Amidst a week bustling with anticipation, the US dollar stood firm on Tuesday as investors exercised caution, eagerly awaiting pivotal central bank decisions that hold the power to shape the global monetary policy landscape.

In the face of challenges, the currency exhibited resilience, recovering from a recent 15-month low, while the euro faced headwinds due to persisting weaknesses in Europe.

US Consumer Confidence Reaches Two-Year High, Provides Boost for the Dollar

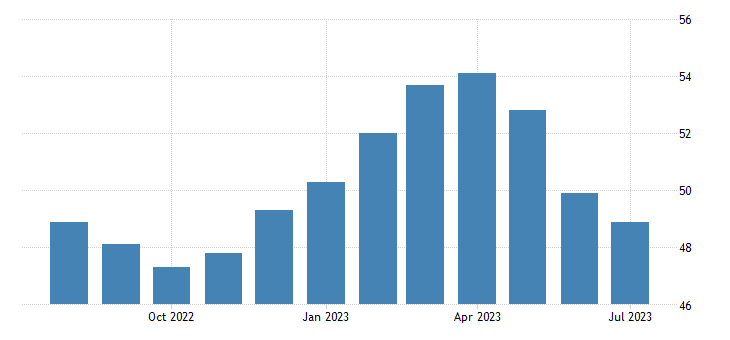

Brightening the economic outlook, US consumer confidence soared to a two-year high in July, instilling optimism among market participants, according to a Reuters report.

source: tradingeconomics.com

According to a survey conducted by The Conference Board, the consumer confidence index surged to an impressive reading of 117 for the month, the highest since July 2021. This remarkable upswing surpassed the expectations of economists, who had forecast the index to reach 111.8.

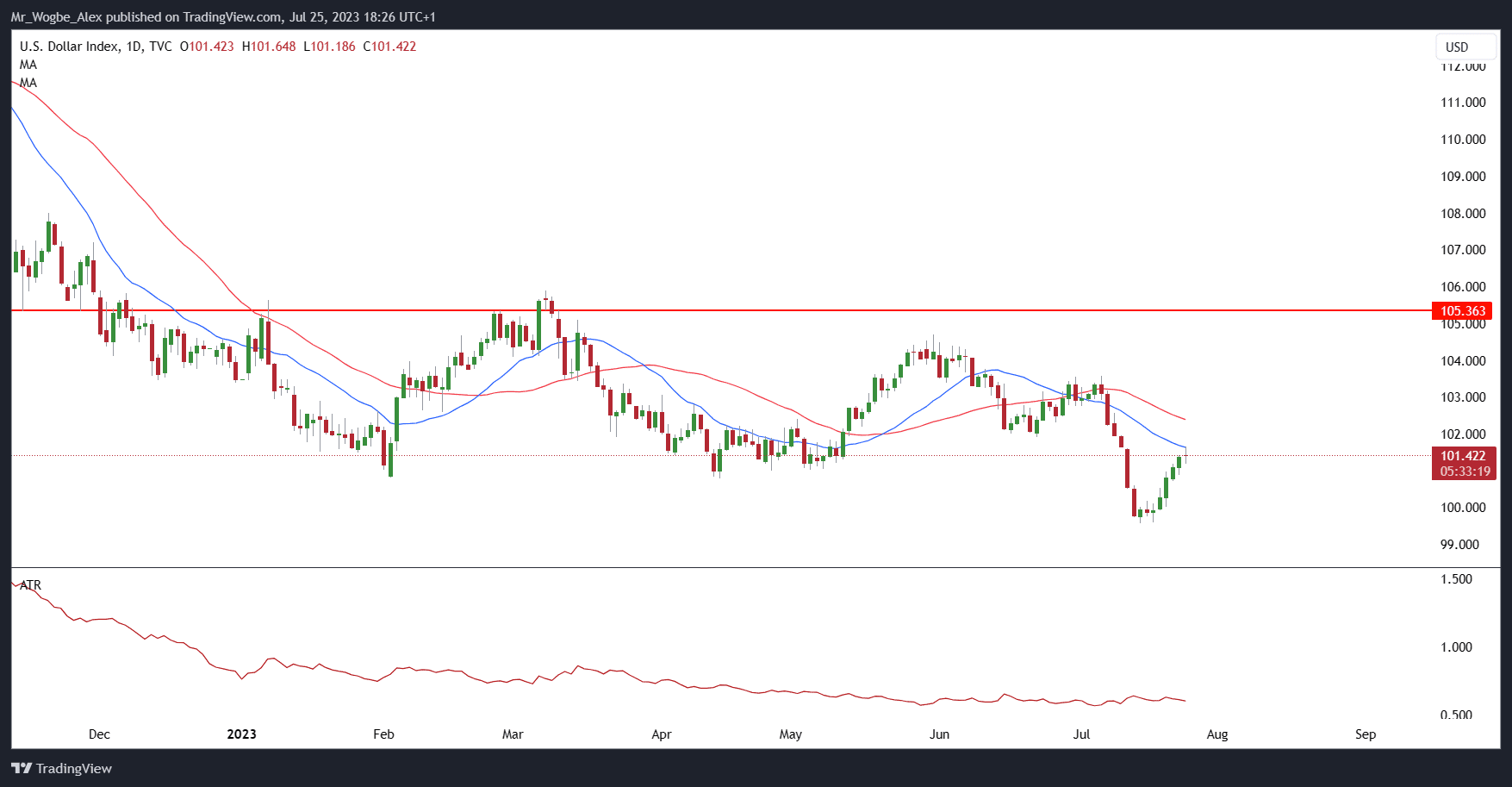

Building on the positive momentum, the dollar index recorded an encouraging 0.118% increase, rising to 101.510. Surpassing expectations, it reached a two-week peak at 101.65, reflecting the underlying strength of the US currency.

Euro Weakens Amid European Slowdown

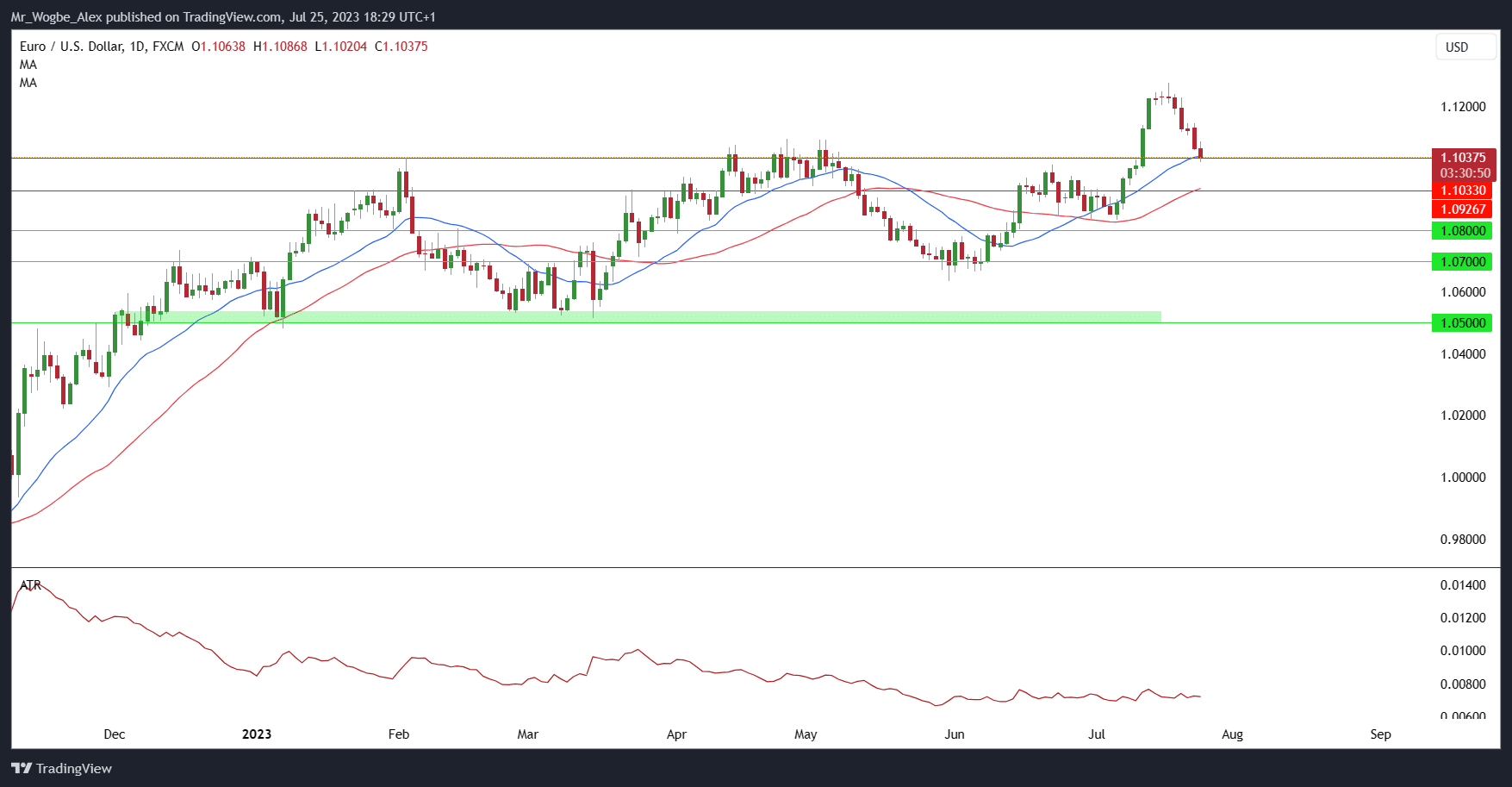

Contrasting the US dollar’s resilience, the euro faced challenges for the fifth consecutive session, grappling with evidence of a slowdown in Europe. The single currency experienced a slight dip of 0.35% against the dollar, dropping to 1.1020 earlier today.

A recent survey indicated a record low in demand for loans within the eurozone during the second quarter, pointing to a concerning economic trend.

Adding to the worries, separate data revealed a deterioration in business confidence in Germany this month. The disappointment continued, with Purchasing Manager Indexes falling below expectations for the eurozone as a whole.

Upcoming Events to Watch

The financial world is keenly eyeing a series of significant events scheduled for this week. The Federal Reserve’s rate-setting meeting is set to conclude on Wednesday, with market participants eagerly awaiting insights into the future course of US monetary policy.

Following closely, the European Central Bank (ECB) will announce its decisions on the subsequent day, and the Bank of Japan will do the same on Friday. Besides, investors will be closely monitoring earnings reports from notable companies, further contributing to the week’s excitement.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.