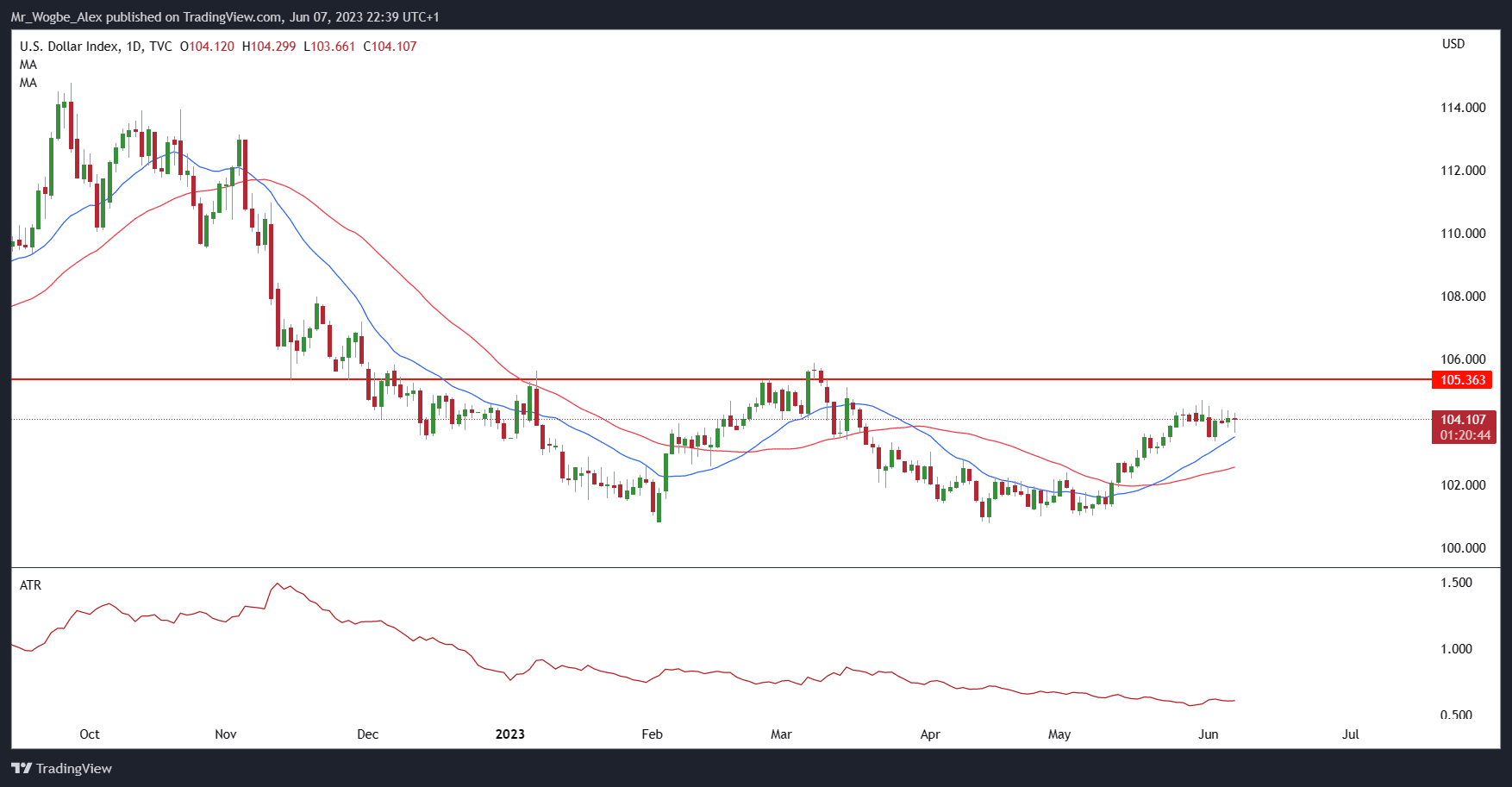

The U.S. dollar, a major player in the global currency arena, recorded a notable dip on Wednesday, with the DXY index slipping by around 0.45% to 103.66. Surprisingly, this happened despite the surge in U.S. Treasury yields. Things really got interesting when the Bank of Canada (BoC) made a surprise move and raised rates, catching investors off guard.

It’s worth noting that the U.S. and Canadian economies have a lot in common when it comes to demand resilience and inflation stickiness. This means that their monetary policies might be birds of a feather, following a similar path.

If the Fed’s peak rate ends up higher than what’s currently priced in, the U.S. dollar will be ready to jump back into the driver’s seat. To stay ahead of the game, keep a close eye on the incoming data, such as the May Consumer Price Index (CPI) and Producer Price Index (PPI) reports. These little nuggets of information might just hold the key to understanding the trend in overall prices and whether the Fed will need to tighten its grip even more in the future.

What to Expect for the Dollar

So, what’s the outlook for the greenback? Well, with the shifting landscape of monetary policy, the U.S. dollar is like a phoenix rising from the ashes. It’s ready to spread its wings and soar once again. The coming months will be crucial in determining its flight path. Traders need to pay attention because economic indicators and the CPI and PPI reports will pretty much determine the dollar’s fate.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.