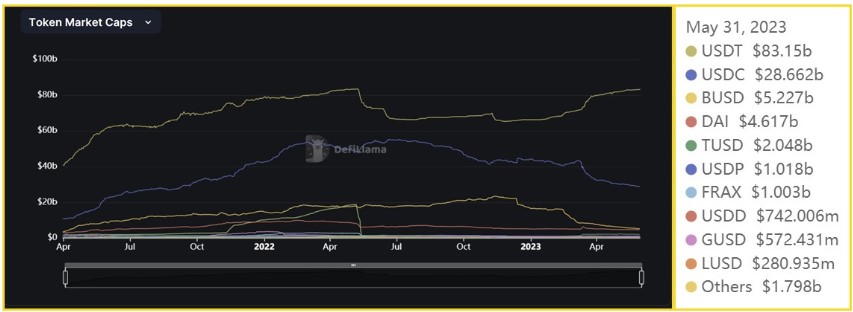

Stablecoins play a crucial role in the cryptocurrency market, providing stability in a volatile environment. They serve as reliable and liquid stores of value for digital asset exchanges. While popular stablecoins like Tether, Binance USD, and USDC gained traction in 2017–18, the bear market of 2022–2023 caused a significant drop in their market cap, with almost $50 billion lost.

The collapse of TerraUSD (UST) and LUNA further impacted the market, wiping out $60 billion in investor wealth. Notably, Tether and USD Coin faced de-pegging incidents during crises, and Binance halted BUSD minting due to investor withdrawals following the FTX crash.

Investment Thesis: Institutional Backing

Stablecoins primarily offer stability rather than speculative gains. However, investors can earn interest through staking and DeFi lending, with staking rewards comparable to US Treasury bonds and municipal bonds. With their extreme stability, high liquidity, and long-term investment potential, stablecoins present an attractive option for patient holders.

Top 5 Stablecoins in Circulation in 2023

1. Tether (USDT): Despite controversies and regulatory scrutiny, Tether remains the leading stablecoin with a market cap of $83 billion and a 63% market share. However, forthcoming regulations pose potential challenges for Tether’s operations and reserves.

3. Binance USD (BUSD): Issued by Paxos, BUSD faced a significant decline in market cap following the FTX crisis and regulatory actions. The future of BUSD remains uncertain as users transition to other stablecoins due to Paxos ending its partnership with Binance.

4. Dai (DAI): DAI, an algorithmic stablecoin on the Ethereum blockchain, initially faced competition from Terra/LUNA. While its market cap declined, DAI maintained steady wallet holdings and active addresses. Proposed regulations may pose challenges for algorithmic stablecoins like DAI.

Conclusion

Stablecoins faced a $50 billion market cap loss in 2022, but investor interest remains strong. Recent market disruptions, such as the Terra/LUNA and FTX collapses, have brought uncertainties. Regulatory control and concerns surround industry leaders like Tether. It is advisable to monitor updates on proposed regulations before making investment decisions.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.