The world’s largest cryptocurrency exchange, Binance, has encountered a significant setback in its market share during H1 2023, according to a recent report from Kaiko Research.

The study sheds light on the challenges faced by Binance and its subsidiaries, like Binance.US, as they grapple with mounting legal issues and regulatory pressures that have made it difficult to maintain their stronghold in the American crypto market.

Binance’s Woes in the US

Enforcement actions launched by US federal agencies, including the CFTC and the SEC, have played a pivotal role in the decline of Binance’s market share. These regulatory interventions have not only cast a shadow over the exchange’s operations but have also affected its reputation among traders and investors.

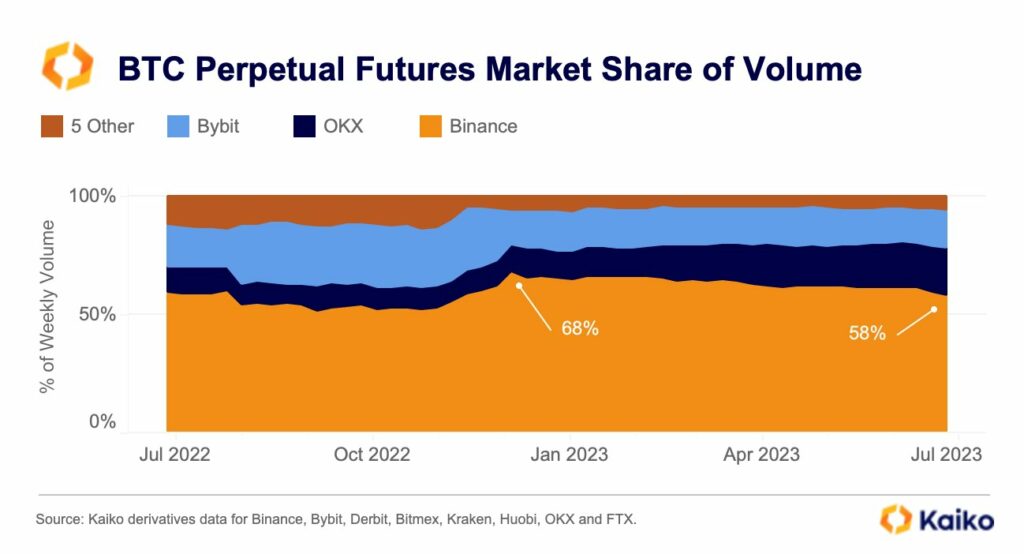

One notable factor contributing to the decline in Binance’s market share was the decision to reintroduce trading fees for some of its spot pairs. This strategic move, while aimed at bolstering profitability, resulted in a decrease in Binance’s spot volume, which fell from 63% to 52% since the beginning of the year.

📉 Binance’s spot volume market share has declined from 63% to 52% this year. #CryptoMarketTrends #Binance pic.twitter.com/pFFac9stLj

— Kaiko (@KaikoData) July 6, 2023

Consequently, rival crypto exchanges seized the opportunity to absorb the lost market share and emerged as popular alternatives among traders.

The decline in Binance’s market share can be attributed to a combination of factors, including intensified regulatory scrutiny, trading fee adjustments, and legal disputes. As the cryptocurrency industry faces increasing regulatory oversight, it is imperative for exchanges like Binance to adeptly navigate this evolving landscape.

Rebuilding trust among users and investors will be crucial for Binance to regain its market position and restore its reputation as a leading crypto exchange.

Binance Faces Challenges in Other Markets as Well

Binance is not only facing legal challenges in the US but also in other countries where it operates. The exchange has been banned or warned about by regulators in Germany, the UK, France, the Netherlands, and Canada for various reasons.

Binance has been trying to adapt to different regulatory environments by launching regional platforms and partnerships. However, some analysts believe that Binance’s global expansion strategy may have backfired and exposed it to more scrutiny and risks.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.