The rapidly increasing number of new cases globally has illustrated that the fight against Covid-19 is far from over and a full economic recovery will take much longer than expected. Optimism for a sharp V-shaped global economic recovery has become even bleaker and is weighing on investors’ sentiment, further underpinning gold’s safe-haven appeal. This coupled with a fresh US dollar sell pressure has extended further support for the dollar-denominated commodity to likely dominate this week.

However, a slight rebound in the US equity sector has kept a lid on any strong surge in price for the yellow metal for the time being. Also, strong intraday pickup in the US Treasury bond yields has placed additional pressure on the non-yielding commodity. Regardless, gold has retained a positive bias since it broke multi-year highs last week Wednesday.

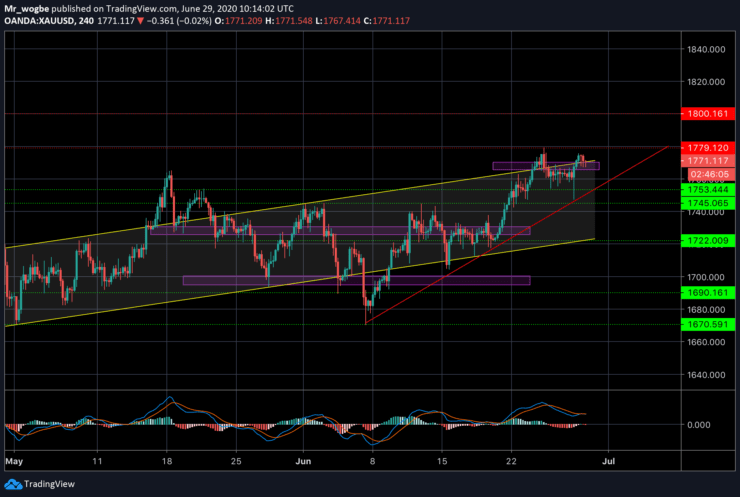

The recent range-bound price action seen in gold can be categorized as a consolidative move that will likely extend further support for a bull-run towards the ambitious $1,800/oz price mark for gold.

Gold (XAU) Value Forecast — June 29

XAU/USD Major Bias: Bullish

Supply Levels: $1,779, $1,790, and $1,800

Demand Levels: $1,765, $1,758, and $1,745

According to the 4-hour timeframe, we can see the steady development of an ascending trendline within our ascending channel. Based on this outlook, we could see a slight retrace towards the $1,755 level. This drop, if it occurs, will serve as a strong booster for the $1,800 price mark. Likewise, we could also see a quick bounce from this level considering we are in the middle of a range-bound pivot region.

Conclusively, a sustained drop to the downside (below the $1,745 support) appears to be off the table for the time being.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.