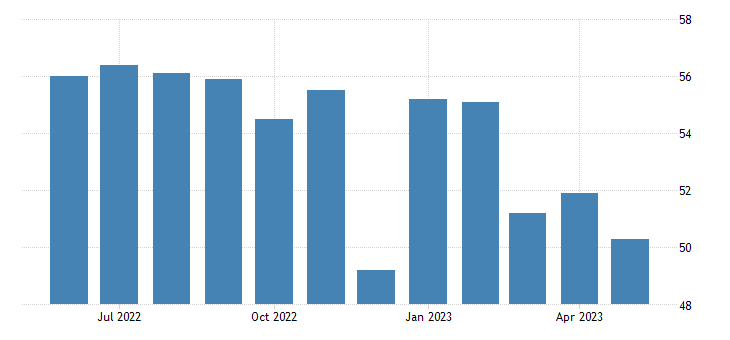

The US dollar hit a speed bump as the gauge of US business services activity stumbled in May. According to the Institute for Supply Management (ISM), its services PMI index took a nosedive, dropping to 50.3. This unexpected decline is fueling worries about the economic outlook, with overly restrictive monetary policy and stubbornly high inflation playing a key role.

The weakening of critical indicators, such as new orders and employment, raises concerns about the hiring landscape. On the bright side, a decline in the price index may bring some relief to the Federal Reserve, potentially influencing its stance on monetary policy.

Concerns Grow as Services PMI Dips Below Expectations

In a surprising turn of events, the ISM’s services PMI index fell to 50.3, way below the expected level of 52.2. This sudden decline is like a red flag signaling a slowdown in the services sector, which is a vital driver of the US economy. A PMI value above 50 usually means growth, but with this reading falling short, it raises eyebrows about the overall economic health of the nation.

Peeking under the hood, the non-manufacturing sector took a punch as new orders plunged from 56.1 to 52.9. This drop suggests that companies are growing cautious about future demand, potentially signaling a slowdown in business activity. As if that weren’t enough, the employment indicator stumbled from 50.8 to 49.2, giving us the impression that the hiring scene may be clouded by stormy weather.

But it’s not all doom and gloom! The prices paid index decided to take a break, declining from 59.6 to 56.2. This drop in cost burdens for service providers, if it sticks around, could offer a breather from the persistent inflationary pressures.

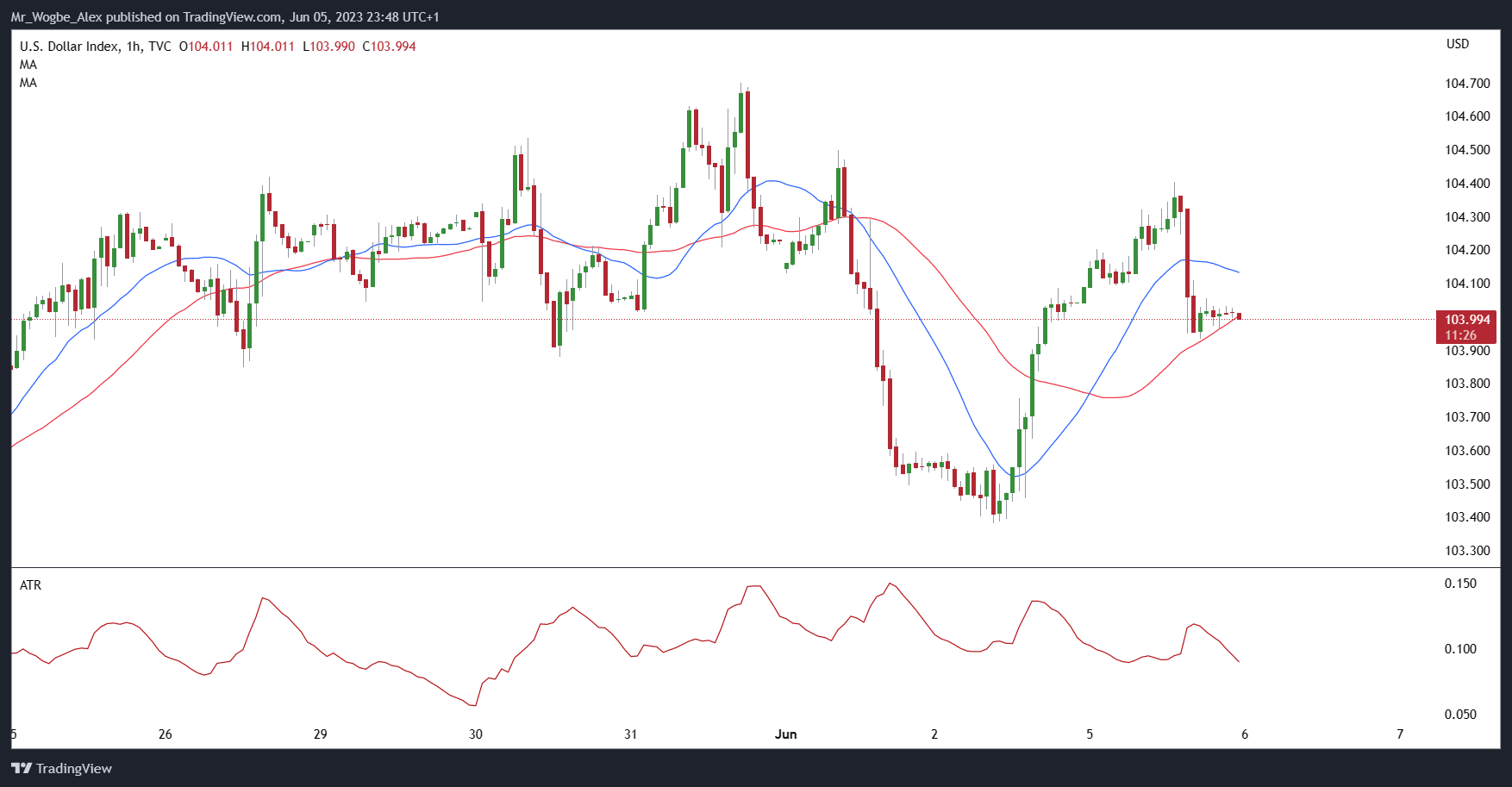

Impact on the US Dollar

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.