Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Futures offer you access to otherwise out-of-reach markets. You can trade futures contracts on commodities such as hard metals, agricultural products, and energies – not to mention financial instruments like currencies and stocks.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioFancy trading on margin without having to own the underlying asset? If so, you need to learn how to trade futures!

In this guide, we talk about the bare basics of futures trading – inclusive of tradable markets, how to create orders, risk management, and key metrics to finding a good trading platform We also divulge our top 5 brokers to trade futures – for your consideration.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

Part 1: Understand the Basics of Trading Futures

Before you can learn how to trade futures you need to have a firm understanding of the basics.

What Does Futures Trading Entail?

A futures contract is an agreement between you and your chosen online broker. Unlike with stocks and shares, whereby you are able to hold onto equities for months or years at a time, the agreement is that you will either buy or sell the asset in question on or before the expiry date. Crucially, this enables you to hypothesize on the future price of say wheat or oil – without taking ownership of it.

For instance, let’s say are quoted $2,600 on cocoa per ton. Your job as a futures trader is to correctly speculate on whether cocoa will see an increase or decrease in price by the time the contract ends. This tends to be a timeframe of around 3 months before expiry.

Hedgers often use futures in order to lock down a price for later down the line – at which point they will buy or sell. Meanwhile, speculators aim to predict price fluctuations and make gains from them.

How is the Price of Futures Determined?

The price of futures is contingent upon the value of the underlying asset in question, as well as supply and demand. Therefore, the price will fluctuate accordingly. This does not mean that the contract will mirror the price of the stock, commodity, or whatever you are trading.

For clarification, some of the main factors that determine the price of futures are:

- The underlying price of the asset

- Dividend income

- Storage costs

- Convenience yield

- Change in interest rates

How to Trade Futures: Online Brokerage or CFDs

When looking to learn how to trade futures, there are a couple of ways to go about it. That is to say, you can buy futures in the traditional sense or CFD futures.

See below for clarification.

Traditional Futures via Brokerage

For those unaware, traditional futures, are more commonly used by institutional investors and large hedge funds etc.

One of the reasons for this is that the contracts can be used to hedge against portfolio interest rates. Furthermore, there is an obligation to buy or sell the underlying asset on expiry – which can be expensive.

For instance:

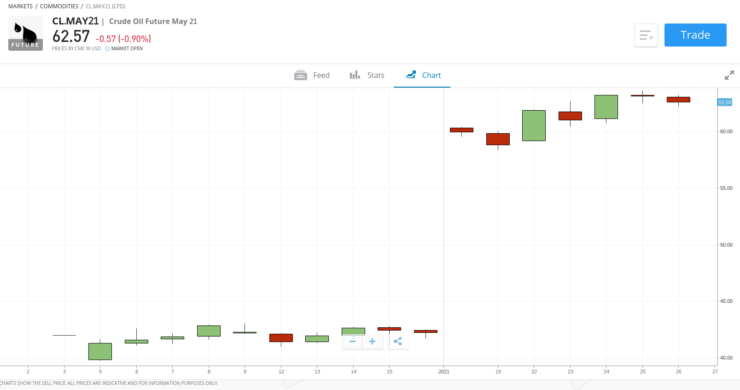

- Let’s say you were to buy a May Crude Oil (CL.May21) futures contract

- You are telling the seller you will purchase 1,000 barrels of oil at the previously agreed price – irrelevant to what the price is at the end of May.

- The seller is also agreeing to sell the asset to you at the same price – as per the contract.

Whilst most people trade futures on commodities, you can also use this contract on forex, indices, and stocks. We cover supported asset classes shortly.

CFD Futures

Traditional futures contracts usually come with large minimums, which is not ideal for your average trader. Therefore, the most popular way to trade futures is via CFDs (Contracts for Difference).

Cutting out the need to own the underlying asset, CFD futures simply monitor the real-world price of the respective contract. This allows you to gain access to the market you are interested in – and then predict the rise or fall in value. If you are correct, you make a profit.

See an example of a CFD future below:

- You are trading CFD futures on oil which are valued at $63.00 per barrel

- As such, the CFD futures contract is also priced at $63.00

To further elaborate:

- If you think the oil futures will experience a price increase – place a buy order at the trading platform

- On the other hand, if you think the contract will see a price decrease – place a sell order with your broker

- If the price goes in the direction you predicted – you will make gains on this trade

Notably, all CFD trade comes with an ‘overnight financing fee’, or ‘swap fee’. This is changed for each day you leave your position open out of market hours. Furthermore, the charge is usually higher on weekends.

