Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

GBPUSD Price Analysis – September 27

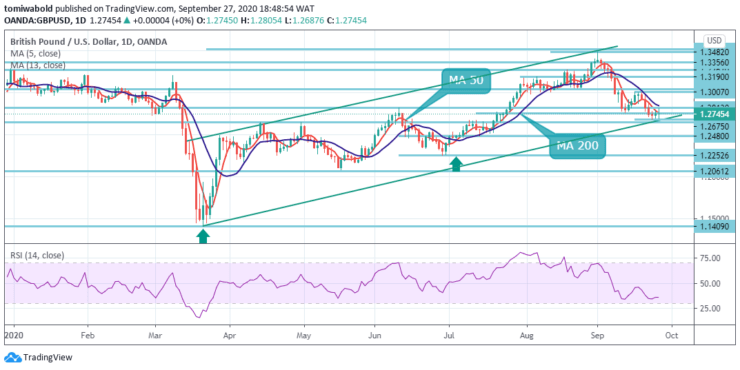

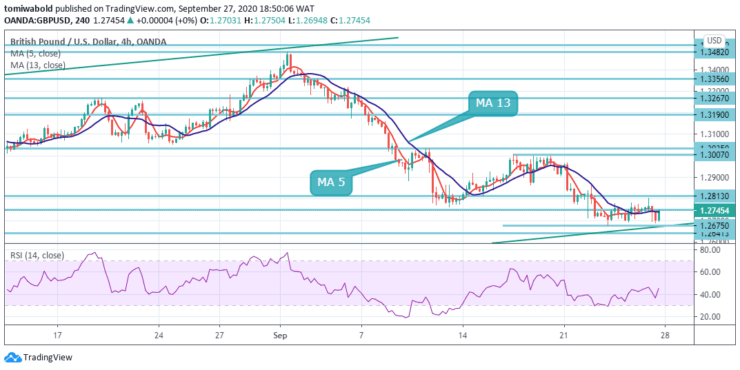

The GBPUSD pair closed for the 3rd day in a row unchanged beneath 1.2800 last Friday, as the Pound found support in Brexit-related headline and the risk-avoidance resurgence of the US dollar. The Pound has lost all of its earlier bounce and is weaker towards the immediate post-pandemic range of 1.2300-1.2700 levels.

Key Levels

Resistance Levels: 1.3514, 1.3035, 1..2813

Support Levels: 1.2675, 1.2252, 1.1409

The Relative Strength Index is down and flat on the daily chart although approaching oversold at 34.64 but will not touch that condition until the support is broken at level 1.2641. That being said, in the wider sense, although the recovery from the level of 1.1409 was significant, both the level of resistance of 1.3514 and the horizontal resistance (now at the level of 1.3482) are constrained.

The growth retains the prospects’ bearish. GBPUSD continued market horizontal support violation (now at level 1.2750) may contribute to medium to long-term bearishness for a new low beneath level 1.1409 at a future stage, regaining the downward trend from the level 2.1161 (high).

The fall of GBPUSD from the 1.3482 level continued last week to as low as the 1.2675 level. Although there was a brief low and the initial bias is neutral this week. As long as the 1.3007 level of resistance persists, a further fall is anticipated.

On the downside, the continuous fall from 1.1409 to 1.3482 at 1.2675 level of 38.2 percent retracement may claim that the increase from 1.1409 level may be achieved, taking a steeper decline to 61.8 percent retracement at 1.2252 level. Nevertheless, the breach of the resistance level of 1.3007 may imply that the decrease from the level of 1.3482 is solely a corrective step and switches bias back to the upside to re-test the level of 1.3482.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus