In what seemed like a promising year for the euro, the currency has experienced a remarkable 3.5% surge against the dollar, hovering just under the $1.10 mark. Investors have been riding high on optimism as they bet on the euro’s continued rise, speculating that the U.S. Federal Reserve will halt its rate hike cycle before the European Central Bank (ECB) turns dovish.

However, recent insights from a comprehensive Reuters report shed light on potential challenges that lie ahead for the eurozone. The ECB finds itself grappling with a delicate dilemma: soaring inflation rates coupled with a weakened economy. This conundrum has even the most hawkish members of the ECB considering an end to their tightening measures as inflation cools down and growth begins to slow.

ECB Chief Says Additional Rate Hikes Unlikely

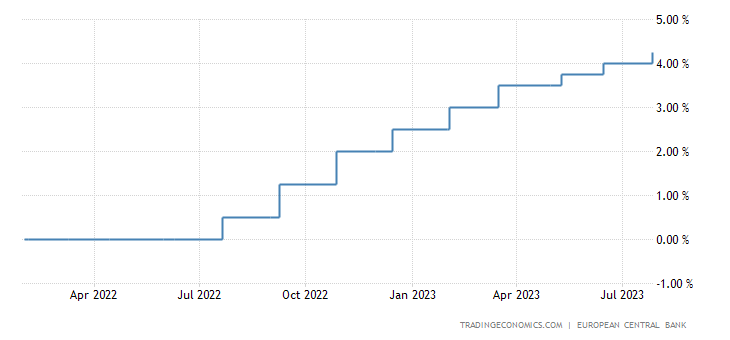

Only last Thursday, the ECB made a decisive move by raising its key interest rate by 25 basis points, reaching a 23-year high of 3.75%, in an effort to curtail the escalating inflation, which soared to an alarming 4.1% in June, significantly overshooting the ECB’s target of keeping it below 2%.

However, ECB President Christine Lagarde’s comments hinted that there might not be much room for further rate hikes, as the bank closely monitors incoming data before deciding on any future moves.

Lagarde’s cautious remarks had an immediate impact on the euro’s performance, causing it to drop 0.9% against the dollar as markets sensed a potential shift towards a more dovish approach. Consequently, money markets have adjusted their projections, now estimating a 40% chance of another quarter-point ECB rate increase in September, down from the earlier estimate of 60%.

The ECB’s cautious approach is indeed well-founded, given the multitude of headwinds currently facing the eurozone’s economy.

A Strong Euro Might Be Bad for the ECB Right Now

The strength of the euro poses an additional challenge for the ECB. The trade-weighted index, a gauge of the euro’s value against a basket of currencies, has been inching closer to record highs. While this may seem positive on the surface, it has adversely affected eurozone exports’ competitiveness and made imports cheaper, resulting in adverse effects on overall growth and inflation.

In light of these developments, some analysts are now expressing reservations about the sustainability of the euro’s rally. They believe that the ECB might soon adopt a more dovish stance, especially as weaker economic data begins to influence its communication and policy decisions.

Adding to the uncertainty, the euro may encounter further pressure if the U.S. Federal Reserve signals its intention to taper its bond-buying program in August or September, potentially bolstering the dollar’s performance. Although the Fed recently raised rates, the market speculates that this may have been the final move for the time being.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.