EURUSD Price Analysis – September 7

EURUSD holds the selling bias unaltered at the beginning of the week, although it has so far managed well to stay under pressure beyond the 1.18 level as the dollar maintains its resilience, holidays in the US and Canada hold volumes at lows. The good impact of European indexes restricts the dollar’s advance, which nevertheless stays among the strongest.

Key Levels

Resistance Levels: 1.2011, 1.1965, 1.1916

Support Levels: 1.1750, 1.1685, 1.1606

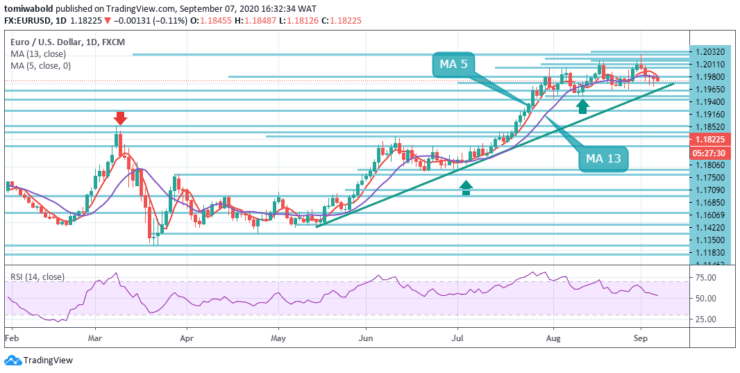

It is remarkable to see the daily candles start to look more unpredictable, with two very small-bodied candlesticks in succession. The corrective traction which pulled the market back from level 1.2011 has now started to consolidate. This comes just beyond the near-level support at 1.1750 while the main medium to long-term support stays unchanged at 1.1685/1.1750 levels also.

Consolidation should be the real key today, but support for another step higher is now beginning to grow. The daily RSI has not validated the new high beyond the 1.20 mark, opening the path to any weakness in the near term. The initial barrier still appears on the upside at the recent peak near the level of 1.2011.

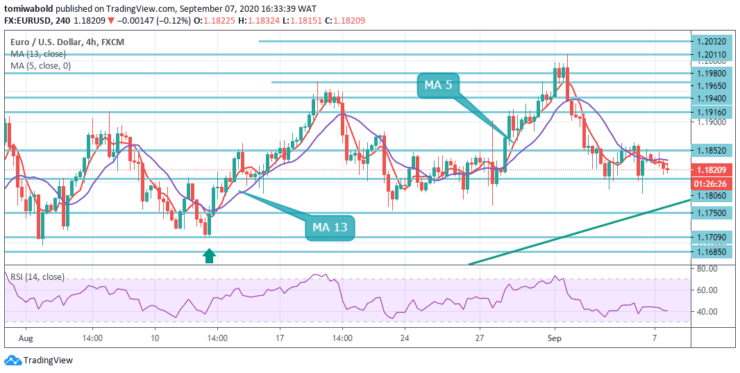

For consolidations initially, the intraday bias in EURUSD stays neutral. With a 1.1750 support level intact, further rise is in progress. On the upside, the level breach of 1.2011 may aim to resume the entire increase from level 1.0635.

On the downside, a strong breach of 1.1750 level may confirm short-term topping and transform the downside to broader pullback, horizontal resistance (now at level 1.1685), and beneath. The 4-hour chart indicates an improved bearish potential for the EURUSD pair.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.