If you bought Halfords stock (HFD) at its March 2020 nadir (51p), then today (280p) you would be sitting on a gain of 449%.

The UK auto and cycle product and services group is without a doubt one of the pandemic winners, but investors on the outside looking in might be wondering if there’s more juice to be squeezed out of this stock.

The answer is yes. Our affirmative response rests at least partly on the assumption that the shift to cycling during the pandemic is not just a passing fad but a trend that will become ingrained as government support in the UK for carbon-neutral mobility takes hold.

Its outperformance during the pandemic was certainly helped by its designation as an “essential retailer” by the government, which meant it has stayed open throughout the lockdown periods, albeit with controlled socially distanced entry combined with click-and-collect service product delivery.

And it’s not all about bicycles.

Another allied trend is the growth in sales of electric scooters and similar micro-mobility options relying on electric propulsion, such as electric motor-assisted cycling, where riders can call on motorised assistance when, for example, cycling up hill.

Halfords could reasonably be considered a renewable energy stock – or at least a green infrastructure play – as it successfully exploits its leading position in the UK market for bicycles and escooters, even if it is still reliant on the legacy internal combustion engine business.

Price-to-free cash flow is impressively low at 2.2 and share price momentum excellent, with a Stockopedia ranking of 93 out of 100.

Its price-to-sales ratio is also excellent at 0.47, which is the basis of its strong value ranking.

Operating margin (5.13%) and return on capital (8.6%) places Halfords in the top third for its industrial sector of speciality retailers (comprised of 37 companies).

In its October trading update for the 26 weeks to 2 October, the company raised guidance on its fiscal first half outlook, with pre-tax profits expected to come in at £55 million, an upward revision from the previously stated £35-40 million.

In particular cycle sales were expected to be up 46% year-on-year in the five weeks to 25 September, which was responsible for its impressive like-for-like cycles segment sales growth of 22%.

the interim results reported in mid-November confirmed the company’s optimistic view, with overall group like-for-like revenue coming in at 9.6% and pre-tax profit beating revised guidance by a whisker at £56 million.

Halfords online sales up 148%

Online sales grew an impressive 148% and group services growth was 166%. That, combined with improving customer satisfaction and the rollout of training across stores and cycling services, shows it is continuing to invest in strategic growth areas.

The one area of its business that has slowed is the Autocentres and motoring accessory sales – both directly related to the fall in car traffic during the lockdown periods of the pandemic. But even with those headwinds, the company still managed to grow business in the motoring division.

Indeed the company continues to invest in motoring, and has an eye on the future with plans to train a further 100 electric car technicians for a total for this year (2021) of 470.

Back on cycles, Halfords is boosting the headcount for ebike and escooter services from 400 to more than 1,800. The aim is to ensure that each of Halfords’ service garages will have at least one electric car technician and every store an ebike and escooter servicer.

On a trailing twelve month basis EPS growth is 67% for a P/E multiple of 6.6 and a dividend yield of 2.18.

Pulling all those metrics together, Halfords combines both growth prospects with exceptional value credentials, making it a candidate for GARP strategists – growth at a reasonable price.

To confirm that, Stockopedia gives Halfords a 96 out of 100 Value Ranking. Allied with its strong price momentum, it means the share price has plenty of scope for further appreciation.

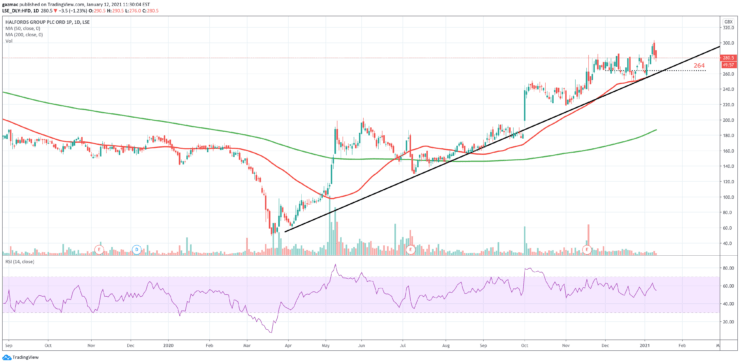

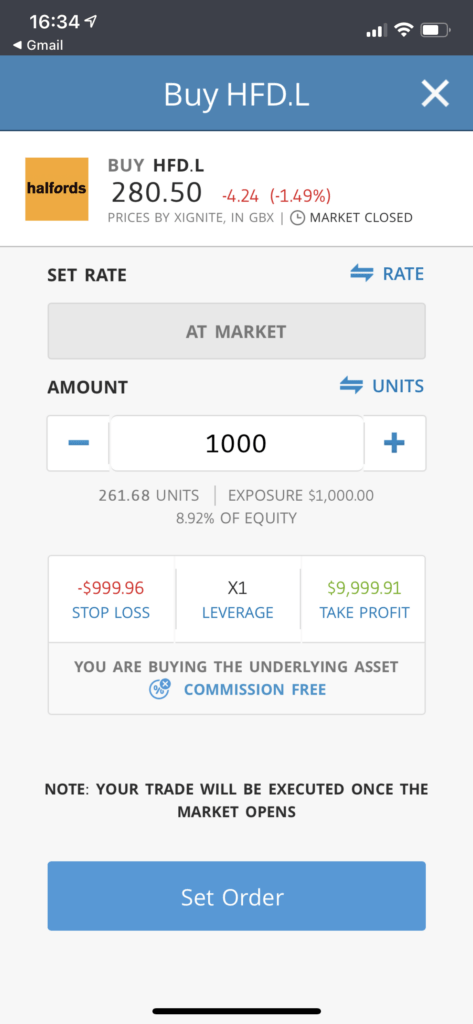

Entry price range 280p to 264p

The stock was down yesterday (Monday 11 January) and on Friday, and is down again today on continued profit-taking, currently priced at 280p. however, this could prove a good near-term entry point for new investors, although traders might want to await further decline towards support at 264p (see chart below).

The trend line above underlines near-term support at 264, and is confirmed by 50-day SMA on the 1-month candles chart (below). The Ichimoku cloud indicates resistance ahead but we expect this to be overcome, with fiscal year-end results at the end of March 2021 to confirm continued strong trading (see chart below).

Halfords’ share price is still a long way off its 2019 high at 389, not to mention its all-time high printed in 2015 at 562 (see chart below).

The stock is a buy with a calendar year-end term price target of 389p.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.