Social trading platform eToro clearly displays the daily fee at the bottom of each order box. The amount you pay depends on which asset you are trading and how much leverage you apply to your position.

If you are from the US, you will not be able to access CFDs on any asset as they are banned.

What Assets can I Trade Futures on?

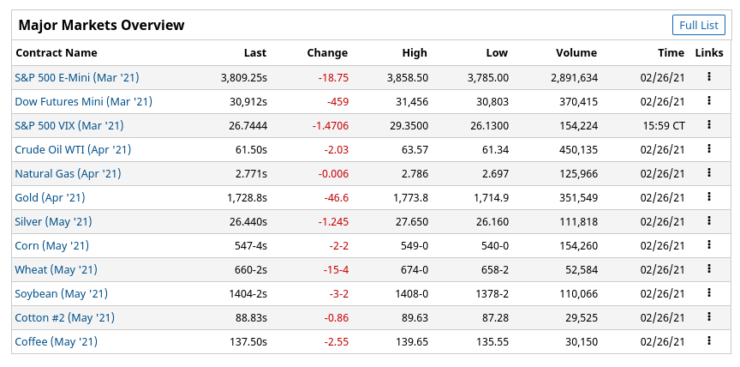

As we touched on, futures can be traded on a variety of different assets, albeit, you will see the most common below.

Stock Futures

Stock futures are no different from others – in the sense that they come with an expiry date. These contracts tend to last 3 months and typically expire on the 3rd Friday of whatever month it is – at which point the contract must be settled.

To give you a clearer idea, see an example of stock futures:

- Let’s say you are interested in futures contracts for Ford stocks

- Each contract contains 100 shares of the stock priced at $5 each – you purchase 1 contract

- If you still have the futures when the expiry date comes around – you must buy the 100 shares in your contract

- This is $5 x 100, which equates to an outlay of $500

Whether or not you make gains will depend on your prediction and the order you place. For instance, if you decide to go long and the underlying stock is worth more than $5 for each share when the expiry date comes around – you make a profit.

As such, if you go short and the price of the shares falls you – you make gains from the contract.

Commodity Futures

Commodity futures are one of the most popular ways to trade futures. Let’s say you are trading Crude Oil futures priced at $37.00. Your job is to speculate on the rise or fall in the value of the commodity you are trading – at the time of contract expiry.

Commodity investors often utilize futures as a way of getting a fixed price on the metal, agricultural, or energies. The majority of contracts offered by online brokers are on oil and gasoline.

Popular commodity futures to trade include:

- Energies, such as crude oil and gasoline

- Hard metals, such as gold, silver, and copper

- Agricultural products such as, meat, livestock, corn, wheat, cocoa, and sugar

Currency Futures

Trading currency futures consists of predicting the future exchange rate price of forex pairs such as EUR/USD. The currency futures market is said to have a daily average of almost a trillion dollars and such contracts are traded via exchanges like the CME.

As we said, if the asset (in this case a currency pair) were to see a decrease in value, the currency futures price would follow suit. Your goal is to correctly predict the currency pair’s increase or decrease in value by the time your contract ends – and make a profit if you are correct.

For those unaware, currency futures pairs include:

- Major FX pairs: EUR/USD (euro/US dollar), USD/JPY (Euro/Japanese yen), NZD/USD (New Zealand dollar/US Dollar), GBP/USD (British pound/US dollar), and more

- Minor FX pairs: EUR/GBP (euro/British pound), EUR/JPY (euro/Japanese Yen), GBP/JPY (British pound/Japanese yen), GBP/CAD (British pound/Canadian dollar), EUR/AUD ( euro/Australian dollar), and more

- Exotic FX pairs: USD/HKD (US dollar/Hong Kong dollar), PLN/USD (Polish zloty/U.S. dollar), EUR/TRY (euro/Turkish lira), GBP/ZAR (British pound/South African rand), JPY/NOK (Japanese Yen / Norwegian krone), and more

As you can see, there are plenty of options to choose from when electing to learn how to trade futures. Now you have a better idea of available assets, you should find it much easier to narrow down your search.

Part 2: Learn Futures Orders

Before you can trade futures you need to access the markets. This is done by signing up with a reputable brokerage and placing an order.

