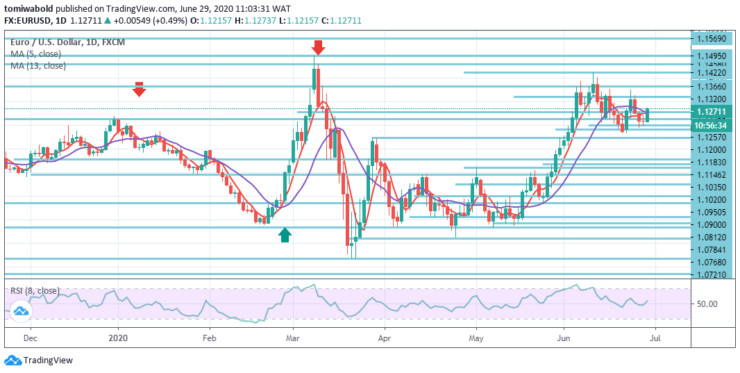

EURUSD Price Analysis – June 29

The single currency seems to have left some of the recent negativity aside and is now pushing EURUSD to new daily highs in the vicinity of 1.1273 level beyond 1.1257 marks while losing some momentum later on. Meanwhile, investors continue to evaluate the rate of economic growth in the Old Continent versus the latest pick-up in cases involving US coronavirus.

Key Levels

Resistance Levels: 1.1495, 1.1422, 1.1366

Support Levels: 1.1183, 1.0950, 1.0635

EURUSD has started Monday’s session after 3 straight daily sell-offs with solid gains just beyond the 1.1200 mark despite some reversal in the U.S dollar. The pair is currently gaining 0.51 percent past the level 1.1257 and a breakout of level 1.1271 may aim level 1.1366 (high) heading to level 1.1422 (high).

Local support is at level 1.1226, which is still being contested for and last week was a swing-high. On the drawback, the next lines of support go up at level 1.1183 seconded by level 1.1146 and eventually level 1.1035 (low).

So far the pair has worked to contain the neckline support of a bearish a double-top pattern on short-term charts from a technical standpoint. It makes it appropriate to wait through its known support for a continuous breach, around the zone of 1.1200-1.1183.

For the flip side, any eventual successful move past the level of mid-1.1200 may now boost the pair to strive back to regain the 1.1300/20 mark. nAny follow-through weakness beneath the support levels of 1.1183-46 may validate a near-term bearish breakdown and pave the way for a further short-term decline.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.