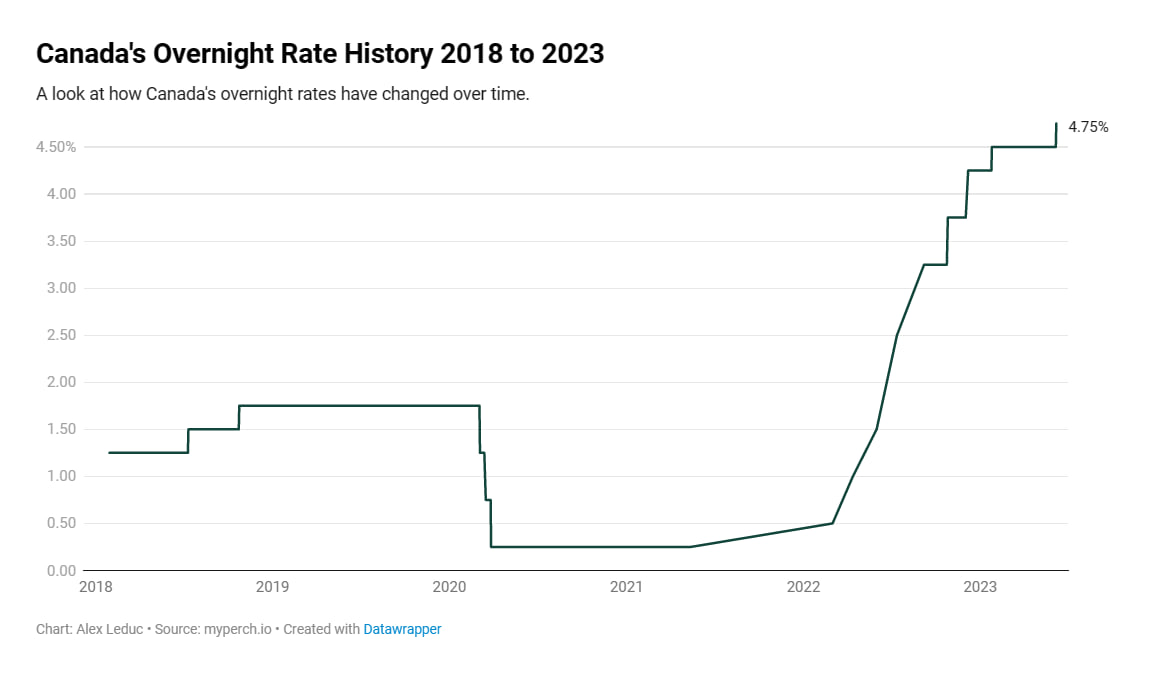

The Canadian dollar is gearing up for a period of strength as the Bank of Canada (BoC) prepares to raise interest rates for a second consecutive meeting on July 12.

In a recent survey conducted by Reuters, economists expressed their confidence in a quarter-point increase, which would push the overnight rate to 5.00%. This decision comes after a five-month pause earlier this year and reflects the persistently lingering price pressures in Canada’s robust economy.

Inflation, which stood at 3.4% in May, has witnessed a slowdown from the previous month. However, it remains well above the central bank’s target of 2.0%. Economists do not expect inflation to reach the target until early 2025.

Despite these challenges, the Bank of Canada is determined to forge ahead with the rate hike, underscoring its commitment to effectively managing inflationary pressures.

Canada’s Unemployment Rate to Remain Steady: Economists

The Canadian economy is expected to display resilience and growth, with economists projecting an annualized pace of 1.3% for this year—an improvement from the 0.7% estimate reported in the April poll.

Additionally, the unemployment rate is predicted to remain relatively stable, with economists forecasting an average of 5.4% in 2023, just marginally higher than the current rate of 5.2%.

While inflation is anticipated to stay above the target, Reuters reports that economists believe that core inflation, which excludes volatile food and energy prices, will experience a modest decline by the end of the year. This suggests that underlying price pressures may gradually ease over time.

The survey conducted among economists also shed light on the uncertainty surrounding the possibility of a recession. The likelihood of a recession occurring within the next year was considered a toss-up, with a median probability of 60% within the next two years. This emphasizes the need for cautious economic management and reinforces the importance of closely monitoring key indicators.

Canadian Dollar Emerges as Second-Best Performer: MUFG

The positive outlook for interest rates has fueled expectations of a stronger Canadian dollar in the currency markets. Referred to affectionately as the “loonie,” the Canadian dollar emerged as the second best-performing G10 currencies last month.

Analysts at MUFG noted:

“We believe CAD performance reflects the ongoing resilience of equity markets but suspect that we could soon see a correction to the downside, which will increasingly weigh on CAD. History of CAD movement also indicates US recessionary conditions tend to result in CAD weakness.”

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.