The euro finds itself under pressure as German inflation takes an unexpected tumble, offering a brief moment of relief for the European Central Bank (ECB) in its ongoing deliberations over interest rate hikes.

Recent data reveals that German inflation for May was 6.1%, surprising market analysts who had anticipated a higher figure of 6.5%. This unexpected dip is a welcome development for the ECB as it attempts to strike the delicate balance between economic growth and price stability.

Source: tradingeconomics.com

Adding to the mixed bag of inflation figures, France also experienced lower-than-expected inflation rates, with May’s reading at 5.1% compared to a forecast of 5.5%. Similarly, Italy fell short of forecasts, albeit by a smaller margin, as inflation dipped 0.6% lower than the previous month. These contrasting inflationary trends within the Euro Area present a complex economic landscape, leaving policymakers and investors on their toes.

In the face of these inflation surprises, the ECB’s recent Financial Stability Review underlines the vulnerability of Euro Area financial markets to adverse growth and inflation outcomes. The report sounds like a cautionary note, highlighting the strain on Euro Area firms, households, and sovereigns due to tighter financial and credit conditions.

Moreover, concerns about a potential correction in property prices and an anticipated increase in sovereign funding costs further heighten apprehensions, with the looming specter of a possible return to recession fears.

The US Had It Better as the Euro Struggles

Across the Atlantic, positive news emerges regarding the US debt ceiling. Reports suggest that the long-awaited deal is likely to pass today, providing much-needed relief to financial markets. House Financial Services Committee Chairman Patrick McHenry confirms that the agreement has garnered sufficient support in both the House and the Senate, alleviating concerns over a potential default.

Meanwhile, US Treasury yields continue to experience slight easing, indicating a cautious sentiment prevailing among investors.

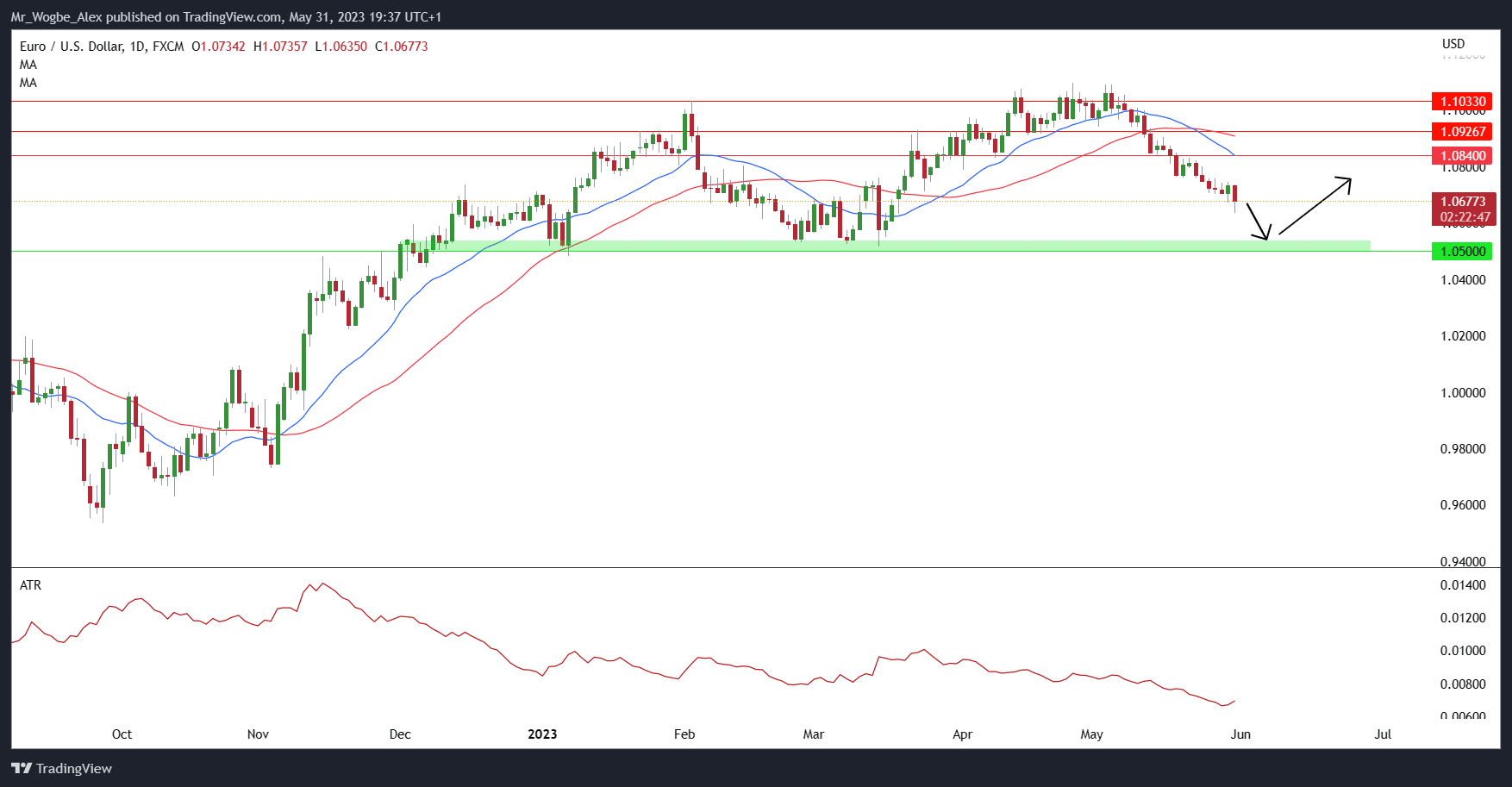

Nevertheless, the euro continues to face headwinds, primarily from a strong US dollar and a somewhat weakened euro. As a result, the EUR/USD pair has recently reached a 10-week low, raising concerns among market participants. Notably, the daily chart provides little indication of solid support, leading experts to speculate that the pair may further slide down to the 1.0500–1.0540 area before attracting buyers once again.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.