bigger screen.

The best stock tracking apps that we have reviewed today are all regulated and offer access to a plethora of leveraged shares – so you can trade in either direction and hopefully boost your investment capital.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts