The yellow metal remained within a narrow trading range throughout the day and was last spotted trading around $1928. Gold has traded in a ‘seesawed’ manner for the fourth consecutive session now. The Federal Reserve continues on its loose monetary policy, which may be the most crucial driver of the choppiness in gold.

This has given the US dollar a little boost, which has further caused stagnation for the dollar-denominated commodity. However, worries over the prospects of a sharp US economic recovery has extended further support for gold’s safe-haven status and has limited further declines. Investors appear to be unwilling to become aggressive at the moment considering the holiday-induced volatility thinning in the markets today.

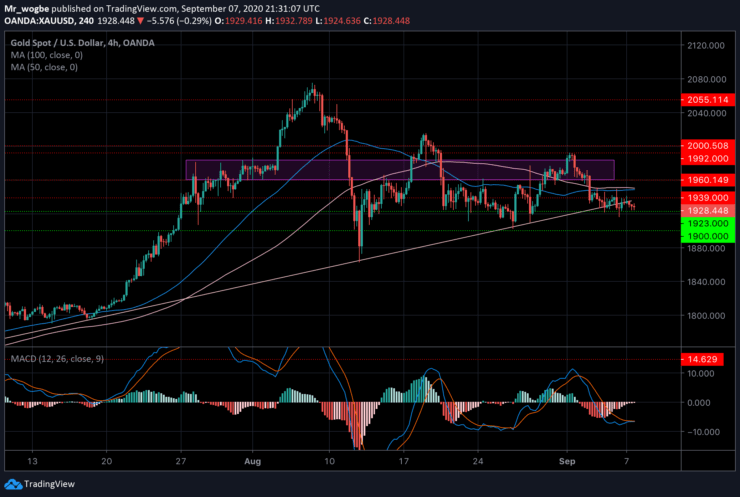

Gold (XAU) Value Forecast — September 7

XAU/USD Major Bias: Bearish

Supply Levels: $1940, $1960, and $1983

Demand Levels: $1923, $1909, and $1900

Gold bulls remain in a fight for control, however, given the prevailing market conditions, a gold recovery doesn’t seem likely in the near-term.

The commodity also failed to rally back above the 4-month ascending trendline, widening its distance the longer it stays below.

Moving on, we have a confluence of indicators (100 and 50 SMA) around the $1950 level, signifying that that’s the level to beat in the near-term for bulls to get comfortable again is the $1950.

Regardless, it seems increasingly likely that we will see the $1900 mark soon and subsequently the $1862 August low if bulls fail to resuscitate the market.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.