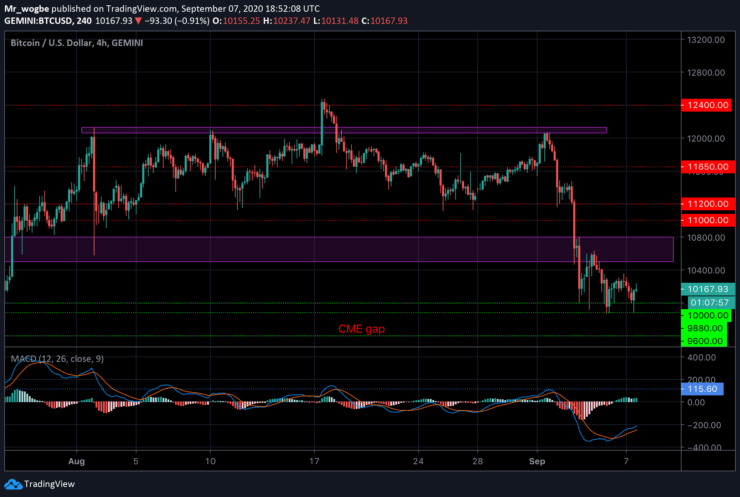

At the start of the day, Bitcoin exhibited significant weakness as bears sent it as low as $9,880 where it carried out a sharp rebound to the $10,200 level. It appears to have gotten stuck around this level as bulls continue to struggle with the mounting selling pressure.

However, one analyst believes that Bitcoin could still be bullish despite its persisting weakness. The analyst notes that this decline is simply a modest retrace with a major recovery on its way.

For this prediction to come to pass, Bitcoin has to hold above the $10,000 line. A failure to do so could spell devastation for bulls in the near-term.

Key BTC Levels to Watch

At press time, Bitcoin is trading down at 0.67% on the day at $10,190. This is a modest climb from its daily low at $9,880 and several points below its daily high at $10,312.

Today’s dip was bought aggressively by bulls at the $9,880 support, sending it back above $10k. This makes that support very crucial and possible BTC’s last defense from the $9,600 CME gap.

However, given the current market conditions, it appears that the CME gap might be filled soon. In the last 24 hours, more than $15 billion has left the cryptocurrency market signifying a sell-off in progress.

That said, the gap getting filled soon could liberate the cryptocurrency and send it back above its YTD highs.

Right now, all eyes are on the $10,000 as Bitcoin’s reaction to this level in the coming hours will help the benchmark crypto regain directional stability.

Total market capital: $328 billion

Bitcoin market capital: $188 billion

Bitcoin dominance: 57.3%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.