Market Analysis – February 9

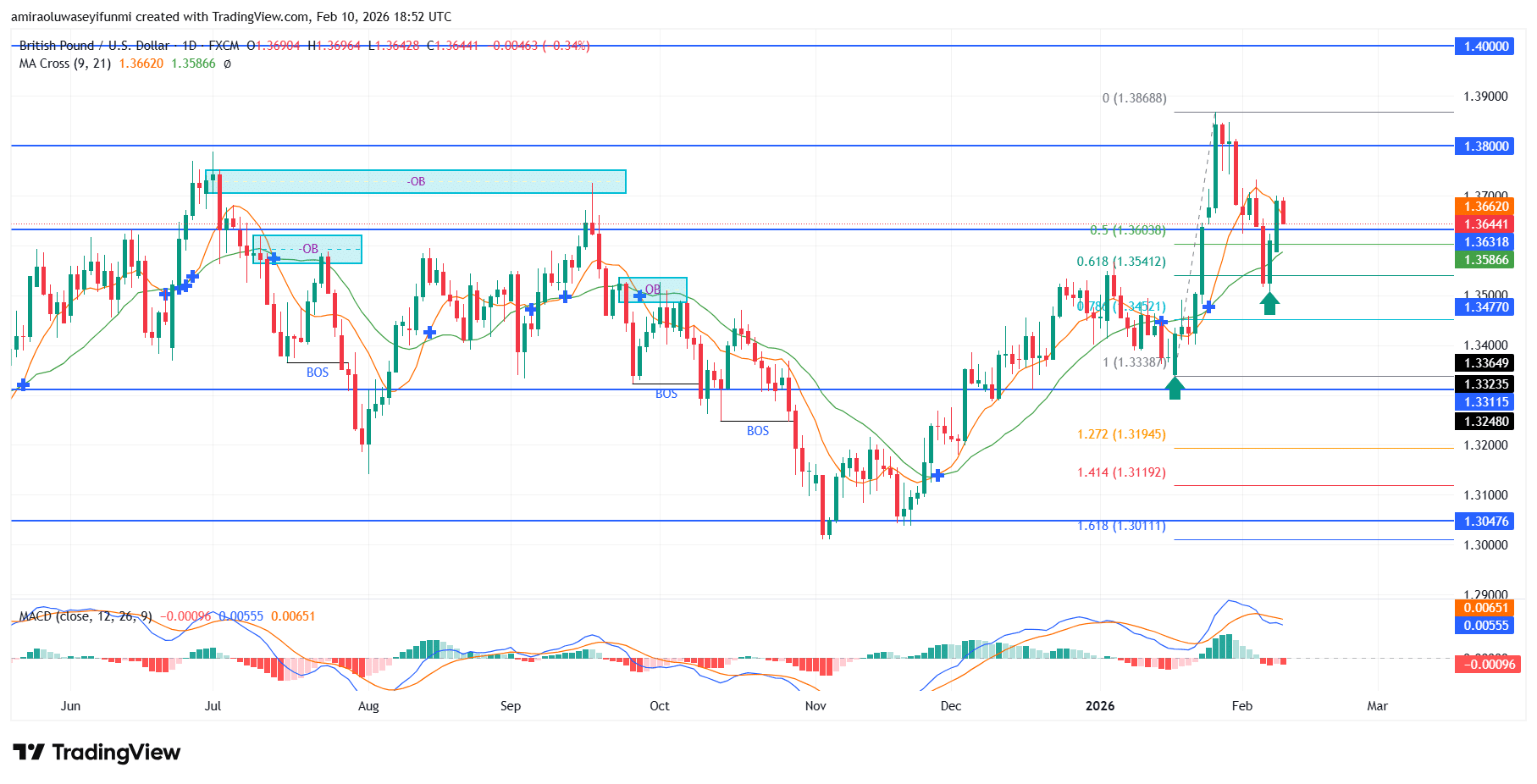

GBPUSD market sustains upside structure as the pullback remains well behaved. GBPUSD Market continues to lean decisively northward, with directional conviction reinforced by strong alignment between trend-following indicators and momentum metrics. Price remains positioned above its ascending short- and medium-term moving averages, highlighting resilience in the bullish narrative despite intermittent volatility. The moving average crossover remains intact, while momentum indicators such as the MACD have moderated without crossing into negative territory, suggesting consolidation rather than deterioration. Collectively, these conditions reflect an orderly recalibration phase rather than hidden distribution.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3310, $1.3050, $1.2900

GBPUSD Long-Term Trend: Bullish

From a structural perspective, the market has consistently formed higher lows since rebounding from the $1.3040 zone, preserving the integrity of its bullish framework. The strong advance into the $1.3800–$1.3860 resistance band marked a clear expansion phase, after which price retraced in a controlled manner and stabilized above the $1.3470–$1.3500 demand area. This pullback aligns with Fibonacci confluence near $1.3540 and $1.3500, where prior selling pressure has transitioned into reliable support, signaling constructive participation rather than weakness.

