Market Analysis – June 6

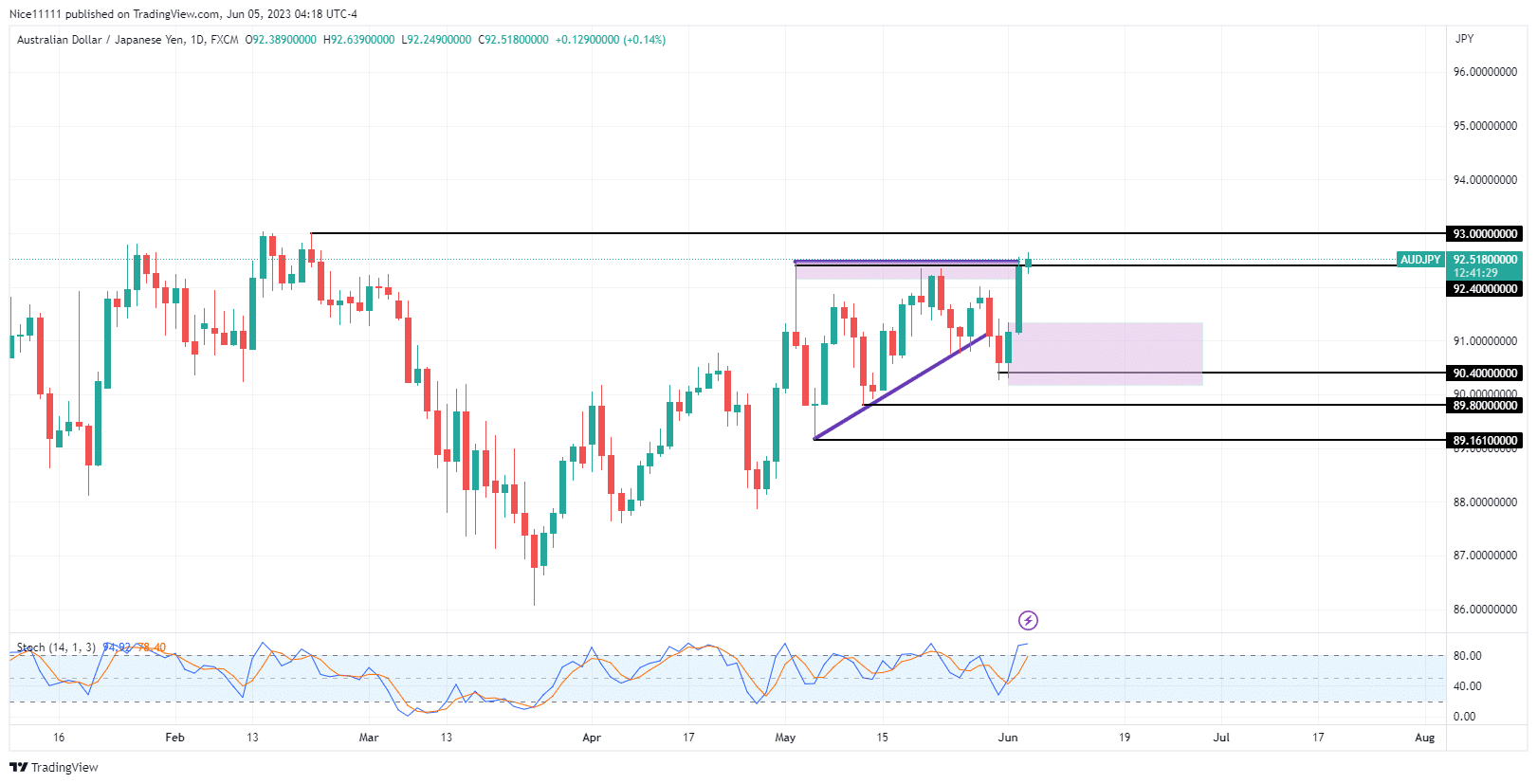

AUDJPY made a significant leap from the demand level at 94.40 to reach relatively equal highs at 92.400. The bullish order flow in AUDJPY is expected to persist as the price surpasses the resistance level at 92.400.

AUDJPY Key levels

Resistance Levels: 92.400, 93.000

Support Levels: 90.400, 89.800, 89.160

AUDJPY Long-term Trend: Bullish

Since early May, AUDJPY has been utilizing the bullish trend line on the daily chart to sustain its upward trajectory. Following the third test of the bullish trend line, the market experienced a significant dip that challenged the bullish trend line. It appeared that the market had shifted direction towards a downward trend. The break of the trend line, coupled with the sweeping of recent lows in late May, indicated a potential bearish reversal, particularly considering the overbought condition of the Stochastic oscillator.

The price dipped into a fair value gap above the support level of 89.80. However, the market took off suddenly as buyers unleashed substantial buying pressure, breaking through the resistance level at 92.40.

AUDJPY Short-term Trend: Bearish

AUDJPY Short-term Trend: Bearish

The swift upward movement of the price above 92.40 has created a fair value gap below the resistance level. A retracement towards the inefficiently traded region is anticipated, considering the overbought reading on the Stochastic oscillator.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

AUDJPY Short-term Trend: Bearish

AUDJPY Short-term Trend: Bearish