Videogames developer Zynga’s (ZNGA) stock is trading at its lowest level ($6.11) since March 2020 as investors worry that its revenues will slip as the Covid pandemic recedes.

Third quarter revenue rose 6.3% to $667.70 million from a year ago, slightly beating analysts forecasts of $665.98 million. But both revenue and bookings were down on the previous quarter.

However, the company made a loss for the quarter of $41 million which equated to an EPS loss of 4 cents. Adjusted EPS was expected to be $0.07 but came in weaker at $0.04.

Zynga shares have great turnaround potential

But we are recommending a buy on the stock because we think Zynga is a great turnaround story and the negativity on the stock is overdone. Indeed, the arrival of omicron on the scene could help to turn sentiment in a more positive direction.

Although it made a loss in 3Q, net loss for the nine months to end September actually fell by 90% to $36.9 million, showing the company is continuing on an improving trajectory.

For the same nine-month period mobile accounted for $1.66 billion of total revenues of $2.11 billion. And it is in the mobile segment that the growth is strongest at 49%, notwithstanding the continuing but weakening impact from Apple’s ad tracking changes, which has had some effect on customer acquisitions.

Mobile segment advertising increased from $186.9 million to $386 million and the US continues to be the top market, accounting for 53% of revenues ($1.27 billion).

We believe that Zynga has the potential to defy the doomsayers because its business does not depend on people playing games at home on a console or PC. Its portfolio of games, which includes FarmVille, CityVille CSR Racing and Zynga Poker and a host of hyper-casual offerings, are played primarily on mobile. Other playing platforms are on PC, consoles such as Ninetendo Switch and social media platforms such as Facebook and SnapChat.

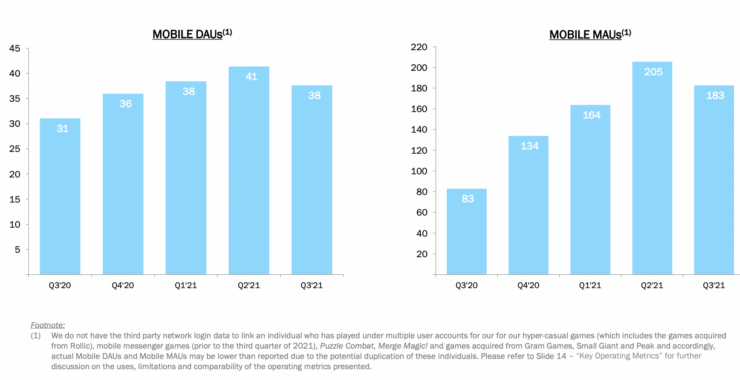

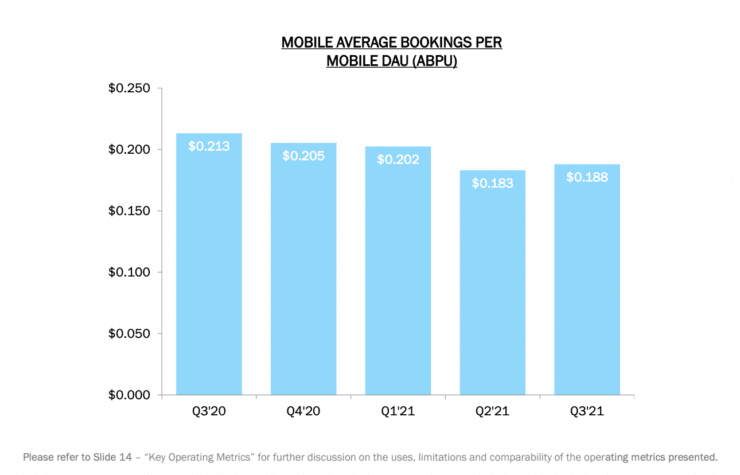

For sure, there has been a drop in daily and monthly user metrics after four quarters of growth, so the fears that have encouraged selling in the stock are understandable.

Digging deeper though, mobile average bookings per mobile DAU are up on the previous quarter.

Also, investors will appreciate the impressive reach of its games with 4 billion downloads across 175 countries.

If you are looking for profitable stock signals then check out our guide.

Hedge funds are buying up Zynga stock

Hedge funds presumably think they know something the rest of the market doesn’t, because they have been buying the stock.

Kestra Advisory Services LLC increased its stake in Zynga by 9.9% in the 3rd quarter – it now owns 16,446 shares after adding 1,485

CAPROCK Group Inc. upped its stake 13.7% in Q2 and now owns 12,871 shares.

Arkadios Wealth Advisors boosted its holding by 168.9% in Q2 It now owns 2,506 shares of the stock.

Kestra Private Wealth Services LLC raised its position in Zynga by 6.5% in Q2. It now owns 26,212 shares valued at $279,000 after purchasing an additional 1,600 shares.

Lastly, Kovack Advisors Inc. has also been buying, raising its holding by 5.2% in Q2 to 32,460 shares valued at $345,000.

Institutions (including hedge funds) have a sizeable proportion of the free float, making up 82.64% of current ownership.

This ownership profile could help the stock to build its position from the year lows, although the risk of further falls can’t be overlooked, given current volatility related to prospects for monetary tightening reducing market liquidity, the large discount to its target price will encourage medium term investors.

77% upside on analyst target price

The target price from 15 brokers covering the stock is $10.8, according to Stockopedia, compared to the current price of $6.1, which means the stock price is trading at a 77% discount to TP.

On Friday during a period of weakness for tech stocks, Zynga managed a 5.8% bounce in the price, which could be indicative of a period of consolidation ahead before the start of a solid recovery in price.

Investor service Sharepad lists 21 analysts covering the stock, with 15 rating it a buy, 4 as outperform and 1 a hold,. There are no sell ratings.

From a loss of -$88 million on net profit on a trailing twelve month basis, analysts expect that to dramatically reverse in 2021 fiscal with a profit of $400 million and in 2022 $490 million. EPS is expected to improve 22% in 2022 ($0.41).

You can buy Zynga stock on global investment platform eToro for 0% commission.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.