$COIN (NASDAQ: COIN) Forecast: February 11

The Coinbase Global (NASDAQ: COIN) value is expected to increase and will load more with the new bullish pattern after the bearish momentum is updated. It is about time for the stock market to resume a bullish pattern. Amidst the selling pressure, the share price gave a bullish breakout from $167.57, indicating that buyers are attempting a comeback. Therefore, if the bullish correction persists and price holds above $361.40, a possible rally might push the $COIN price to an upper resistance level of $392.00, indicating a potential buy signal for the stock buyers.

Key Levels:

Resistance Levels: $360.00, $361.00, $362.00

Support Levels: $231.00, $230.00, $229.00

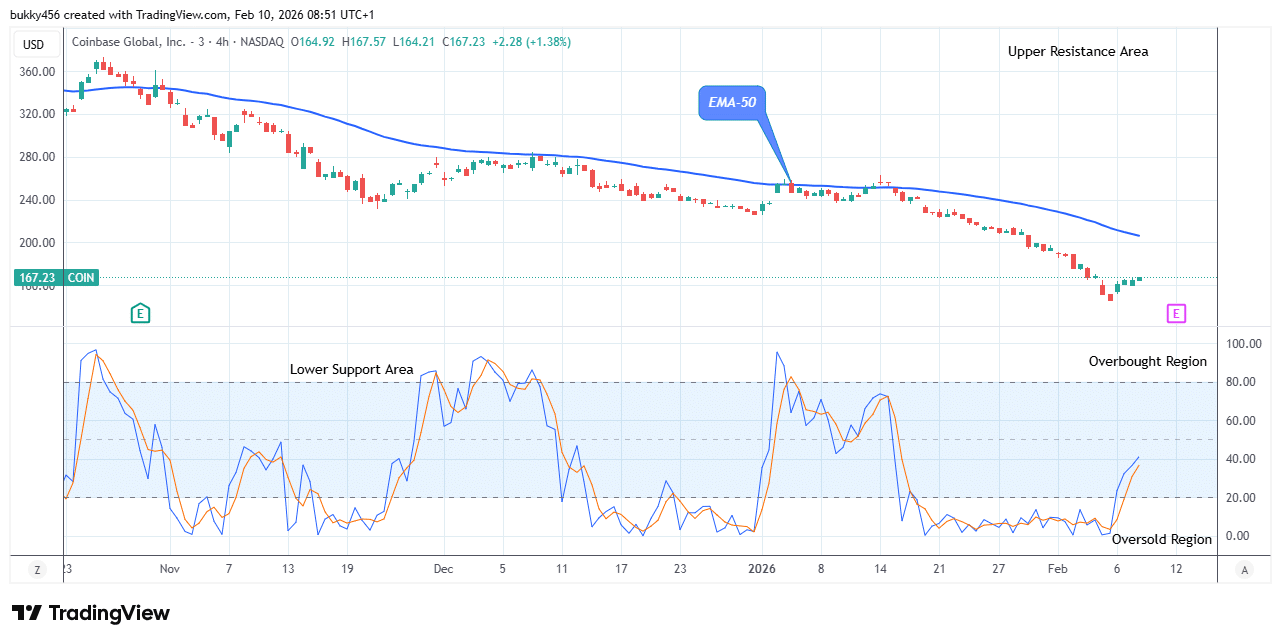

COIN Long-term Trend: Bearish (Daily Chart)

The NASDAQ: COIN price retracement will surge higher after rebounding from its massive drop in the long-term perspective.

However, the current trend will soon be nullified as the market price retracement has just begun.

The persistent pressure from bears at the $145.16 in the last session has contributed to its bearishness in its recent correction.

The $COIN price pulled back to a $167.57 high level below the EMA-50 at the opening of the daily chart today, indicates the return of long traders following the completion of the downward trend, as the stock price moves towards a bullish trend.

Hence, the share is attempting a comeback syndrome, and the price retracement may load more and surge higher.

Thus, a possible breakout from the mentioned price retracement level may accelerate the buying momentum and push the stock price higher to the previous high of $361.40, bolstering buyers for a sustainable rally.

Given this, the price retracement may surge to the $392.00 upper resistance level in its higher time frame.

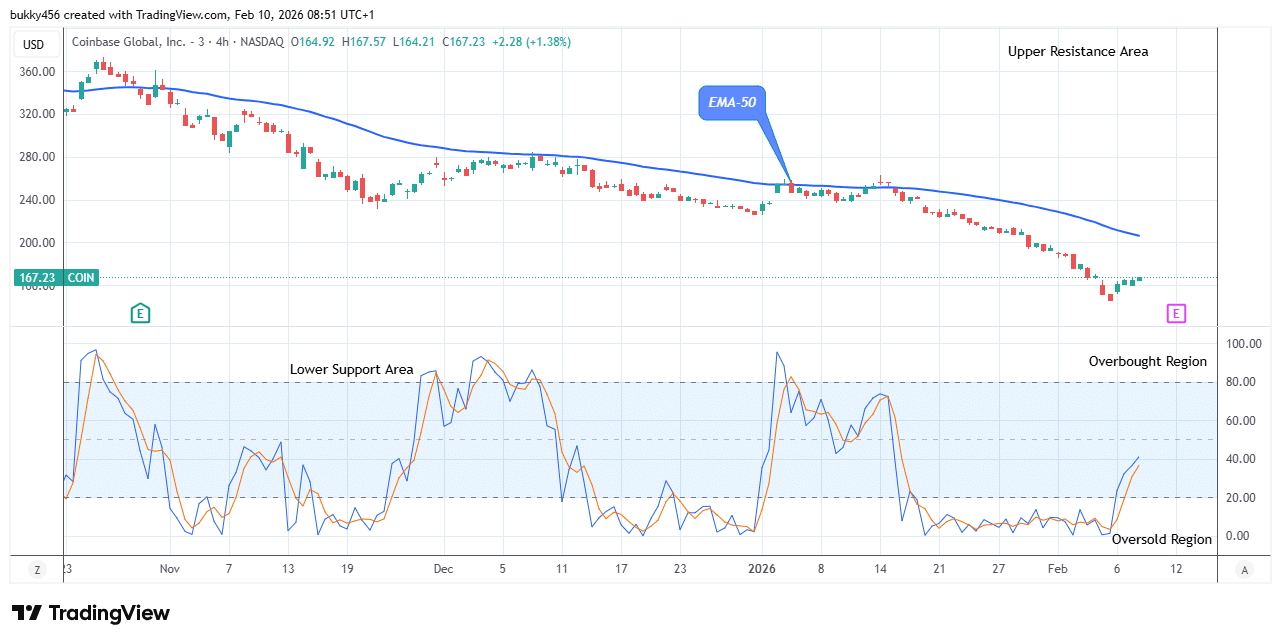

COIN Medium-term Trend: Bearish (4H Chart)

In the medium-term outlook, the NASDAQ stock price may rise and load more as the bullish correction has just begun following the completion of the bearish momentum. The price is trending below the supply levels, indicating a bearish trend.

$COIN Bulls Will Load More

Now, no bear can oppose these sentiments. Bulls will load more. Only two realistic resolution zones remain after this modification. The potential grows as the level of uncertainty rises. We anticipate an upside of almost 300% from here.

This correction has narrowed to just two realistic resolution zones.

As uncertainty increases, so does the opportunity.

From here, we’re looking at roughly 300% upside.When it feels hardest to stay patient, the bottom usually isn’t far away.

Don’t miss this. Not now. pic.twitter.com/oYrr2JdVjn

— Mind Investor (@mind1nvestor) February 9, 2026

At the time of writing, the $COIN price retracement at $167.57 below the EMA-50 served as a solid resistance for the stock price as the 4-hourly session begins today.

Due to the current bullish correction in place, it is extremely likely that the price retracement will continue, and the next price target may surpass the previous peak barrier of $356.85.

Therefore, if the bulls increase their buying speed and close above the peak resistance level, the buy investors would record more intraday gains.

Additionally, the bullish movement is likely as the price indicator projects an upward move, implying that the bullish trend will continue.

As a result, the pattern may surge to hit the $392.00 upper resistance trend line, indicating a potential buy signal.

Trade your favorite stocks using a premium broker. Open an account here

Related Resources

- Crypto Trading Signals — real-time alerts for BTC, ETH, SOL and XRP

- Best Crypto Signals — top-rated providers reviewed for UK traders

- VIP Trading Signals — join 40,000+ traders getting early signals

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.