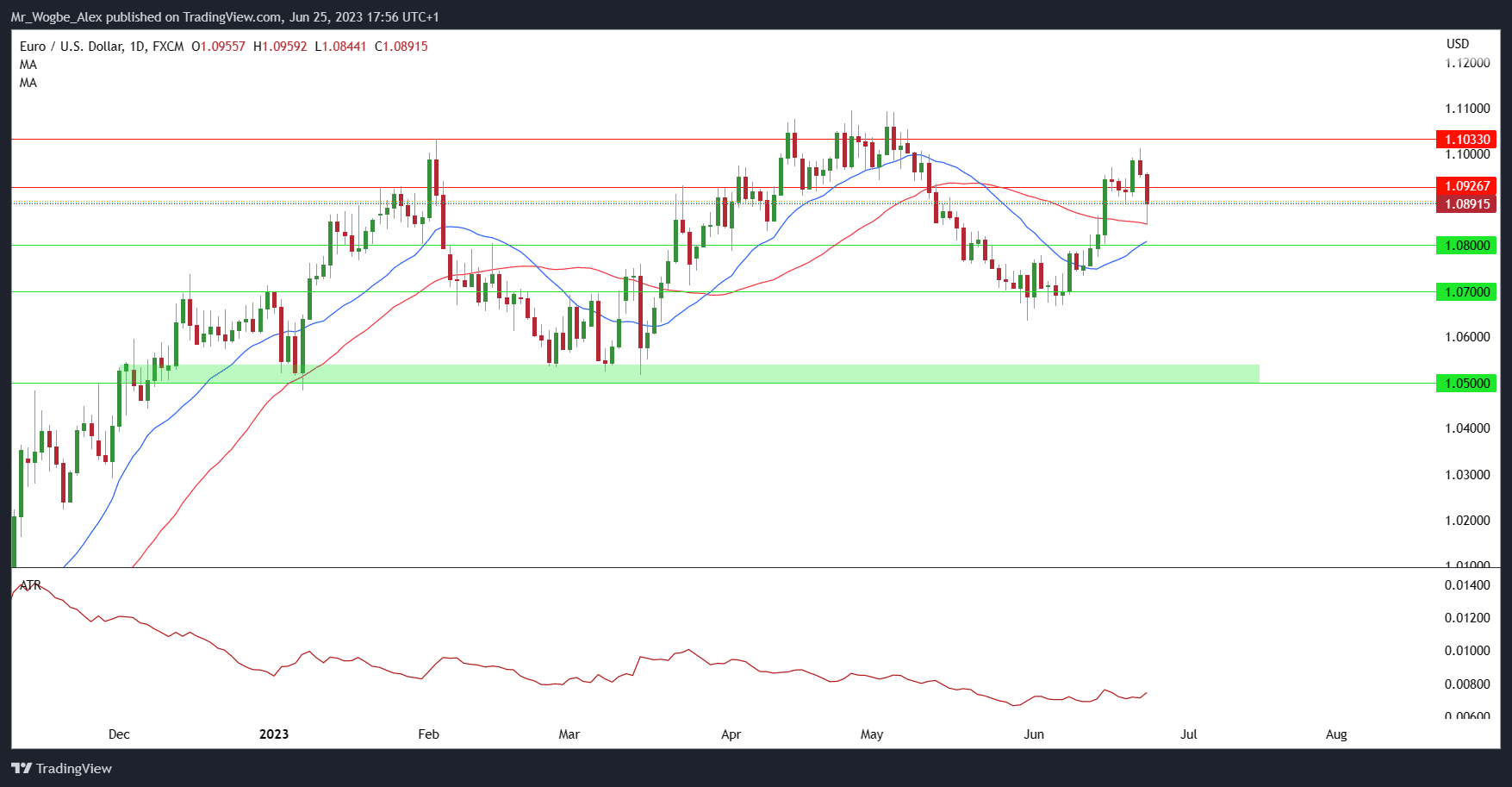

The euro faced a setback in its recent rally against the US dollar, failing to maintain its grip above the psychological level of 1.1000. Instead, it closed the week at 1.0844 after a significant sell-off on Friday, triggered by lackluster Purchasing Managers’ Index (PMI) data from Europe.

