Cryptocurrency markets have seen significant growth in the past few years, making quick and low-cost transactions more accessible to investors. However, the inherent volatility of cryptocurrencies still causes hesitation among many potential users, especially when it comes to using them for everyday payments. To address this issue, stablecoins have emerged as a solution, providing stability by being pegged to less volatile assets.

In this blog post, we will delve into the concept of stablecoins and explore some of the leading stablecoin lending platforms that enable investors to earn attractive yields.

What are Stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a fixed value by being linked to an underlying asset, such as a fiat currency or a precious metal.

Unlike other cryptocurrencies, which are known for their price fluctuations, stablecoins offer stability and aim to replicate the value of traditional currencies. This feature makes stablecoins more familiar and accessible to individuals accustomed to using traditional currencies in their daily lives.

Top Stablecoin Lending Platforms

When venturing into stablecoin investments, selecting the right lending platform becomes crucial. Let’s take a closer look at some of the leading stablecoin lending platforms available:

- Nexo

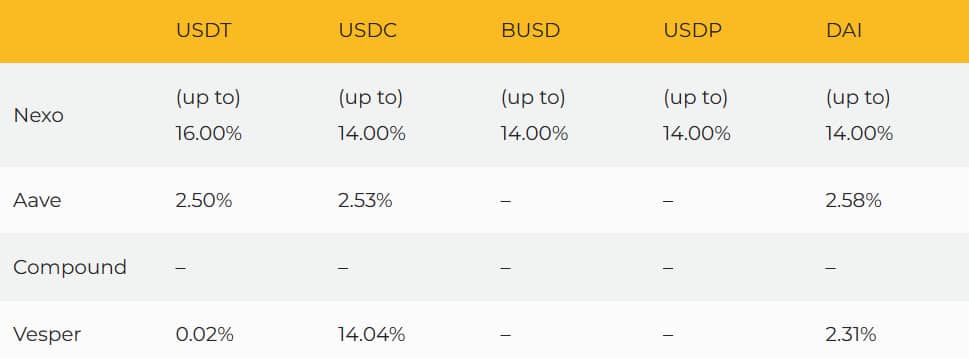

Nexo stands out as a prominent platform offering a wide array of supported tokens and highly attractive Annual Percentage Yields (APYs). Investors can earn APYs as high as 16% for stablecoins like USDT, with earnings paid out in Nexo tokens. The platform provides both locked and flexible-term holdings, catering to different investment preferences.

While flexible holdings offer lower interest rates compared to locked holdings, they also come with the added benefit of free withdrawals. Additionally, Nexo offers $375 million in insurance on all custodial assets, providing peace of mind for more risk-averse investors.

- AAVE

AAVE is a decentralized finance (DeFi) liquidity protocol that offers a diverse range of crypto loan options, including stablecoin loans. The platform facilitates short-term fixed-interest rate loans, uncollateralized flash loans, and regular crypto loans.

AAVE allows users to earn interest on their crypto deposits and also enables them to borrow funds by staking their assets. One notable feature of AAVE is its transparent display of interest rates, making it easy for investors to compare borrowing and deposit rates.

- Compound

Compound is another noteworthy DeFi liquidity protocol that offers a variety of lending and borrowing options. The platform supports numerous cryptocurrencies and stablecoins, providing users with ample flexibility.

Compound ensures top-notch security and incorporates a live price feed that allows users to track prices based on liquidity availability. This feature empowers investors to make informed decisions while navigating the platform.

