Sellers’ momentum is increasing in the Silver market

SILVER Price Analysis – 15 June

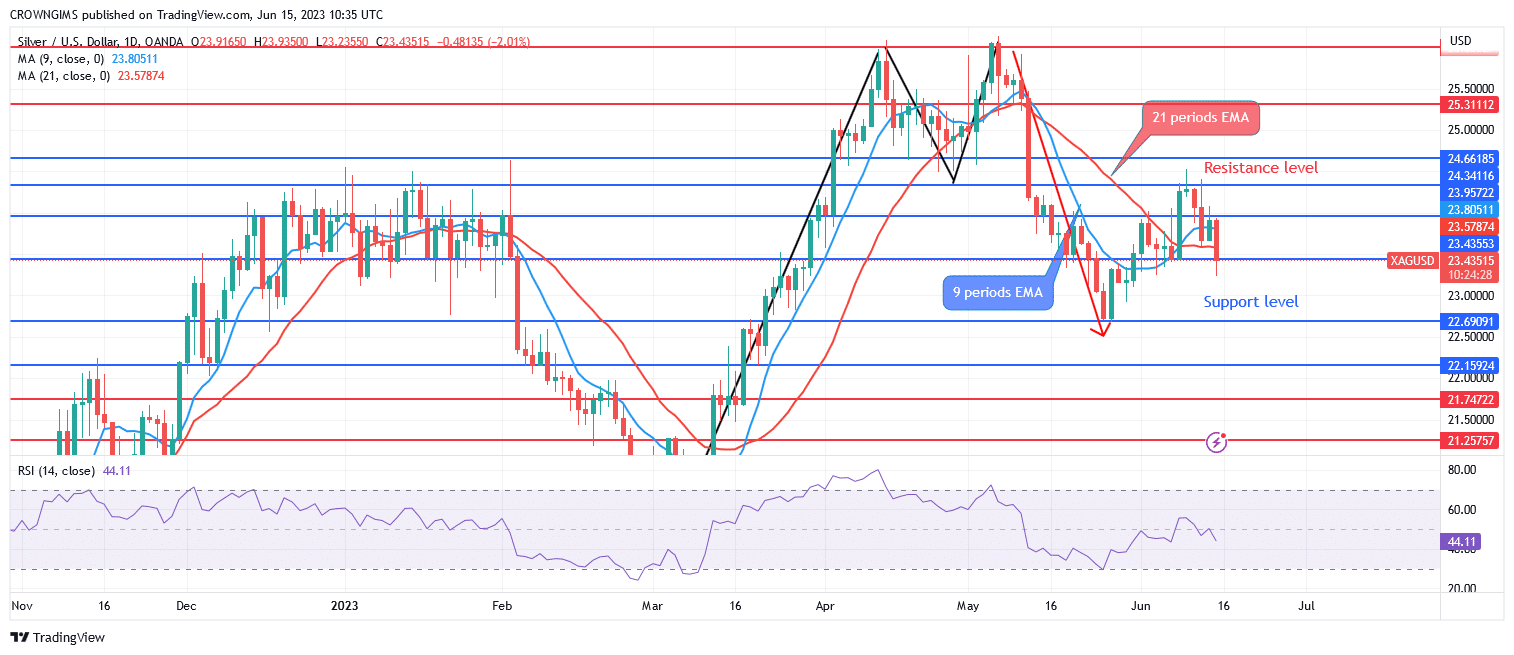

The price resistance levels of $25 and $26 may be tested if demand rises once the $24 level is breached higher. If sellers are able to hold the $24 price level and the $23 support level is breached, silver’s price might decline and test the $22 and $21 support levels.

XAGUSD Market

Key Levels:

Resistance levels: $24, $25, $26

Support levels: $23, $22, $21

XAGUSD Long-term trend: Bearish

The long-term forecast for silver is negative. The double-top chart pattern that appeared at $25 is mostly responsible for the beginning of a downward trend. The cost of white metal increased above that cap, from $19 to $23. More bearish candles have formed since May 5, and the silver market has been dominated by sellers. As the price declines toward the low support level of $23, the buyers are attempting to limit their losses. Price retracements are inevitable in a trending market; last week, it did so to retest $24 resistance level.

While the fast EMA is crossing the slow EMA downward, white metal is trading in a bearish trend below the 9-period and 21-period exponential moving averages. The relative strength index period 14 signal lines pointing down at 43 imply a selling setting. The price resistance levels of $25 and $26 may be tested if demand rises once the $24 level is breached higher. If sellers are able to hold the $24 price level and the $23 support level is breached, silver’s price might decline and test the $22 and $21 support levels.

XAGUSD Medium-term Trend: Bearish

On the 4-hour chart, XAGUSD is in a negative phase. At the $26 resistance level, the double-top bearish reversal chart pattern is formed. The price of white metal rapidly started to decline after twice reaching a high of $26. As sellers gained greater momentum, the previous support levels of $24 and $23 changed into levels of resistance. It is retreating from the current support level of $23.

A bearish market is present since the price of silver is trading below dynamic support levels. The relative strength index period 14 signal line is going downward at a level of 57, signaling a sell.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.