Despite strategists’ cautions that Wednesday’s Fed meeting could cause a “bloodbath” in cryptocurrency markets, Bitcoin options markets continue to show short-term upside risks to the BTC price.

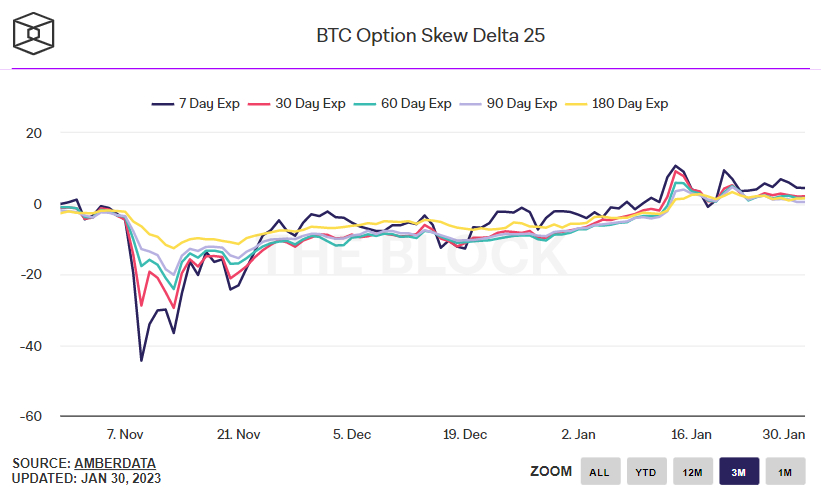

The frequently watched 25% delta skew of Bitcoin options expiring in seven days was still at 4.44 as of January 30, not too far behind recent multi-year highs achieved earlier this month in the 9.0 area, according to a chart from on-chain data aggregator The Block.

Although they are all still near multi-month highs, the 25% delta skew of Bitcoin options expiring in 30, 60, 90, and 180 days was all between 0.5 and 2.0, indicating more of a neutral market tilt.

The choices with a 25% delta skew are a widely watched gauge for how much trading desks overcharge or undercharge for upside or downside protection through the put and call options they are offering to investors. The right to sell an asset at a certain price is provided by a put option, and the right to purchase an asset at a predetermined price is provided by a call option.

A 25% delta options skew above zero indicates that desks are charging more for call options than puts of equal value. This might be regarded as a bullish indicator since investors are keener to acquire protection against (or to wager on) a rise in prices. There appears to be a stronger demand for calls than puts.

Bitcoin Open Interest Plunges to Record Low

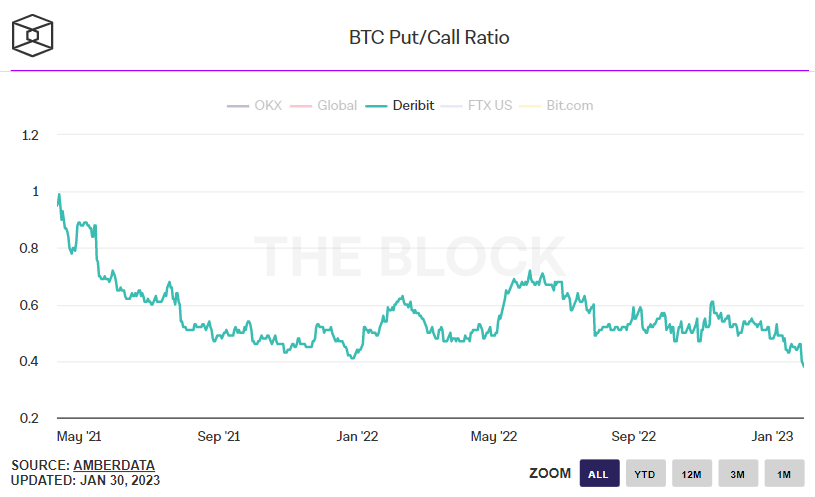

On the leading cryptocurrency derivatives exchange Deribit, the Bitcoin open interest put/call ratio fell to a new record low of 0.38 on January 29th. By a record margin, investors prefer to possess call options—bets on the price increasing—over put options—bets on the price decreasing.

You can purchase Lucky Block here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.