In a bid to address the legal challenges posed by the US Commodity Futures Trading Commission (CFTC), Binance, the leading cryptocurrency exchange, and its CEO, Changpeng Zhao, are preparing to take decisive action.

The CFTC had filed a lawsuit in March accusing Binance of violating US laws by offering and executing crypto derivatives transactions for US customers without the required registration.

The CFTC’s lawsuit brought to light serious allegations against Binance. It contended that the exchange operated a “sham” compliance program and deliberately evaded US regulations by obscuring its headquarters and relying on foreign entities.

The commission also asserted that Binance and its CEO were fully aware of US customers accessing their platform since at least July 2019, despite having purportedly banned US residents from using their services.

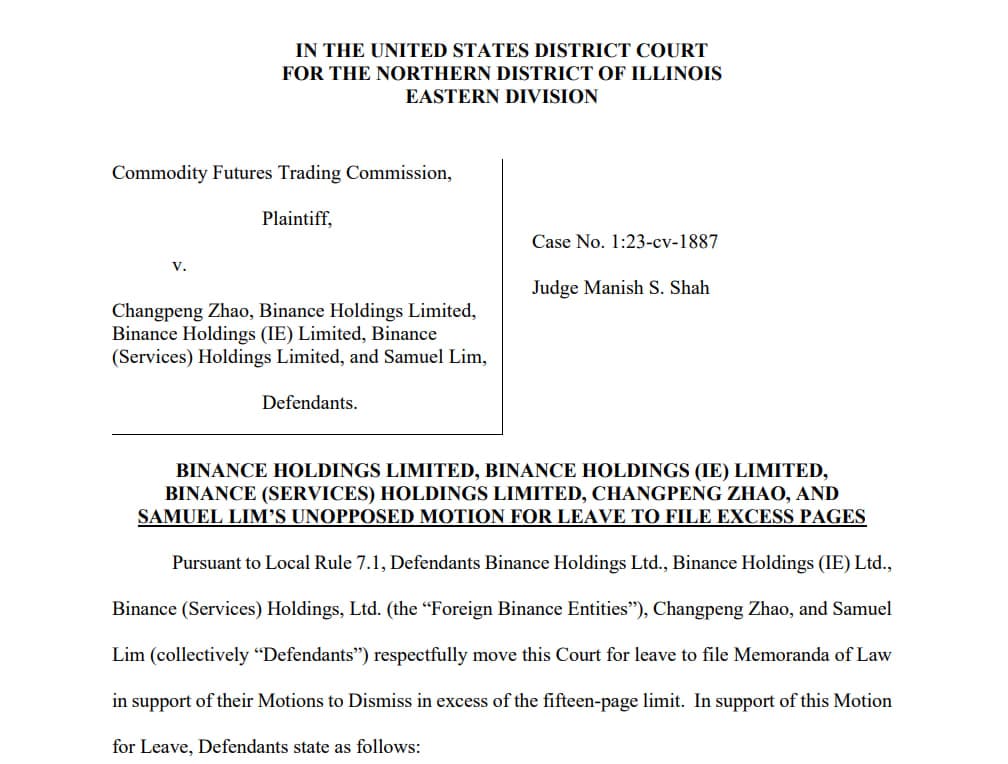

As the deadline for responding to the CFTC complaint approaches, Binance, Changpeng Zhao, and former chief compliance officer Samuel Lim are gearing up to file their motions seeking dismissal. They have sought permission to exceed the standard 15-page limit for their supporting briefs, citing the complexity of the case and the multitude of arguments they plan to present.

Binance and CZ filed a license application with the U.S. District Court for the Northern District of Illinois, planning to file a legal memorandum to initiate a motion to dismiss the lawsuit filed by the U.S. Commodity Futures Trading Commission (CFTC). Earlier, the U.S. CFTC…

— Wu Blockchain (@WuBlockchain) July 25, 2023

Additional Legal Challenges

The CFTC lawsuit is not the only legal battle Binance is currently facing in the US. In June, the Securities and Exchange Commission (SEC) took legal action against the exchange and its CEO, alleging a “web of deception” and listing 13 charges related to unregistered securities-based swaps offered to US investors without proper disclosure.

Furthermore, Binance is also under investigation by the Justice Department for suspected involvement in money laundering and sanctions violations, as reported by Reuters in May. The series of legal challenges have had a significant impact on the cryptocurrency industry and drawn the attention of regulators worldwide.

Global Regulatory Pressure on Binance

In addition to the challenges in the US, Binance is experiencing increased scrutiny from regulators in various other countries, including the UK, Japan, Canada, Italy, and Thailand. The growing regulatory pressure has put Binance’s compliance standards and practices under the microscope.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.