For those who need a recap or have never traded in any capacity, see a list of useful orders below.

Buy Orders and Sell Orders

To enter the market, you must start by placing a ‘buy’ or ‘sell’ order. Which one you choose will depend on your prediction of the rise or fall in the value of your chosen futures contract.

For instance, let’s say you are trading oil futures:

- You feel like the underlying commodity is undervalued, and is therefore about to experience a sharp price rise.

- This is when you will place a buy order with your online broker.

- If the opposite is true and you think the price is about to fall – place a sell order with the futures provider.

Importantly, if you enter the oil market with a buy order, you must use a sell order to exit your position – should you wish to offload the contracts before expiry.

Market Orders and Limit Orders

The price of commodities and financial assets fluctuates every second of the trading day, due to supply and demand. As such you might not always enter your trade in the same way.

As we said, a buy or sell order must be placed to start, and this will depend on your hypothesis. You will also need to choose between a ‘market’ and ‘limit’ order – we explain both next.

Market Order

If you are quoted the current market price and are happy – a ‘market’ order will be the most suitable order for you. This illustrates to your broker that you like the number and want your order placing immediately – at the next best price the market has to offer.

See an example of a market order below:

- You have been quoted $62.50 on a May oil futures contract

- This price is fine by you – as such you stick with a market order

- The online broker executes your order straight away

- Upon looking at your order you notice the price is $62.48

As you can see from above, there will invariably be a slight difference between the price you see upon placing your futures order and the end result. This is down to the ever-changing price shifts of the underlying asset.

A market order is often automatically selected at most futures platforms. If you wish to be more price specific, then you may need to select a ‘limit’ order instead – which we talk about next.

Limit Order

As we eluded to, a ‘limit’ order enables you to enter your chosen futures market at a particular price specified by you.

See a simple example of a limit order below:

- The May oil futures contract is priced at $62.50

- You are not interested in this contract until the value rises to $64.37

- Consequently, your limit order needs to be set to $64.37 upon placing your order

If the oil futures rise to $64.37, the broker will automatically execute your order at that price. This order will remain in place until either that happens – or you cancel the limit order manually.

Stop-Loss Orders and Take-Profit Orders

As well as having a clear idea of how you wish to enter the market to trade futures, it’s always wise to plan your exit.

Otherwise, you stand the risk of being liable to buy or sell the underlying asset on expiry. This is where ‘stop-loss’ and ‘take-profit’ orders come into play.

Stop-Loss Orders

Stop-loss orders are used by traders of all assets – largely because you are able to gain control over losses incurred. As the name suggests, this order enables you to quite literally stop your losses, best of all – automatically.

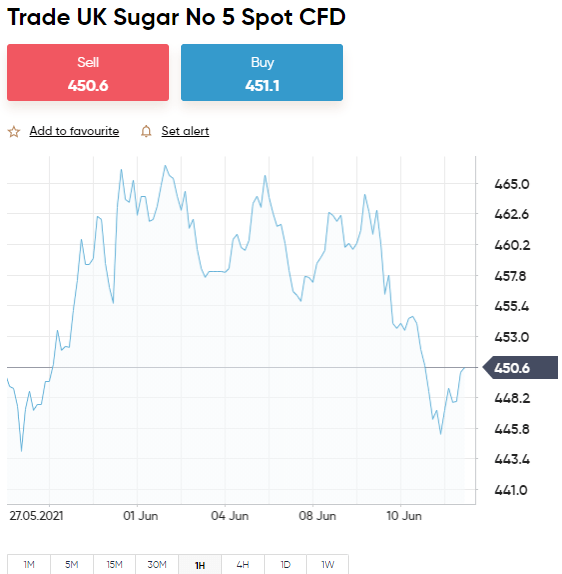

See an example of a stop-loss below, this time using a sugar futures contract:

- You decide to place a buy order on sugar

- This contract is priced at $0.1642 per lb

- You are not willing to lose more than 4% on the position

- As such, you set the stop-loss to 4% below the entry amount ($0.1576)

- Alternatively, if you want to sell and go short on this futures contract – you need to set the stop-loss to 4% above the entry price ($0.1707)

This allows you to put your own specific entry and exit strategies in place, and let the futures broker do the rest.

Take Profit-Orders

A ‘take-profit’ order works much the same as a ‘stop-loss’ – although this one locks in your profits, instead of stopping your losses.

