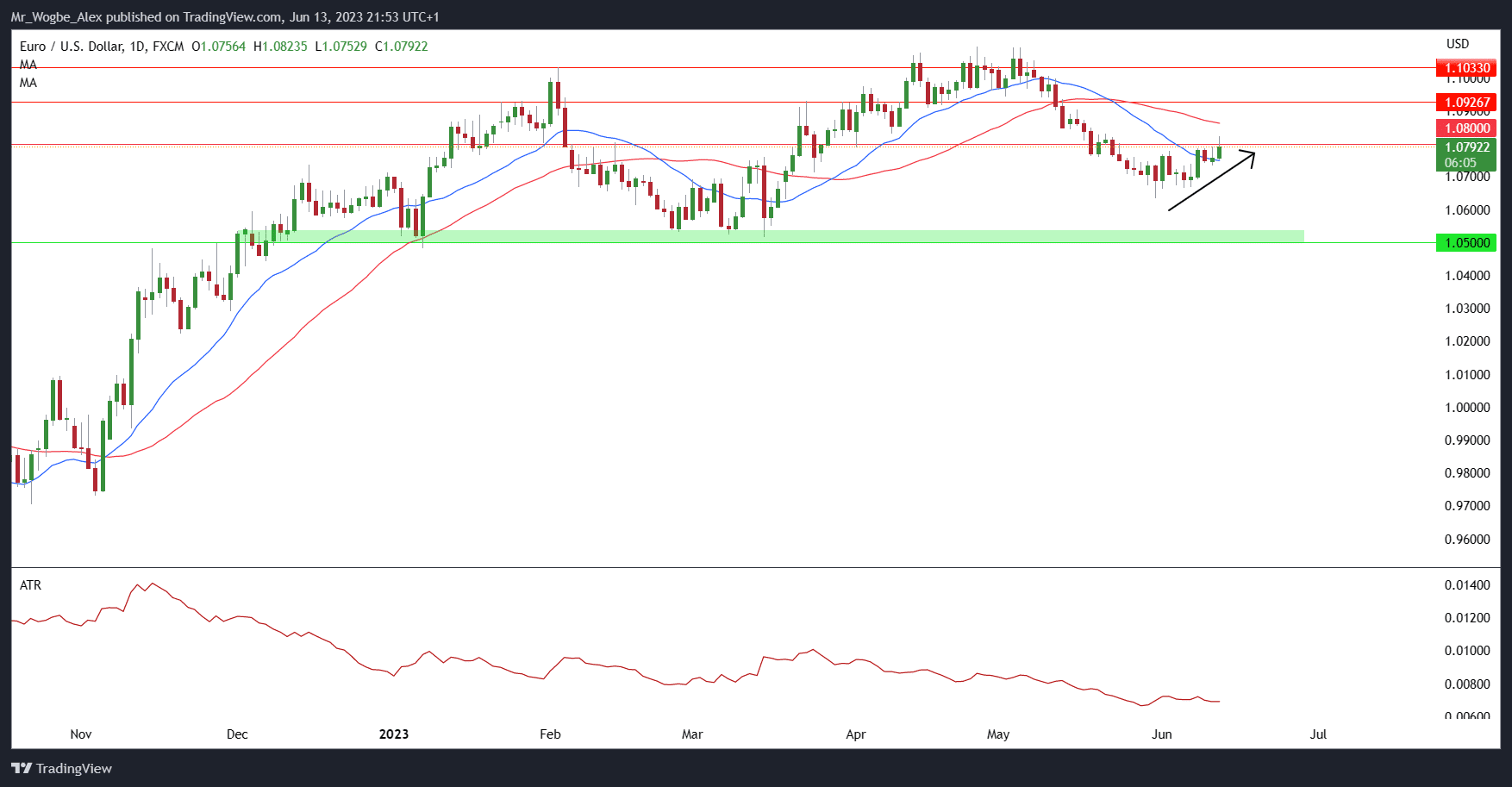

The EUR/USD currency pair finds itself at a critical juncture as it tests a prior level of resistance just shy of 1.0800. That said, in an encouraging turn of events, the pair has managed to reach a fresh two-week high, signaling potential bullish momentum.

However, the market is likely to remain ensnared in a tight range until the US Consumer Price Index (CPI) is unveiled, unless we witness a significant deviation that could jolt us before the Federal Open Market Committee (FOMC) delivers its much-anticipated decision on Wednesday.

source: tradingeconomics.com

Retail trader data reveals some intriguing insights. Presently, a whopping 59.86% of traders are net-long, resulting in a long-to-short ratio of 1.49 to 1. It seems like the scales are tipped in favor of the bulls. Comparing the figures to yesterday, there is a 6.98% surge in net-long traders, which is undeniably a step in the bullish direction.

However, when the scope is widened to last week, the number of net-long traders still stands at 8.88% lower, perhaps suggesting some lingering apprehension.

On the flip side, the number of net-short traders has decreased by 2.14% from yesterday, but they remain stubbornly 6.55% higher than last week. It’s a tug of war, and both sides are putting up a fight.

EUR/USD Sentient: Federal Reserve and European Central Bank Set to Announce Monetary Policy Decisions

The next couple of days are primed to be defining moments in the realm of monetary policy. Traders will be on the edge of their seats as both the Federal Reserve (Fed) and the European Central Bank (ECB) prepare to make their grand announcements.

The market has already priced in the expected outcome, with the Fed widely anticipated to pump the brakes on its fourteen-month hiking cycle, while the ECB is readying to execute a well-telegraphed 25 basis point rate hike. However, the real game-changer for the EUR/USD pair lies in the commentary delivered by these central banks post-decision.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.