Although the euro had been experiencing a strong bullish trend since the beginning of the month, upward momentum is now showing signs of fatigue, coinciding with a resurgence in the US dollar’s strength.

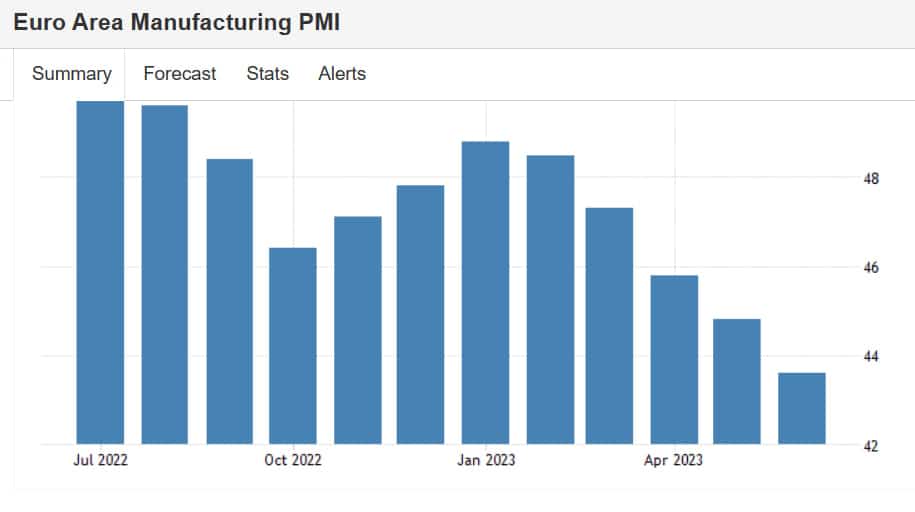

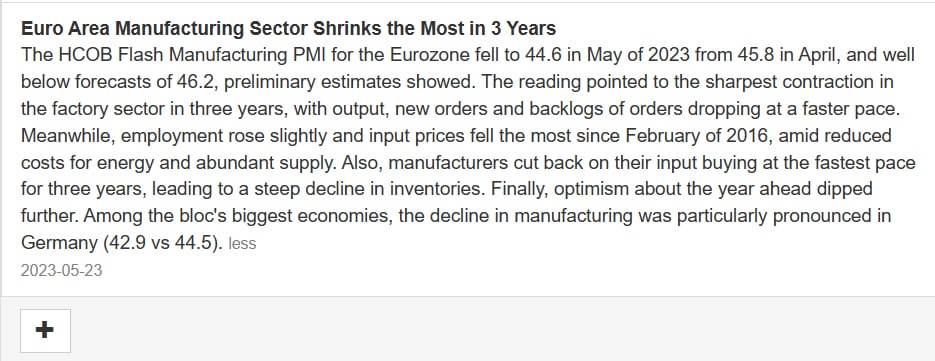

Friday’s release of disappointing EU statistics added to the shift in sentiment. Factory activity worsened in June, with the PMI dropping to 43.6 from May’s 44.8, marking the lowest level in 37 months and deepening concerns about a manufacturing recession.

Softening Services Sector Raises Alarms

Meanwhile, the HCOB Flash Eurozone PMI indicated a significant softening in the services sector, declining from 55.1 to 52.4, well below the median estimate of 54.5. A reading above 50 suggests expansion, while a value below that threshold indicates contraction.

While it’s important not to draw broad conclusions from a single report, the deteriorating growth environment poses a potential challenge for the euro. If demand conditions in the region fail to stabilize and improve soon, the European Central Bank (ECB) may find it difficult to justify further interest rate hikes, as a more restrictive approach could deepen the economic downturn.

Key Economic Reports to Watch for Euro Traders

To gain insight into the future of monetary policy, close attention should be paid to upcoming economic reports. Notably, the German Ifo business climate survey on Monday, German GfK consumer confidence on Tuesday, and Eurozone Consumer Price Index (CPI) results on Friday are key releases that warrant scrutiny.

Amid concerns over the euro’s performance and the ECB’s decision-making, monitoring incoming economic data is crucial. Investors and analysts will eagerly await these reports, as they hold the potential to shape the outlook for monetary policy decisions.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.