Take a look at a simple example of a take-profit order below:

- You wish to make gains of 5% on your sugar futures trade

- As such, if you enter the contract with a buy order – you will set the take-profit value to 5% above the initial price

- If you go into the contract with a sell order – you will set the take-profit value to 5% below the initial price

No matter which direction the price of sugar goes in, you now have an order set up for both eventualities. As with ‘stop-loss’ orders, this will be actioned automatically by the broker.

Part 3: Learn Futures Risk-Management

A big part of learning how to trade futures successfully is to add risk management to your trading strategy.

See below some commonly utilized futures risk management systems.

Percentage-Based Bankroll Management on Futures

Percentage-based bankroll management works just as well on futures as it does on any other instrument. All you have to do is pay some consideration to your realistic trading budget, and set parameters accordingly.

To explain further:

- Let’s imagine you have decided to spend no more than 2% of your trading account on each trade

- This system means that irrelevant to whether your account contains $20 or $20k – you never stake more than 2%

- As such, if you have $1,000 – don’t stake more than $20

- If you have $5,000 – don’t stake more than $100 – and so forth

As you can see, in order to readjust this strategy, you just have to perform a simple calculation to stay on track. This should be carried out before each trade.

Trading Futures via a Risk and Reward Ratio

Many futures traders utilize a simple but effective risk and reward strategy.

The best way to explain this is by using a simple example:

- Let’s assume that for every $1 you risk on a trading position, you are hoping to make gains of $3

- This is a 1:3 risk/reward

- Ergo, if you stake $50, you hope to make $150 in return

- Other commonly used ratios for this system are 1:2 and 1:4

The easiest way to utilize this particular strategy is alongside the aforementioned ‘stop-loss’ and ‘take-profit’ orders.

Leverage on Futures

For those unaware, leverage tends to go hand in hand with futures. It allows you, as a trader, to open a position that is bigger than your account balance allows. This is offered by brokers and the amount you can apply will depend on factors such as your location, the type of futures you are trading, and the size of your stake.

See an example below to clear the mist:

- You have $100 remaining in your trading account

- Believing the price will rise, you place a buy order on cocoa futures

- The online broker offers you 1:10 (otherwise shown as x10) leverage

- Your $100 stake is now worth $1,000

If this trade goes your way, the leverage boosts your profits 10 fold. Of course, if you incorrectly predict the market sentiment on cocoa – your losses will be magnified by 10.

Take note, retail investors are often capped with how much leverage they can apply. A quick internet search including your jurisdiction and the words ‘leverage limits’ should tell you what your own restrictions will be – if any.

Part 4: Learn How to Analyze Futures Prices

By this point, you will have a clear grasp on what futures are, what assets are on the table, and how to place an order relevant to your price prediction.

As such, you should be about ready to learn how to analyze futures prices.

Fundamental Analysis in Futures

In a nutshell, fundamental analysis in futures trading comprises evaluating all of the important metrics that affect supply and demand in the markets. This involves studying various geopolitical, economic, and financial factors regarding the specific security.

The main goal is to gain insight into where the price of the asset might be heading, by the end of your futures contract. As we touched on, a multitude of different things can affect the supply and demand of futures. This is why it’s crucial to keep abreast with any relevant economic, business, and geopolitical news.

If you are lacking in time, or are a beginner – it’s worth doing your homework. There are hundreds of different websites offering daily insight, opinions, expert forecasts, and strategy ideas. Furthermore, you can also sign up for a news subscription service. You will receive regular and breaking news updates relating to your chosen futures.

Technical Analysis in Futures

Performing technical analysis on futures will see you studying indicators, charts, earnings and sales reports, volume, historic prices, and trends. By analyzing a multitude of data, you are better equipped to gauge the market sentiment and value of the relevant futures.

- Stochastics

- Moving Average Convergence/Divergence

- Bollinger Bands

- Relative Strength Index

- And many more

Part 5: Learn How to Choose a Good Futures Broker

Finding a decent futures broker isn’t an easy feat. As such, as well as listing our own findings on the matter, we have also listed some of the more important factors to consider when finding a futures trading platform yourself

Regulation

Regulated brokers have to follow various rules to maintain a license to operate legally and offer financial services.

Such rules include client fund segregation in a tier 1 bank, KYC, regular thorough audits, fee transparency, and more. As such it’s a no-brainer to only trade futures via a licensed and regulated platform.

