Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

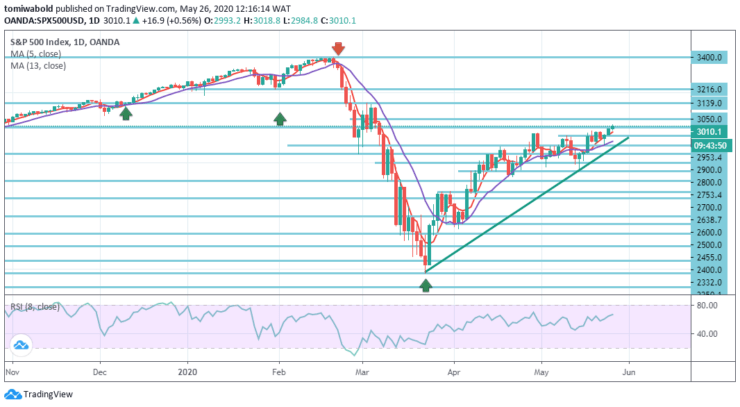

S&P 500 Price Analysis – May 26

The American S&P 500 is driving past a double test which is especially important. Futures on the S&P 500 (SPX) this morning surpassed level 3000. With the S&P 500 bouncing above 3000 psychological levels, the global markets are progressing higher as investors focused on markets resuming amidst the huge threat between the US and China.

Key Levels

Resistance Levels: 3216, 3139.0, 3050

Support levels: 2953, 2854, 2753

On the daily chart the index broke past May’s highs beyond the horizontal resistance. A relentless pass toward the mid-3000 level appears unavoidable as buyers stay fully in control. A continuous breach beyond the above-mentioned point may see the S&P 500 hit the medium to long-term price zone of 3139 levels.

On the flip side, support is seen close to the levels at 2900 and 2854.0. Following the initial rallying, a recovery activity to the support near 2953.4 or lower level may be anticipated. Consequently the possible entry is to aim for a pullback to the support area close to 2900 level to go long.

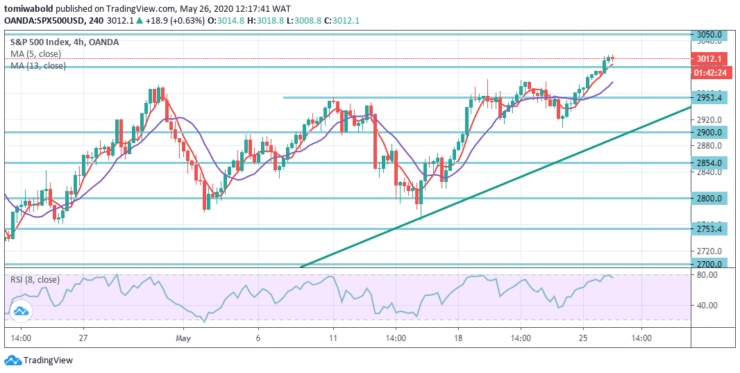

The breach of the 3000 levels is evident on the 4 hour time frame and indicates the significance of this level further reinforced by the fact that the moving average 5 crossed the horizontal resistance line near it validating a bullish breakout.

This level technically distinguishes downtrend from the uptrend. So several traders avoid buying the asset when trading underneath level 3000, as a move beyond that level generates also as buying signal.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus