Market Analysis – February 2

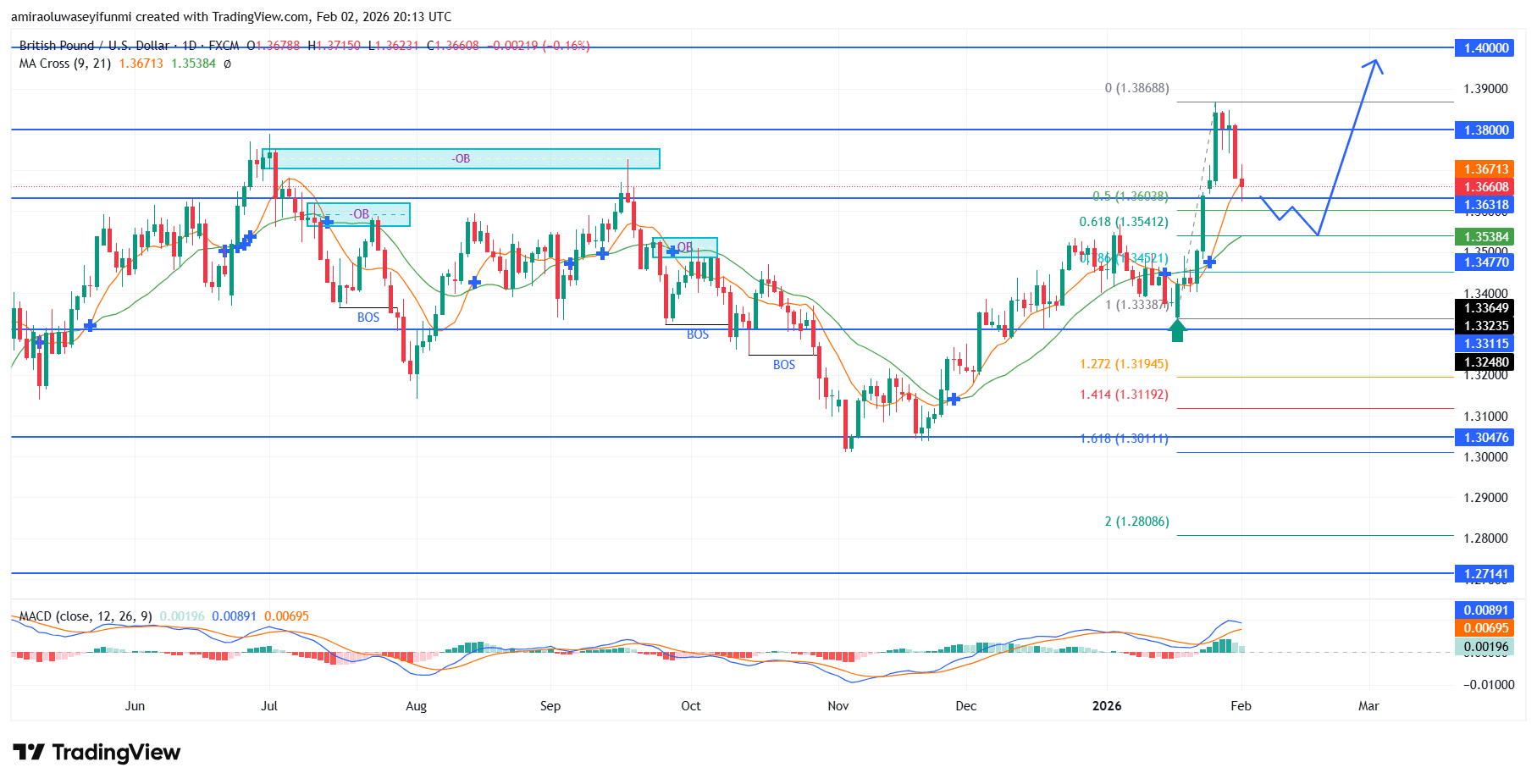

GBPUSD market preserves upward bias after expansion and controlled retracement. GBPUSD continues to maintain an upward-leaning technical posture, supported by clear alignment between directional structure and momentum indicators. Price remains positioned above its rising near-term moving averages, reflecting sustained buyer participation, while the MACD stays in positive territory with a gradual expansion, signaling strengthening momentum rather than loss of drive. Together, these conditions suggest a market transitioning from recovery into a more established continuation phase.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3310, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bullish

From a price-structure perspective, conditions remain constructive, defined by steady advances followed by controlled pullbacks that reinforce trend integrity. The impulsive move from the $1.3330 area into the $1.3860 region confirmed directional strength, after which price retraced methodically toward the $1.3540–$1.3600 zone. This area, aligning with prior supply turned demand and key retracement overlap, has effectively absorbed selling pressure and preserved structural support above $1.3470.