The main regulatory bodies in the space are as follows:

- FCA

- ASIC

- CySEC

- FINRA

- MAS

There are other bodies in this space, however more often than not, you will see that online brokers hold a license from one or more of the aforementioned organizations.

eToro, which we review shortly, is regulated by the FCA, CYSEC, and ASIC. Furthermore, the broker is also approved by and registered with US authority FINRA.

Fees and Commissions

The lion’s share of online brokers charge fees and commissions. It is a business and therefore must do so in order to offer a service and keep the wheels turning.

Commissions

The most commonly charged commission fee when trading futures is a variable one – see an example below:

- Imagine your broker of choice charges 2% commissions on every trade

- This means you must pay 2% on entering and exiting the futures position

- As such, if you enter the contract with a $1,000 buy order – you need to pay $20

- If your contract is worth $1,600 upon exiting your position – you must pay $32

As you can see from above, such fees can soon diminish any profits. If you trade CFD futures at eToro there is no commission payable at all. This means you would have saved $52 on this contract!

Spreads

The spread is the difference between the ‘buy’ price and the ‘sell’ price of the futures contract. In other words – how much the market is willing to buy the futures for and how much they will sell for.

The gap between these prices is an indirect fee payable to the broker and will be shown as pips in forex futures, or percentage or cents on other assets.

See a simple example below:

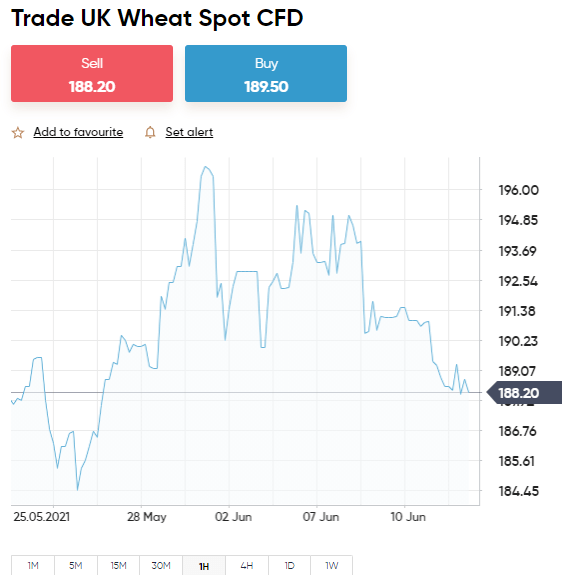

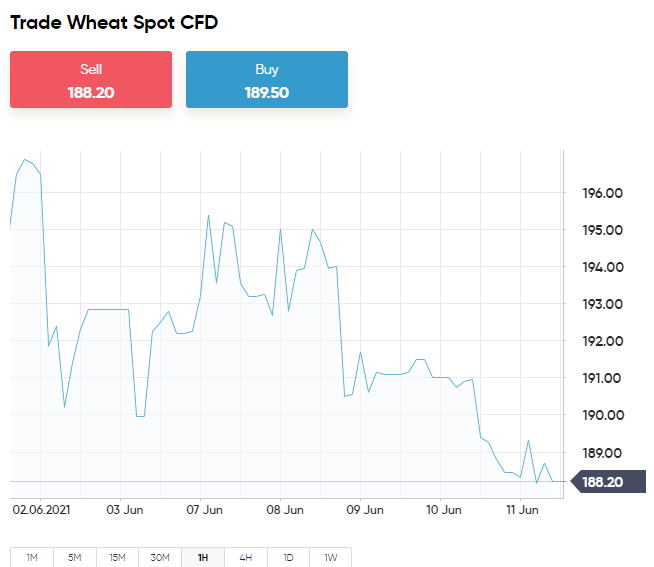

- You are trading wheat futures

- The buy price is $663.00

- The sell price is $663.90

- The spread is 90 cents

If your wheat futures trade rises by 90 cents you will break-even. If wheat surpasses a growth of 90 cents, you make a profit.

Payments

If you have an idea of what payment method you want to use to deposit funds into your account – you should check what’s available before signing up.

Whilst some online brokers only accept the sluggish option of a bank transfer – others enable everything under the sun. Popular CFD futures broker eToro accepts credit and debit cards, as well as e-wallets like Skrill, PayPal, and more depending on where you live.

Best Brokers to Trade Futures Online

We have saved you hours of legwork and narrowed our search of the best brokers to trade futures down to 5.