Looking ahead, as long as GBPUSD Market continues to defend the $1.3470 base, the technical outlook remains skewed toward further upside. Stability at current levels paves the way for another test of $1.3800, with potential extension toward the psychologically significant $1.4000 region thereafter. A decisive break below $1.3470 could prompt a deeper rotational move toward $1.3350, though such a scenario would still reflect a corrective phase rather than a full reversal of the prevailing bullish trend often monitored through forex signals.

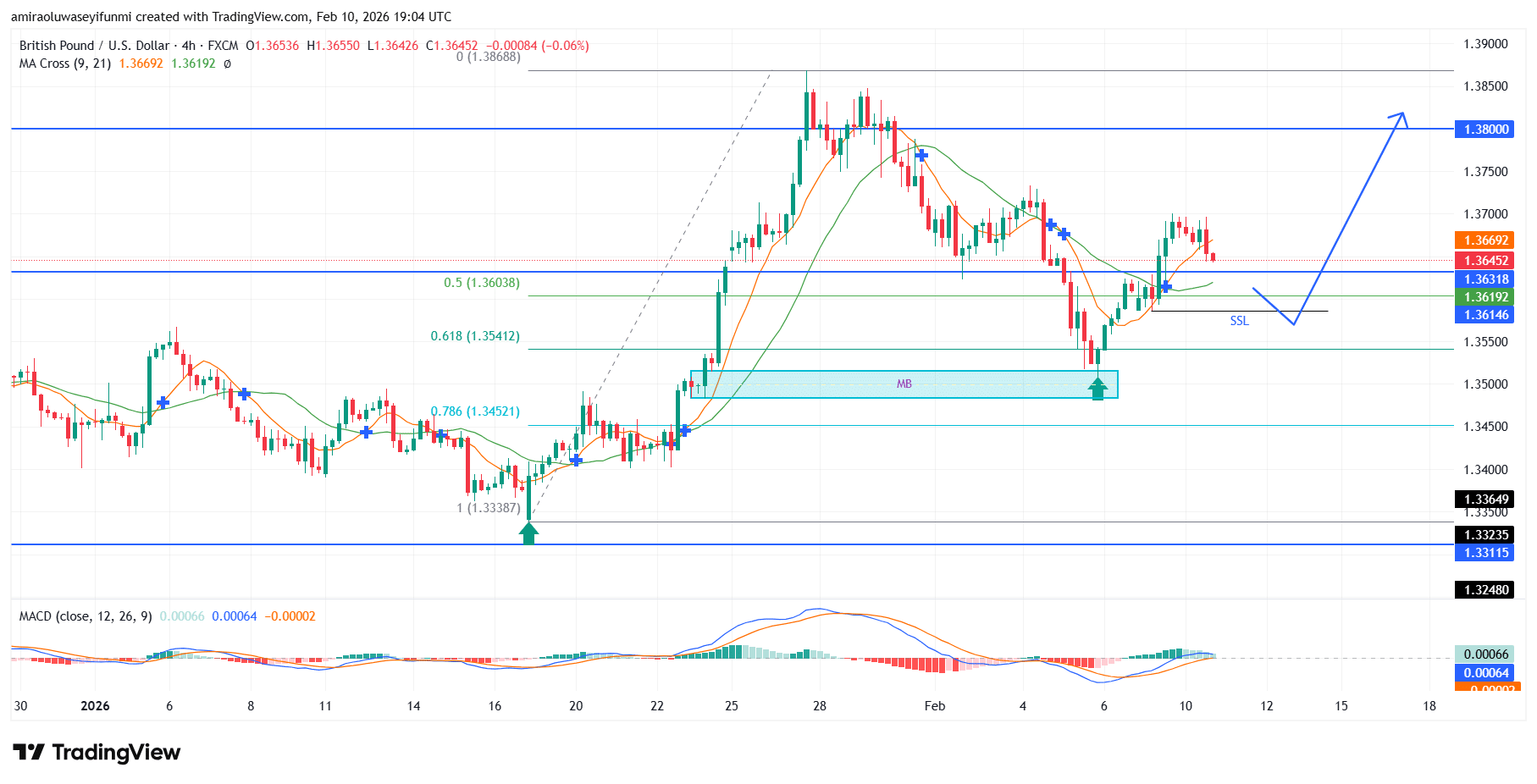

GBPUSD Short-Term Trend: Bullish

GBPUSD on the four-hour chart maintains a bullish bias, with price holding above the rising short-term moving averages and overall trend structure remaining intact. The recent pullback appears corrective, finding support within the $1.3500–$1.3550 demand zone, where buyers have demonstrated renewed interest.

Momentum indicators are stabilizing following a brief cooling phase, indicating that downside pressure is fading rather than intensifying. As long as price holds above $1.3500, a continuation toward $1.3800 remains the preferred technical scenario.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

Related Resources

- Forex Signals — live EUR/USD, GBP/USD and more

- What Are Trading Signals? — beginner’s guide to signal services

- VIP Trading Signals — join 40,000+ traders getting early signals

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.