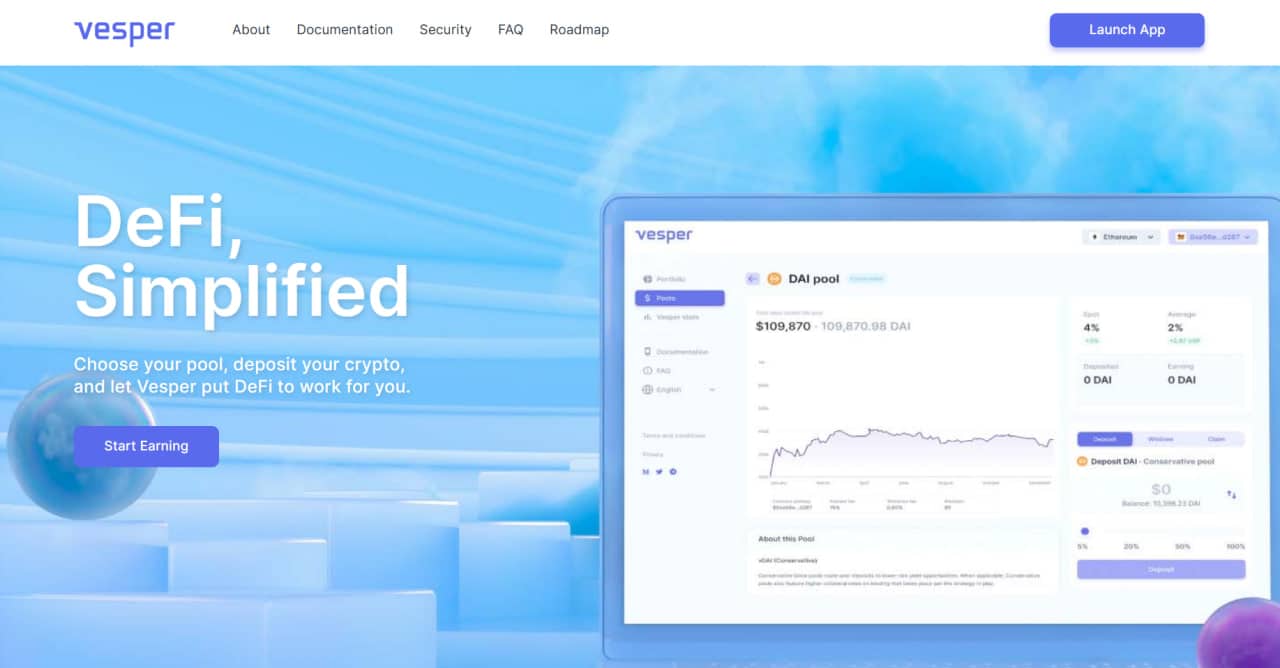

- Vesper

Vesper is a platform that enables users to earn interest on various stablecoins and cryptocurrencies. Previously, interest payments were limited to the same cryptocurrency as the deposit.

However, Vesper now offers the opportunity to earn interest through a mix of Ethereum, Wrapped Bitcoin (WBTC), DAI, and other stablecoins. This diversification broadens the earning potential for users and adds flexibility to their investment strategies.

Why Are Stablecoin Interest Rates Higher?

One might assume that stablecoins, which are pegged at a 1:1 ratio to the US dollar, would command similar interest rates. However, stablecoin interest rates often surpass those of traditional interest products, reaching as high as 9–13% or even more.

This discrepancy is primarily due to supply and demand dynamics. As the Federal Reserve has reduced interest rates to historically low levels, banks have little incentive to offer significant interest on deposits.

Meanwhile, the demand for stablecoins consistently outpaces the available supply. Consequently, stablecoin holders can charge premium interest rates, and crypto exchange platforms, in a bid to attract stablecoin lenders, offer high interest rates.

Final Word: Stablecoins are Making a Mark

Stablecoin lending platforms provide an enticing opportunity for investors seeking competitive yields while mitigating the inherent volatility of cryptocurrencies. By selecting reputable platforms like Nexo, AAVE, Compound, or Vesper, investors can benefit from the stability and profit potential offered by stablecoin investments.

As stablecoins continue to gain traction and cryptocurrencies become more widely adopted, these platforms bridge the gap between traditional financial systems and the crypto market, providing a win-win situation for conservative investors and the evolving digital economy. Invest wisely, harness the power of stablecoins, and unlock the full potential of the crypto market.

You can purchase Lucky Block here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.