Looking ahead, upside continuation remains favored while price consolidates above the $1.3600 threshold. Sustained acceptance in this region would likely encourage a renewed push toward $1.3800, with extension potential toward $1.3860 and the psychological $1.4000 level. The broader bullish framework remains valid unless price breaks decisively below $1.3470, which would indicate a material shift in directional risk.

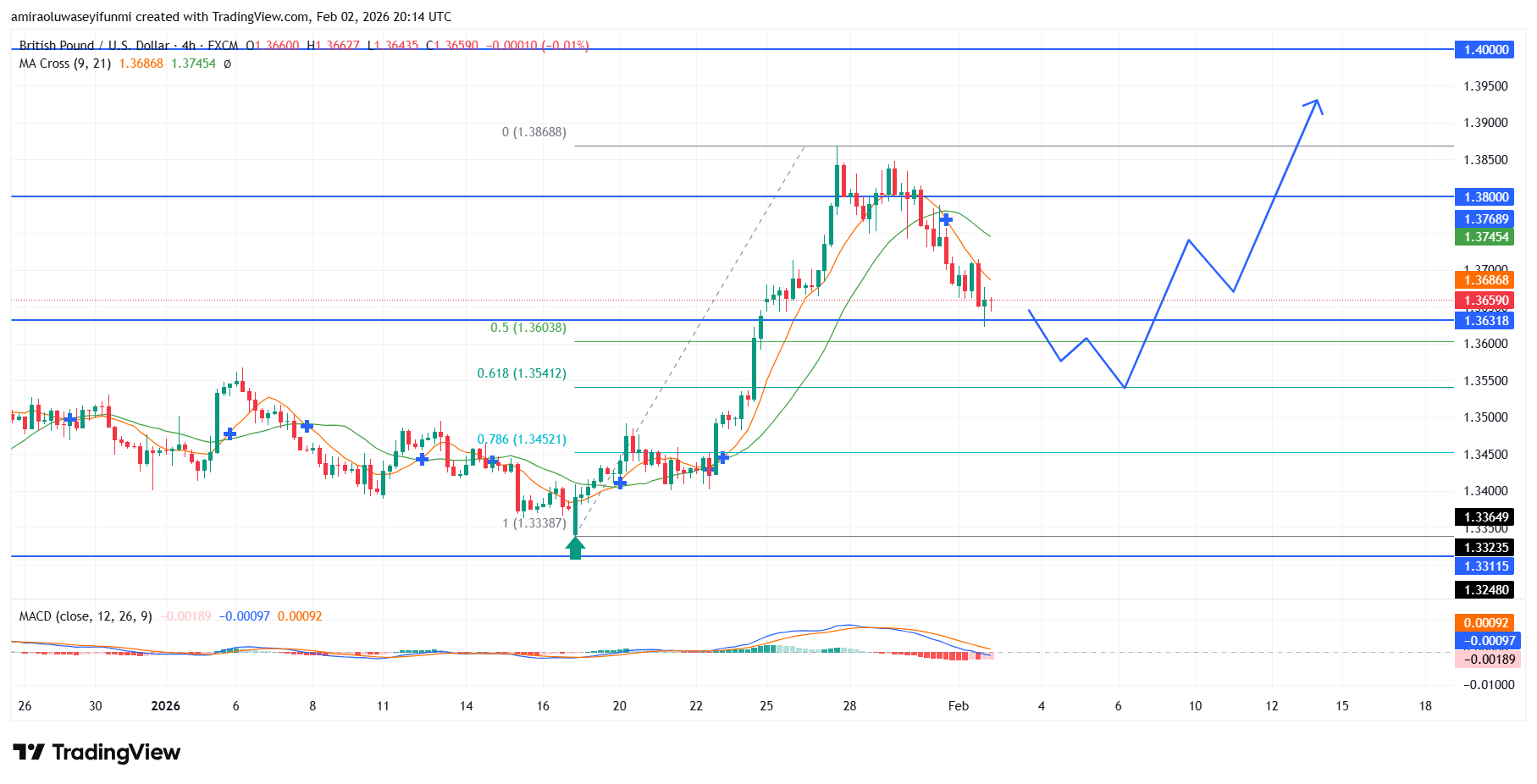

GBPUSD Short-Term Trend: Bullish

On the four-hour chart, GBPUSD maintains a bullish structure, with price holding above the $1.3600 support area despite the ongoing retracement. The recent decline appears corrective in nature, rotating into prior demand between $1.3540 and $1.3600, while the overarching sequence of higher highs and higher lows remains intact. Short-term moving averages are flattening but continue to offer dynamic support, pointing to consolidation rather than trend failure, and a sustained rebound above $1.3700 would likely reopen upside toward $1.3800 and $1.3900 in line with prevailing forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.