The euro has experienced a surge in value following the European Central Bank’s (ECB) decision to raise interest rates by 25 basis points, in line with market expectations. This upward momentum in the euro’s strength is attributed to the ECB’s revised projections for inflation, despite a downward adjustment in economic growth estimates.

The central bank’s forecasts indicate an average inflation rate of 5.4% for 2023, 3.0% for 2024, and 2.2% for 2025, as measured by headline inflation. When considering core inflation, the figures are slightly lower at 5.1% for 2023, 3.0% for 2024, and 2.3% for 2025. On the other hand, the projections for economic growth stand at 0.9% for 2023, 1.5% for 2024, and 1.6% for 2025.

ECB’s Ambitious 2% Inflation Target Post 2025 Raises Doubts

Although the ECB’s projections indicate a potential attainment of the 2% inflation target beyond 2025, skepticism arises due to recent downward trends in inflation readings, albeit at a slower pace. The global experience with interest rate hikes suggests that their impact on the overall economy may have a delayed effect, potentially yielding more substantial outcomes sooner than anticipated.

Notably, money markets have recalibrated their expectations for 2023, exhibiting a more dovish stance by reducing the projected cumulative rate hikes from over 60 basis points to 40 basis points. This adjustment may stem from concerns about lower economic growth, which could amplify fears of a recession in the eurozone. The declining manufacturing statistics within the region further contribute to these apprehensions.

Euro Shows Bullish Response Despite Positive US Retail Sales Report

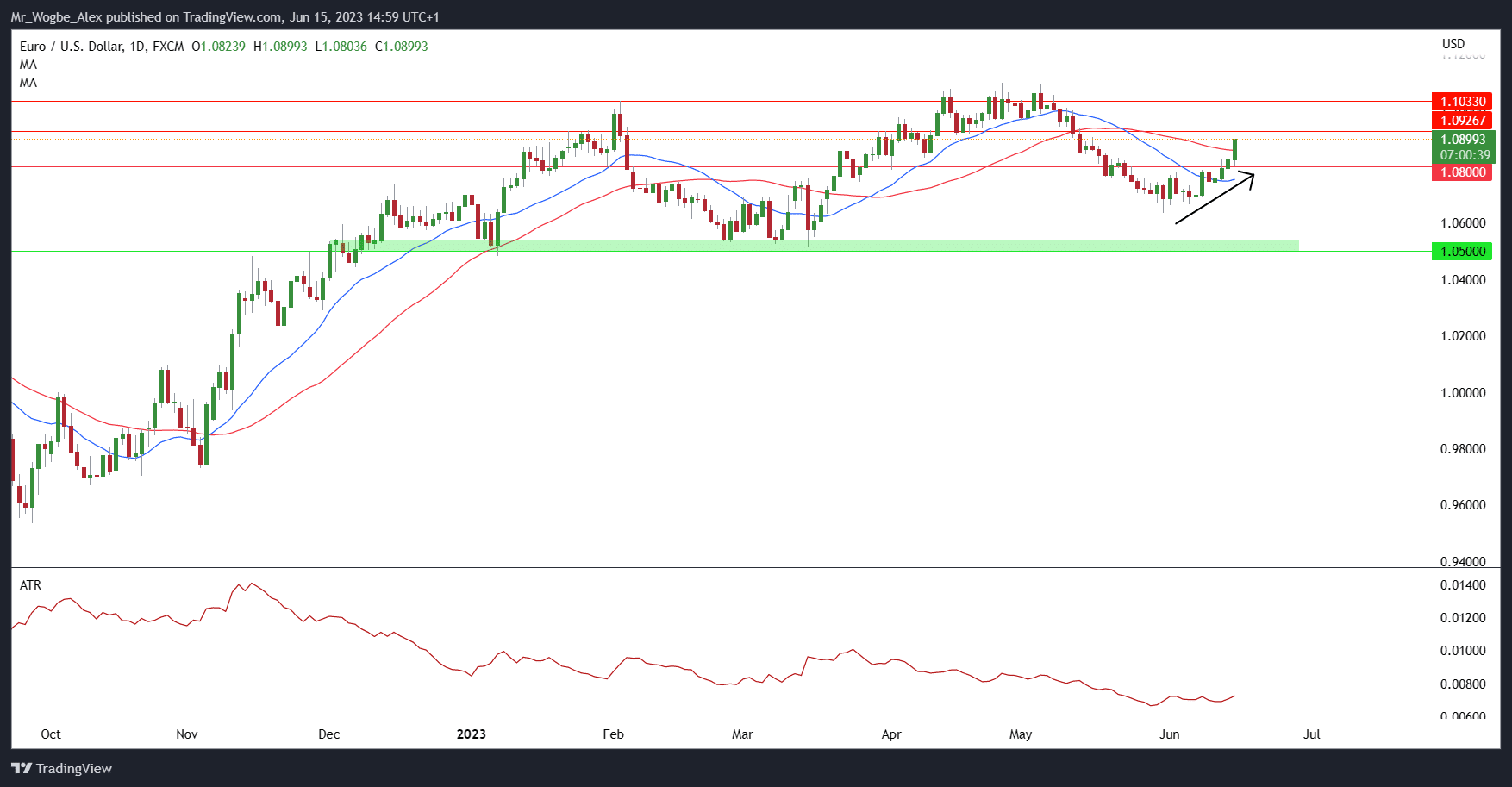

Despite the release of a favorable US retail sales report featuring better-than-expected results, the daily price action of EUR/USD reflects a bullish reaction to the ECB’s news. The market seems undeterred by the positive economic indicators from the United States, including an upbeat initial jobless claims figure.

As there are no high-impact data releases scheduled for today, market participants eagerly await the US trading session to assess the sustainability of these elevated levels.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.