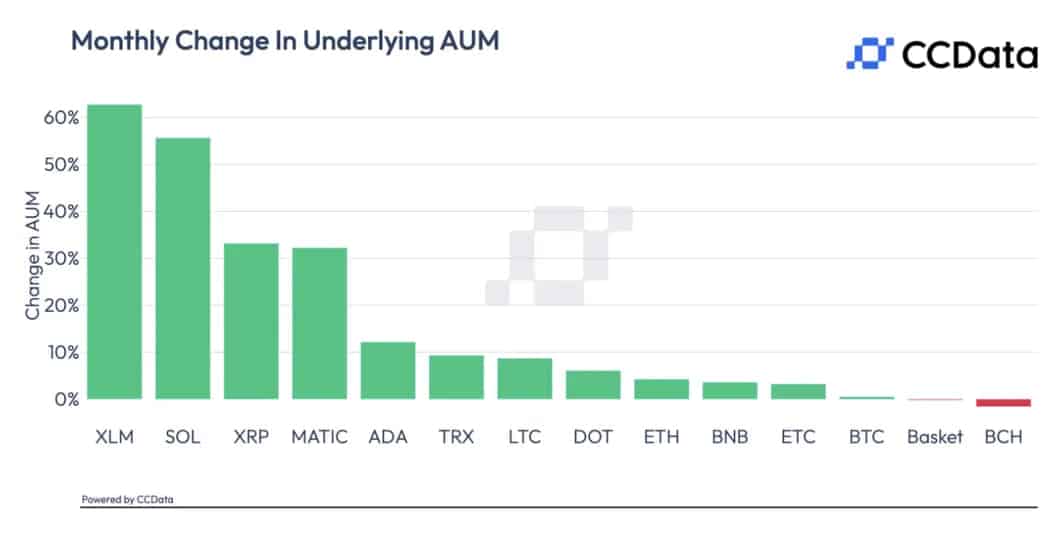

July emerged as a prosperous month for investment funds associated with three prominent cryptocurrencies: Stellar’s XLM, Ripple’s XRP, and Solana’s SOL. According to an insightful report from CCData, these funds experienced a substantial surge in their assets under management (AUM), leading to renewed interest and positive market sentiment.

Surge for Investment Funds Came After Favorable Summary Judgment for Ripple

According to CoinDesk, the notable turning point for these funds was marked on July 14, just one day after a significant U.S. legal ruling in favor of Ripple. The ruling clarified that the sale of XRP tokens on exchanges did not fall under the classification of investment contracts, providing a much-needed boost for Ripple amidst an ongoing lawsuit with the U.S. Securities and Exchange Commission (SEC).

This development not only boded well for Ripple but also sparked enthusiasm across the crypto sector, benefiting altcoins like XLM, SOL, and XRP.

According to CCData data, Ripple’s native token, XRP, witnessed an impressive 33.2% increase in AUM for associated products, soaring to $65.7 million in July. Stellar’s XLM-based products experienced even more remarkable growth, with AUM surging by 62.7% to reach $17.3 million. Meanwhile, Solana’s SOL-based products saw a robust jump in AUM, reaching $87.8 million with a remarkable 55.7% increase during the same period.

CCData Analyst Sheds Light on the Latest Happenings

CCData’s research analyst, Hosam Mahmoud, shed light on the positive sentiment surrounding XLM throughout July. In a note to CoinDesk, Mahmoud highlighted the progress of Stellar’s partnership with USDC’s Circle and its collaborations with esteemed entities like MoneyGram, which contributed to the crypto’s growing appeal among investors.

Additionally, Solana’s SOL gained significant traction as a formidable competitor to Ethereum thanks to its lightning-fast transaction speeds and remarkably low fees.

The report’s findings suggest that investors continue to demonstrate a keen interest in crypto funds, particularly those tied to promising altcoins. These funds offer an accessible and efficient way for investors to gain exposure to the thriving crypto market, eliminating the complexities and uncertainties of directly purchasing and storing individual tokens.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.