Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

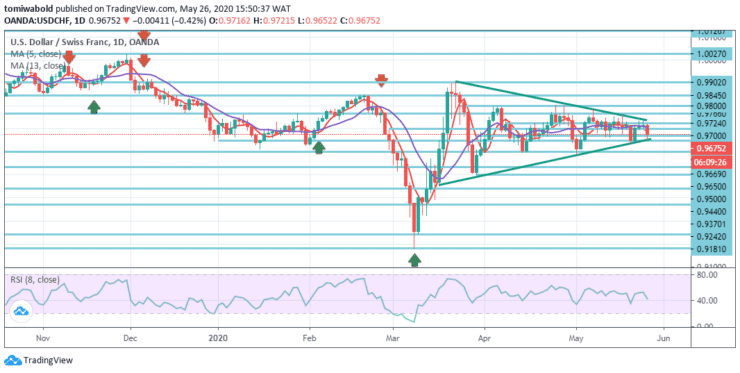

USDCHF Price Analysis – May 26

The USDCHF pair failed to build on its initial rise to highs of one week and now seemed to be slipping down to the lower side of the daily trading range. The range trading under 0.9700 level for the umpteenth session was supported by the risk market mood, which continues to bolster the demand for the safe-haven Swiss franc.

Key levels

Resistance Levels: 1.0231, 1.0027, 0.9766

Support Levels: 0.9650, 0.9440, 0.9181

Tuesday, amid the range trading conditions, the USDCHF pair is losing in a 50-pip range. As of writing, the pair was trading at 0.9656 level in the middle of its three-week-old range, losing 0.60 percent daily.

On the contrary a 0.9902 level breach may increase the 0.9181 level of the rebound context through 1.0027 level of resistance. After all, medium- to long-term trading in ranges is likely to persist for some extended periods between 0.9181/1.0231 levels.

Intraday bias in USDCHF stays neutral with emphasis shifted to 0.9650 support level with today ‘s fall. A drop expands the corrective trend from 0.9902 level to 0.9600 support level and beneath with another decline.

Although downside may be limited by retracing 61.8 percent from 0.9181 to 0.9902 to recover at 0.9440 levels. On the upside, a test at 0.9902 high level may aim a breach of 0.9766 resistance level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus