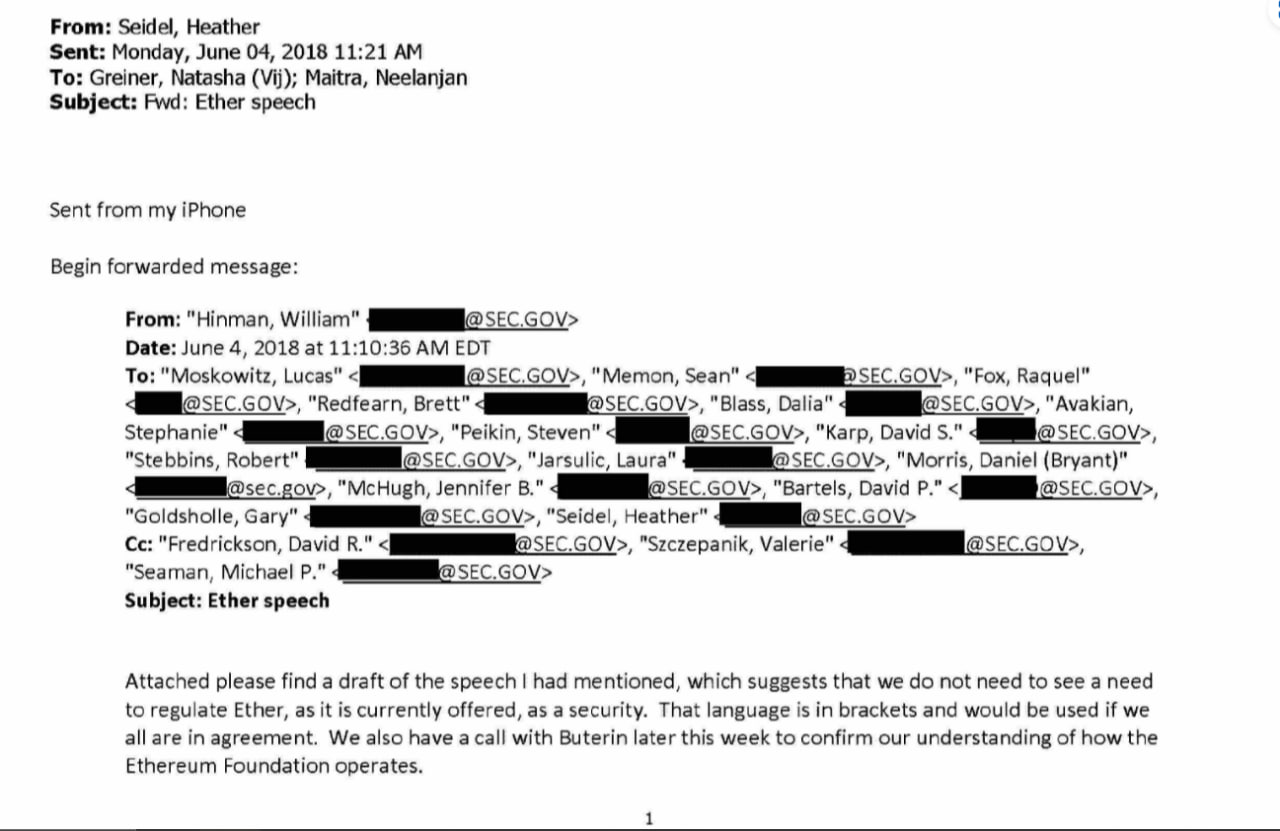

The Ripple community reacted excitedly on Tuesday after the U.S. Securities and Exchange Commission (SEC) finally released internal documents pertaining to former commissioner William Hinman’s speech on digital assets back in 2018. However, the SEC’s decision to disclose the speech has not only intensified the ongoing legal battle but has also provoked a scathing response from Ripple CEO Brad Garlinghouse, who claims that the SEC has purposefully thrown “an entire industry into chaos.”

It turns out that the agency had repeatedly cautioned Hinman about the potential confusion his speech could create in the market regarding the SEC’s stance on ether (ETH) as a security. One agency member expressed concerns, stating that the speech’s wording failed to clearly indicate the factors that influenced Hinman’s view.

The June 2018 speech by Hinman presented a non-exhaustive list of factors that the SEC might consider when determining the security status of a digital asset. However, some agency members criticized Hinman for not explicitly linking these criteria to the Howey analysis—an established standard used for classifying investment contracts and now frequently referenced by SEC Chairman Gary Gensler.

Moreover, certain factors mentioned in the speech were viewed as “ambiguously worded” and seemed to encompass elements unrelated to securities laws, including the ability to “hoard” an asset. The lack of clarity in Hinman’s speech raised eyebrows and cast doubt on the reliability of his arguments.

Speech Fuels SEC vs. Ripple Legal Battle

Hinman’s speech has become the focal point of the ongoing legal dispute between the SEC and Ripple. Notably, Ripple’s CEO, Brad Garlinghouse, has expressed his dismay over the release of these internal documents, vociferously accusing the SEC of intentionally sowing chaos within the industry. The controversy surrounding Hinman’s speech and its potential implications for the classification of digital assets continue to add fuel to the already heated legal battle between Ripple and the SEC.

It’s absolutely unconscionable that a regulator – when presented with so much pushback on what he was about to say / how he compiled this fake “test” in the first place – decided to move forward anyway, and throw an entire industry into chaos. https://t.co/9qzKOiPWsA

— Brad Garlinghouse (@bgarlinghouse) June 13, 2023

By making these internal documents public, the SEC has opened itself up to heightened scrutiny and raised questions about its regulatory approach to the ever-evolving digital asset landscape. The full extent of the impact resulting from this revelation and its potential consequences for the ongoing lawsuit remain uncertain. Nevertheless, it is clear that the stakes are high, and the repercussions may reverberate far beyond the Ripple-SEC dispute, shaping the future of digital asset regulation.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.