Binance, the crypto behemoth known for its global reach and dominant position in the market, is facing a storm of controversy as US authorities charge the company with a series of securities law breaches.

In what can only be described as an intricate web of deception, Binance is accused of deliberately evading regulations and engaging in deceptive practices. Not only did they allegedly allow US residents to trade on their platform without proper registration, but they also stand accused of misusing customer funds. The repercussions of these charges have sent shockwaves through the cryptocurrency market, resulting in a significant sell-off and billions of dollars lost within hours.

Binance and Its Secret US Trading

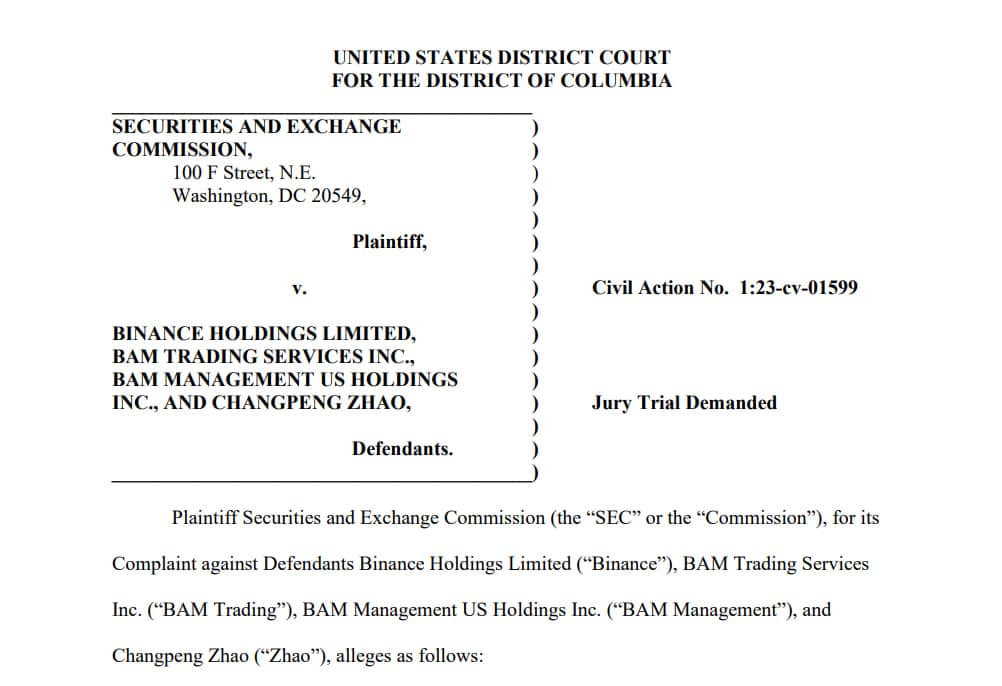

In a bold move, the Securities and Exchange Commission (SEC) has launched a civil complaint against Binance, targeting not only the exchange but also various investment entities controlled by its founder, Changpeng Zhao. The complaint alleges that despite Binance publicly declaring a ban on US customers trading on Binance.com, the exchange secretly permitted high-value customers to continue their activities.

Adding another layer to the saga, Binance’s supposedly independent US-focused site, Binance.us, was revealed to be under the secret control of its parent company, Binance. This covert maneuvering has raised eyebrows and further fueled suspicions surrounding Binance’s operations.

The SEC’s complaint doesn’t stop there. It accuses Binance and Zhao of crossing ethical boundaries by commingling customer assets, a practice that raises serious concerns about transparency and investor protection.

Additionally, the complaint sheds light on the activities of Signa Chain, an entity controlled by Zhao, which allegedly engaged in manipulative trading strategies, artificially inflating Binance’s trading volume. These actions not only tarnish the reputation of the cryptocurrency market but also expose unsuspecting investors to unnecessary risks.

Market Fallout

The news of the charges against Binance has reverberated across the global cryptocurrency landscape, causing panic and uncertainty. Within a mere hour of the announcement, the combined market capitalization of digital assets plummeted by over 5%, wiping out a staggering $53 billion in value. Investors, concerned about the potential implications of Binance’s legal battles, swiftly reacted to protect their investments.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.