1. AvaTrade – CFD Futures and Heaps of Trading Tools

Starting with regulation, AvaTrade is approved by various juresdictions, including the UK, Australia, Japan, South Africa, UAE, EU and more. As such, legitimacy is no conern with this online broker.

The platform offers access to heaps of different markets from various asset classes. Furthermore, you can trade futures without paying a cent in commission fees. This means you only need to factor in the spread and overnight financing fees when trading CFD futures.

If you are never far from your mobile phone you will likely enjoy the convenience of the broker's own app 'AvaTradeGO'. This is packed to the rafters with trading tools, indicators, simulators, and educational guides. For those of you who like to make the most of the wide range of tools available on MT4 - you can link your AvaTrade account in a few simple steps.

You can also connect your broker account to third-party social trading platforms 'Zulutrade' and 'DupliTrade'. These sites are useful for gaining extra insight from seasoned traders, who are perhaps more well versed in futures.

The minimum deposit amount required by AvaTrade is just $100. When it comes to payment types, this broker accepts traditional bank transfers, and credit and debit cards. E-wallets such as Neteller and Skrill are accepted but not for all jurisdictions. For instance, if you are in the EU or Australia, you cannot deposit funds into your account using this payment method.

- Deposit $100 to trade futures

- Regulated in multiple juresdictions such as the UK, Australia, and EU

- Trade futures on a commission-free basis

- $50 inactivity fee after 3 months without trading

2. VantageFX –Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Part 6: Learn How to Trade Futures Today – Walkthrough

By this point in our Learn How to Trade Futures Guide you are likely ready to get started on your trading adventures.

The best futures platform to sign up with is Capital.com,so we are going to this top-rated broker for our step-by-step walkthrough.

Step 1: Open an Account & Upload ID

Open the official Capital.com page and click ‘Join Now’. The box you see below will appear.

Simply enter the particulars required by the platform. This will be the usual, like your name, address, date of birth, and such. As per KYC, the trading platform also requires proof of the information given.

As such, you will need to upload your government-issued photo ID. You will also have to send a clear copy of your proof of address. This can be a bank statement or utility bill from the last 3 months.

If you are in a hurry, you can skip the uploading of documents. However, you will have to fulfill this requirement before you can withdraw any cash (or deposit more than $2,225). We found that from start to finish, the process still takes less than 10 or 15 minutes.

Step 2: Deposit Some Trading Funds

After receiving your confirmation email, you can go ahead and deposit some funds to trade futures. As you can see, this part couldn’t be more simple. Start by entering the amount you wish to deposit in the ‘Amount’ box.

Remember, if you are not depositing funds in USD, you will pay a small 0.5% exchange fee. This is because the trading platform is denominated in US dollars.

That’s it, now you can choose a payment method from what’s available in your country of residence. Check over all of your details and click ‘Deposit’ to confirm.

Step 3: Search for Futures

After following Steps 1 and 2, you will now have a new trading account topped up with funds to trade futures.

As you can see, we are looking to trade wheat futures. If you are unsure of what you would like to trade, click ‘Trade Markets’ to browse what’s available.

Step 4: Start Trading Futures

When you have found which futures you wish to trade you can place your first order. Simply click ‘ Trade’ next to your chosen contract and an order box will appear.

To refresh your memory you should enter the following information:

To refresh your memory you should enter the following information:

- Buy or sell order

- Stake amount

- Market or limit order

- Stop-loss price

- Take-profit price

Check all of the information you have entered and click ‘Open Trade’. That’s it. You’ve placed your first futures order at Capital.com- the broker will now execute this order accordingly.

Learn How to Trade Futures – The Verdict

In this guide, we have covered the ins and outs of how to trade futures. By now you should be feeling ready to go out there and trade – with a good grasp of how it all works.

When trading futures, it’s a good idea to incorporate risk management tools into your trading strategy at all times. This includes using stop-loss and take-profit orders, and a risk-reward ratio on each and every trade.

Regulated platform Capital.com made the top of our list when researching the best broker for trading futures. The website is super easy to navigate and safety isn’t an issue thanks to regulations from the FCA, ASIC, CySEC, and NBRB. Furthermore, you can trade a range of futures whilst paying zero percent in commission fees.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

FAQs

Can I make a living trading futures?

What are the most popular futures to trade?

Will I be able to close my trade before the futures contract ends?

What is the best broker for futures trading?

Can I hold a futures contract past the expiration date?